Environmental sustainability has deeply found its way into business, and the world of finance seems to adapt, with Poseidon Principles being the most recent well-known example of how sustainability relates to profitability. Adopted in 2019, the Poseidon Principles were excitingly accepted as they set the first global framework for adding climate considerations into lending decisions, opening the way for responsible ship finance that will support the industry’s decarbonization race.

Launched in New York on 18 June 2019, the Poseidon Principles set a global benchmark for what it means to be a responsible bank in the maritime sector and provide actionable guidance on how to achieve this. For instance, considering the hot topic of shipping emissions reduction, the Poseidon Principles closely follow the policies and ambitions of IMO’s 2018 Initial Strategy, which eyes reduction of shipping’s total annual GHG emissions by at least 50% by 2050. Making access to finance conditional upon the level of compliance with environmental measures seeks to encourage ‘greener’ ships in the industry.

What led to Poseidon Principles adoption?

In November 2017, three major global shipping banks (Citi, DNB and Societe Generale) initiated a wide discussion on climate risk in ship finance and “greener” shipping. The discussion was encouraged by several shipping stakeholders, including AP Møller Mærsk, Cargill, Euronav, Gram Car Carriers, Lloyd’s Register and Watson Farley & Williams, Global Maritime Forum, Rocky Mountain Institute, and University College London Energy Institute, with several workshops taking place. This led to the first draft in February 2019 and the official adoption in November 2019. The initiative could be seen as an immediate reflection of the rising maritime decarbonization debate in the last few years which was climaxed with the IMO’s GHG strategy in 2018.

What are these “principles” exactly?

Principle #1: Assessment of climate alignment:

Under the pledge, signatories commit to measure the carbon intensity of their shipping portfolios on an annual basis and assess their climate alignment relative to established decarbonization trajectories. This assessment is based on robust methodology, tailored to shipping.

Climate alignment is defined as the degree to which carbon intensity is in line with a decarbonization trajectory that meets the IMO GHG strategy. A decarbonization trajectory is a representation of how many grams of CO2 a single ship can emit to move one tonne of goods one nautical mile over a time horizon.

The Poseidon Principles rely specifically on the Annual Efficiency Ratio (AER) as the carbon intensity metric (to remind, AER is also the metric used for measuring the carbon intensity indicator (CII) which enters into force in 2023). The AER uses the parameters of fuel consumption, distance travelled, and deadweight tonnage at summer draught.

To assess climate alignment of a single vessel, the vessel’s annual carbon intensity is compared with the decarbonization trajectory for its ship type and size class. The climate alignment of a product and or portfolio is a weighted average of the vessel carbon intensities in each product or portfolio.

Principle #2: Accountability

For each step in the assessment of climate alignment, signatories will rely exclusively on the data types, data sources, and service providers established by the IMO, such as classification societies and other recognized organizations. In practice, this requires sourcing of data and a Statement of Compliance and/or a Verification Letter as defined by the IMO DCS, the mandatory regulation for collecting data on fuel consumption from ships.

Principle #3: Enforcement

Signatories commit to work with clients and partners to covenant the provision of necessary information to calculate carbon intensity and climate alignment. To meet this requirement, they will use a standardized covenant clause covering the more specific information needed, so that shipowners do not have to negotiate similar language with every lender. For this reason, it is recommended that the covenant clause be included in new loan agreements, but it is not compulsory for Signatories.

Principle #4: Transparency

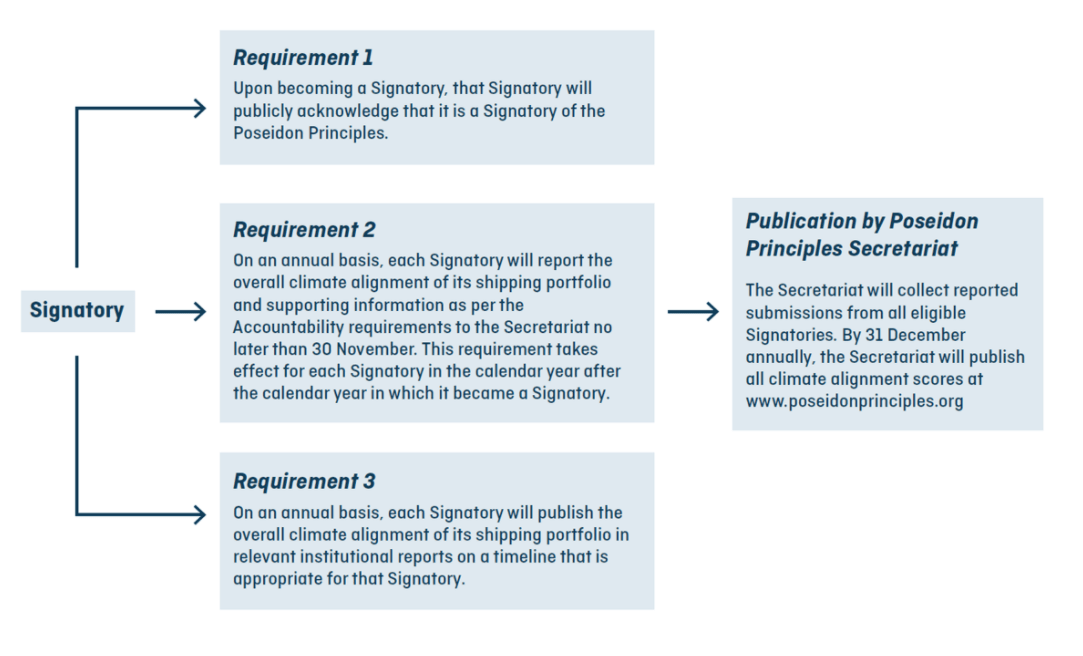

Signatories are required to report their portfolio alignment score on an annual basis. All Signatories’ scores will be published annually by the Secretariat of the Poseidon Principles.

The Poseidon Principles are applicable to lenders, lessors, and financial guarantors globally. However, the Poseidon Principles for Marine Insurance, which recognize the role insurers play in shipping industry, are specifically applicable to insurance providers with hull and machinery coverage and are supported by insurance brokers and business partners. They apply globally to all shipping activities where a vessel or vessels fall under the purview of the IMO.

Why “Poseidon” Principles?

The name of the ambitious initiative was taken after Poseidon, the God of the Sea in Greek mythology.

Which banks are signatories?

As of January 2022, signatories to the Poseidon Principles include ABN Amro, BNP Paribas, Bpifrance Assurance Export, Citi, Credit Agricole CIB, Crédit Industriel et Commercial, Credit Suisse, Danish Ship Finance, Danske Bank, Development Bank of Japan, DNB, Export Finance Norway, Finnvera, ING, MUFG Bank, Nordea Bank, OCBC Bank, SACE, SEB, Shinsei Bank, Société Générale, SpareBank 1 SR-Bank, Sparebanken Vest, Standard Chartered Bank, Sumitomo Mitsui Banking Corporation, Sumitomo Mitsui Finance & Leasing, and Sumitomo Mitsui Trust Bank. Together they represent a bank loan portfolio to global shipping of more than US$185 billion – nearly 50% of the global ship finance portfolio.

What is next?

The second annual Poseidon Principles report at the end of 2021 showed that half of the financial institutions in the scheme -11 out of 23- were found to be aligned with the IMO’s decarbonization target. This constitutes a significant progress from last year’s report that revealed only 3 out of 12 institutions complying being in line with the goals. And although an overnight fix of the shipping decarbonization challenge does not seem feasible, the Poseidon Principles have already sent the message that shipping decarbonization is a necessity and gradually sustainable finance becomes a normality.