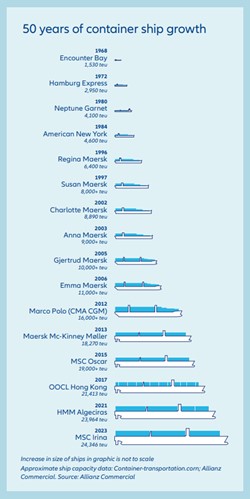

The evolution of containerships has been key to transforming global trade. As ships grow, the continuous innovation in containerization reflects the growing demands of global commerce.

Evolution of containerships

The first generation of containerships consisted of converted bulk carriers or tankers, with a capacity of up to 1,000 TEUs. The pioneering containership, the “Ideal-X,” was a modified World War II-era T2 tanker. During the early 1960s, container transport was still evolving, and converting existing vessels was seen as a cost-effective and low-risk solution.

These early ships were equipped with onboard cranes, as many ports lacked the infrastructure to handle containers. However, these vessels were relatively slow, cruising at speeds of just 18 to 20 knots, and could only carry containers on their converted decks, not in the bellyhold.

As containerization gained widespread acceptance in the early 1970s, the focus shifted to the construction of fully cellular containerships (FCC), purpose-built for container transport.

The first of these, the C7 class, was introduced in 1968. These ships featured dedicated cells designed to stack containers at varying heights, depending on the vessel’s capacity. This cellular design allowed for optimal use of the ship’s entire space, including the bellyhold, and even made it possible to carry additional containers on top of the deck.

With the advent of specialized container terminals, port limitations no longer pose significant challenges. The new generation of cellular containerships also became faster, with speeds ranging from 20 to 24 knots, establishing the standard for containerized shipping.

The removal of cranes from the ship’s design maximized container capacity, although cranes remain a feature on some specialized vessels today.

Size categories of containerships

Containerships are distinguished into 7 major size categories:

- Small feeder

- Feeder

- Feedermax

- Panamax

- Post-Panamax

- Neopanamax

- Ultra-large containerships

Current situation

Economies of scale have dictated an upward trend in the size of containerships to reduce expenses. However, there are certain limitations to the size of containerships.

Primarily, these are the availability of sufficiently large main engines, and the availability of a sufficient number of ports and terminals prepared and equipped to handle ultra-large containerships.

Furthermore, the permissible maximum ship dimensions in some of the world’s main waterways could present an upper limit in terms of vessel growth. This primarily concerns the Suez Canal and Singapore Strait.

McKinsey’s 2017 report ‘Container Shipping: The next 50 years’ has made a prediction that the search for scale certainly isn’t over. That is due to larger vessels offering significant cost efficiencies in fuel and crew and can reduce greenhouse gas emissions per container.

Moreover, while 20,000 TEU vessels may not be the ultimate limit, 50,000 TEU ships are a possibility over the next fifty years.

As of 2024, according to BIMCO, the containership orderbook has reached an all time high with liner operators now controlling 79% of the order book capacity.

“At the end of 2024, the container ship order book was 8.3m TEU, a new record compared with the previous high of 7.8m TEU in early 2023” noted Niels Rasmussen, Chief Shipping Analyst, BIMCO.

However, the Allianz Safety and Shipping Review of 2024 highlighted that while the number of serious shipping accidents worldwide has declined over the long term, incidents involving large vessels, particularly container ships and roll-on/roll-off (Ro-ro) car carriers, remain a significant concern.

These incidents lead to disproportionately high losses and insurance claims due to events such as fires, container and carrier losses, hazardous cargo, more complex salvage operations, expensive repair costs, and difficulties with ports of refuge.

Ultimately, larger ships on our seas are not resulting in a higher frequency of accidents but when something does go wrong, the scale of the damage is likely to be much more severe because of their size and the fact that surrounding civil infrastructure did not anticipate such behemoths.

…said Captain Rahul Khanna, Global Head of Marine Risk Consulting, Allianz Commercial.

In addition, loss of propulsion is not an uncommon occurrence in containerships and fire is also a major cause of loss for large containerships. As containerships have grown in size, concerns about the adequacy of firefighting capabilities persist.

During the 2024 SAFETY4SEA Athens Forum, Ioanna Kafka, Senior Claims Executive, Hull & Machinery Team Greece, The Swedish Club, addressed the growing trend of fire incidents on ships and pointed out that even after successfully extinguishing the fire, the cargo itself can reignite due to its specific characteristics making the firefighting efforts more difficult.

Pursuit of larger vessels likely to persist

In conclusion, the evolution of containerships has significantly transformed global trade, driven by advancements in containerization technology and the push for greater efficiency through larger vessels. While early containerships were adapted from bulk carriers, modern vessels are purpose-built with sophisticated designs that optimize container capacity and enhance speed.

The trend toward larger ships continues to grow due to economies of scale, though challenges such as overcapacity and port limitations remain. Despite these constraints, the pursuit of larger and larger vessels is likely to persist despite the risks, particularly as demand for efficient global trade increases.