Another exciting year is coming to an end. With only few days left until the end of 2018, SAFETY4SEA looks back on the events that defined the environmental stage of the shipping industry. 2020 sulphur cap, scrubbers, LNG, emissions; these are all topics that made the headlines throughout the year. But let’s take a closer look at those topics, which now are at the core of the shipping industry.

-

- Year in Review: Top shipping stories to remember from 2018

- Year in Review: Environmental issues that caught shipping’s eye in 2018

- Year in Review: Timeline of smart shipping developments in 2018

- Year in Review: Top priorities of the 2018 Regulatory Agenda

- 2018 Highlights: Major cyber attacks reported in maritime industry

- A year in pictures: Shipping industry’s highlights in 2018

- Top shipping books we read in 2018

2020 sulphur cap

Without a doubt, the 0.5% Sulphur cap that will begin from 2020 is – and will be – perhaps the hottest topic that the industry has to deal with right now. How to comply, what are the best solutions, how will this regulation eventually affect shipping? These are questions that anyone involved has thought of. But let’s take it step by step.

MEPC 72 & 73

IMO’s 72nd session of Marine Environment Protection Committee took place on 9-13 April 2018. It discussed key environmental issues for global shipping industry, while global attention was focused on the adoption of initial strategy for the GHG emissions reduction from ships.

MEPC 72 adopted an initial strategy, which envisages, for the first time, a reduction in total GHG emissions from shipping which should peak as soon as possible and to reduce the total annual GHG emissions by at least 50% by 2050 compared to 2008. At the same time, the strategy pursues efforts towards phasing them out entirely. The strategy includes a specific reference to “a pathway of CO2 emissions reduction consistent with the Paris Agreement temperature goals”.

In the next MEPC, which held its 73rd session from October 22 to 26, 2018, the focus was on a number of areas to improve shipping’s environmental footprint, such as:

- Ban of carriage of non-compliant fuel oil

MEPC 73 banned the carriage of non-compliant fuel oil for combustion purposes for propulsion or operation on board a ship.

However, the prohibition does not apply to ships employing an alternative arrangement, like scrubbers.

The ban will enter into force on 1 March 2020.

- 2020 global sulphur limit

During the discussions, Bangladesh called for a delay to implementing the carriage ban, as it is concerned about the availability, safety and cost of compliant fuels.

Several developing countries supported the proposal from Bangladesh, however the majority of the countries wanted the carriage ban to proceed without delay.

- Development of ship implementation plan for 0.50% global sulphur limit

MEPC 73 also approved guidance for developing a non-mandatory plan for ships to implement the 0.50% sulphur limit. Items recommended to be addressed by the plan include:

- Risk assessment and mitigation plan on the impact of new fuels;

- Modifications of the fuel oil system and tank cleaning;

- Fuel oil capacity and segregation capability;

- Procurement of compliant fuel;

- Fuel oil changeover and documentation and reporting.

The Plan should also address issues regarding the use of compliant fuel oil which include the capability/suitability of the ship’s equipment to deal with different fuel types and their characteristics.

- Best practice for fuel oil suppliers

What is more, MEPC created a Guidance on Best Practice for Fuel Oil Suppliers to ensure the high quality of fuel oil delivered to ships.

These practices focuse on quality control during production of bunkers, in the supply chain and during transport, storage and transfer excluding low flashpoint fuels such as LNG, LPG or methyl/ethyl alcohols and pure biofuels.

Sampling and testing should also be carried out and be documented at each point of product custody.

Nevertheless, the industry is worried. According to a survey by Drewry, the industry is concerned about carriers’ methods of fuel cost recovery with 56% stating that they did not consider their service providers’ approaches as either fair or transparent.

What is more, 33% of respondents expressed poor awareness and understanding of the new regulation, while 52% feel either ‘not prepared’ or ‘not at all prepared’ for the impact of the new emissions regulations.

In fact, only 1 in 10 of shippers responding to the survey has conducted an impact assessment.

What is more, the US supported the phasing implementation of the Sulphur cap, fearing a possible increase in fuel costs.

Demand surge for scrubbers

As the 2020 sulphur cap is approaching, the shipping industry is taking the final measures to comply. Currently, scrubbers are on the rise. According to Global Market Insights, scrubbers will surpass USD8 billion by 2024, driven by the 2020 regulation, emission effects, and a rise in clean fuel cost.

Confirming this, many ship owners are already choosing this solution. Namely, Maersk will add scrubbers to some of its ships, despite announcing last February that it would choose low sulphur fuel oil. CMA CGM has decided to favor the use of 0.5% fuel oil for its fleet, and to invest significantly:

- By using LNG to power some of its future container ships (9 ships on order), resulting in a 99% reduction in sulphur emissions;

- By ordering several scrubbers for its ships.

Additionally, Hapag-Lloyd announced it has ordered ten hybrid-ready scrubbers to be gradually installed to ten of its 13,000 TEU Hamburg class vessels during 2019 and 2020.

DFDS will also install scrubbers on 12 freight ferries on routes in the Mediterranean. In addition, companies such as GOGL, Danaos, MPC, Torm, Frontline, Seanergy have all chosen scrubbers. However, Euronav opposes, as it considers scrubbers ‘a loop hole which makes enforcement of the sulphur ban extremely complex.’ In the same wavelength, Odfjell will not invest in scrubbers, as this technology ‘does not make sense’.

Commenting on this issue, Nicholas Confuorto, President & CEO, CR Ocean Engineering, argues that scrubbers are the best option for compliance with 2020. He notes that considering all options, only those who choose scrubbers can benefit from this technology, which is already available and proven.

For his part, Dr. Martin Koller, Product Manager, Air Pollution Control, ANDRITZ, mentioned that if operators choose scrubbers, they will need to retrofit their ships today in order to get them ready in 2020. For this reason, space and power requirements onboard are important to be evaluated.

On the other hand, the Union of Greek Shipowners questioned the environmental benefits of scrubbers, saying that compliance with this technology ‘is the exception to the rule, especially in this sector due to its fundamental operational characteristics’.

Furthermore, Dragos Rauta, Technical Director at Intertanko, explained that as far as scrubbers are concerned, they will last for no more than 10 years ‘because the high acidity of the wash-water is a challenge for the integrity of the installation. There will still be some impact on the environment that will not go unnoticed.’

COP 24

The 24th session of the Conference of the Parties (COP 24) to the UN Convention on Climate Change (UNFCCC) began in Katowice, Poland, on 3 December, aiming to fight against climate change.

The conference coincided with the three year anniversary of the Paris Agreement adoption, and finalized the rules for implementation of the Paris Agreement under the Paris Agreement work programme (PAWP).

Our job here in Katowice is to finalize the Paris Agreement Work Programme – the rule book for implementation. I remind all Parties that this is a deadline you set for yourselves

…said UN Chief Antonio Guterres to delegates at COP24.

What is more, in September 2019, Mr. Guterres will convene a climate summit to boost political and economic efforts to strengthen climate action and ambition globally.

The Summit will focus on practical initiatives to cut emissions and build climate resilience. Namely, it will give emphasis on six key areas:

- Energy transition;

- Climate finance and carbon pricing;

- Industry transition;

- Nature-based solutions;

- Cities and local action;

- Resilience.

However, even if all the commitments that countries made for the Paris Agreement are achieved, then world could be on a course to warm by more than 3°C this century.

Did you know? The Paris Agreement aims to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels. It also pursues efforts to limit the temperature increase even further to 1.5 degrees Celsius.

New routes opening up in Arctic

The Arctic is considered as one of the most challenging shipping routes. Being open only a few months, few ship have chosen this route for their voyages, worrying about the extreme weather.

However, this seems to be changing, as lately more and more ships actually prefer the Northern Sea Route. In fact, large companies are sending their ships through Arctic Routes:

- On September 11, Atomflot’s nuclear icebreaker “50 Years of Victory” escorted the container vessel Venta Maersk; the first ever container ship on an Arctic route, travelling from the East to Northern Europe along the Northern Sea Route.

- ESL Shipping received the bulk carrier ‘Viikki’ which will travel to the Baltic Sea via the Northern Sea Route to Japan.

- Cosco’s Tian En’s maiden voyage started after it sailed through the Bering Strait on August 17, having left from Lianyungang Port in China on August 4. The ship travelled the Northern Sea Route along the coast of Russia, between the Pacific and the Atlantic.

- Sovcomflot’s icebreaking LNG carrier, Christophe de Margerie, crossed the Northern Sea Route in a new record time for a merchant ship without icebreaker support.

Nonetheless, a new study published in Geophysical Research Letters suggests that this growth of trans-Arctic shipping and the subsequent increase in emissions may offset some of the overall warming trend in the Arctic by the end of the century.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

In order to protect the Arctic, MEPC 72 agreed to move forward with an Arctic ban on heavy fuel oil. The meeting directed a sub-committee (PPR6) to develop a ban on heavy fuel oil use and carriage for use by ships in the Arctic.

Contaminated fuels affect ships worldwide

During April multiple vessels reported problems with contaminated fuels in Houston, Texas. Phenolic compounds were present in every sample which damage the ships’ engines. A similar problem was also reported in Singapore and Panama.

These issues made INTERTANKO state that fuel contamination may become a ‘global epidemic’, while IBIA claimed that no meaningful resolution has been reached. This is important as from 2020, an increase in low sulphur blends demand is expected. This spike will increase the risk of contamination, argues Lars Robert Pedersen of BIMCO. However, there are worries as to whether there are enough methods to detect such issues.

According to IBIA, ISO 8217 and Regulation 18.3 of MARPOL Annex VI, which state that fuels should not contain any harmful materials, do not necessarily show if the fuel is contaminated. In an attempt to protect operators, Gard Club outlined key factors which everyone should consider when selecting the supplier, such as: whether the supplier has been involved in contaminated bunkers; and whether supplier can provide evidence of insurance for poor quality bunkers. Finally, Standard Club recommended operators to limit their exposure to contaminated bunkers, by: ensuring good bunker management; checking historical records of bunker supplier; and sending samples for laboratory analysis immediately.

Is decarbonisation possible?

The UN Environment issued its annual Emissions Gap Report providing an assessment of current national mitigation efforts and the ambitions countries have presented in their Nationally Determined Contributions, under the Paris Agreement on climate change.

The report identifies current commitments by states as inadequate to bridge the emissions gap by 2030, while it reveals that there is no sign of improvement on GHG emissions.

DNV GL seems to be on the page. In its Energy Transition Outlook, it notes that natural gas projects will receive a significant investment over the coming years, while the global energy demand will peak in 2035. Additionally, the increased electrification of energy demand, along with the rise of wind and solar energy, will grow the world’s electricity transmission and distribution systems. However, despite the rapid transition and decarbonisation, DNV GL expects that these will not happen fast enough to meet the 2⁰C climate goal that the Paris Agreement has set.

On the other hand, a report by the Energy Transitions Commission (ETC) found that reaching zero emissions from transport, including shipping, is possible by 2050. In order to achieve this, Namely, three sets of actions are needed:

- Limiting demand growth: This will reduce the cost of industrial decarbonization and of heavy-duty transport decarbonization;

- Improving energy efficiency: This will enable early progress in emissions reduction and could reduce decarbonization costs;

- Applying decarbonization technologies: These technologies are vital to achieve zero CO2 emissions from the energy and industrial systems.

Providing more ways to achieve decarbonisation, IEA says that a global attempt to use the right energy efficiency policies could lead greenhouse gas emissions to peak quickly and then decrease. This could happen even as the global economy doubles between now and 2040. Specifically, the study indicates that right efficiency policies could deliver a 40% reduction of emissions. This is the amount needed to meet with current climate goals, using the technology we have today.

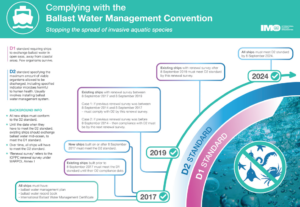

Developments on BWMS

During December, the USCG granted the 14th BWMS Type Approval Certificates to Panasia Co., for its GloEn-Patrol BWMS. What is more, in November, the USCG granted the 12th and 13th BWMS Type Approval Certificates to Qingdao Headway Technology, for its OceanGuard BWMS and to JFE Engineering Corporation for its BallastAce BWMS. Hyundai Heavy Industries had received the 11th Certificate, for its HiBallast BWMS, during October.

Other manufacturers that have received the final certificate are: Wärtsilä Water Systems (England), BIO-UV Group (France), Samsung Heavy Industries (Republic of Korea), Techcross (Republic of Korea), Optimarin (Norway), Alfa Laval (Sweden), TeamTec Ocean Saver (Norway), Sunrui (China), Ecochlor (USA) and Erma First (Greece).

Analyzing the retrofitting status of ballast water management systems (BWMS) on its registered ships, ClassNK confirmed that installation deadlines based on the Ballast Water Management Convention (BWM Convention) for many of them are highly concentrated in the year 2022. ClassNK added that difficulties are expected in the installation of BWMS if everyone around the world waits until 2022, so it recommended installing early.

Vessel Incidental Discharge Act (VIDA)

On December 4, 2018, US President Trump signed the USCG Authorization Act, S. 140. This is a new bill which includes measures for USCG operations while it incorporates the Vessel Incidental Discharge Act (VIDA).

Until now, two US federal agencies, the US Coast Guard and the Environmental Protection Agency (EPA), have been regulating ballast water and other vessel discharges under differing statutory authorities.

VIDA now delegates the lead role in establishing standards for US ballast water regulations to the EPA and assigns to the US Coast Guard the lead role in monitoring and enforcing those standards. Now, the EPA and the USCG will cooperate under the Clean Water Act to jointly set and implement standards for ballast water and incidental discharges.

Under VIDA, USCG is required to draft a policy letter for testing BWMS within 180 days, followed by a 90 day comment period. In total, the USCG has 360 days after the date of enactment of the Act to come up with a final policy.

Additionally, the Bill includes legislative language that amends the USCG regulations. Specifically, it will allow the use of reproductive methods by explicitly expanding the definition of ‘living’ to ensure that organisms that cannot reproduce (non-viable) are not considered to be living. This means that organisms which cannot reproduce are as good as dead for the purposes of the regulation.

Beyond BWM, the new Act also affects the Vessel General Permit (VGP), which is expected to disappear in 4 years. The bill eliminates the Small Vessel General Permit program for all vessels below 79 feet. In addition, it permanently exempts all fishing vessels from the EPA discharge requirements. Small vessels had a temporary VGP exemption, which ended this year. As a result, vessel owners were worried because without a solution, activities such as washing a deck after gutting fish could lead to fines.

It is not secret that climate issues are now one of the most pressing problems that the world has to deal with. In fact, WWF published the report ‘Living Planet’ in which it reports that wildlife populations have decreased by 60%, in a span of 40 years. It also states that this generation is the first that knows people are destroying the environment and the last one that can do something to reverse it. The news are not positive, but there is some time to change. The fact that key industries like shipping have mobilized to reduce emissions and improve their environmental footprint gives hope that we are able to reverse climate change. Nevertheless, these efforts need to continue to ensure a sustainable climate for future generations.