According to a survey conducted by Drewry, there is a significant concern among global shippers/BCOs (Beneficial Cargo Owners) and freight forwarders ahead of the IMO’s 2020 global emissions regulations, which will enter into force on 1 January 2020.

Particular concern was expressed about carriers’ methods of fuel cost recovery with 56% stating that they did not consider their service providers’ existing approaches as either fair or transparent.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

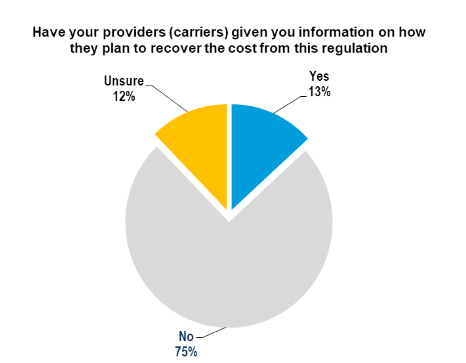

In addition, 4 in every 5 of the shippers/BCOs participating in the survey stated that they had yet to receive clarity from their providers regarding the future fuel costs.

However, despite the significance of the change, 33% of respondents admitted to having poor or very poor awareness and understanding of the new regulation.

Philip Damas, Head of Drewry Supply Chain Advisors, highlighted:

Given the scale of the extra costs triggered by the new regulation and the carriers’ expectations that their pricing and fuel charge mechanism with customers must be restructured, there is a need for carriers to address the transparency concerns expressed by their customers.”

In order to mitigate some of these problems, Drewry is working on an IMO low-sulphur rule ‘cost impact tool’ based on robust market data. Fuel surcharges are one of the largest components of container freight costs and, according to Drewry Benchmarking Club data, typically average $150/teu on the major routes from Asia today.

In summary, Drewry’s survey found the following:

Poor awareness and understanding

- 33% of respondents expressed poor awareness and understanding of the new regulation.

- More than half of all respondents had not received formal guidance on the pending changes from either the IMO or their national administration/transport ministry

Lack of preparation

- 52% feel either ‘not prepared’ or ‘not at all prepared’ for the impact of the new IMO emissions regulations.

- Only 14% of respondents have conducted an impact assessment, only 1 in 10 of shippers (importers/exporters) responding to the survey have conducted such an assessment

Cost impact concerns and considerable uncertainty

22% of all respondents believe the cost impact to their organisation from the new regulation will be either significant (16%) or extremely significant (6%)

Lack of transparency in fuel cost recovery methods

- 56% do not believe the current methods of fuel cost recovery are sufficiently fair and transparent

- 76% of respondents had not received clarification or information from their provider as to how they intend covering potential cost increases from the regulation.

- 4 in every 5 of the shipper/BCO respondents had not received such clarity from their providers.