During the 2023 SAFETY4SEA Limassol Forum, Bill Stamatopoulos, Global Business Development Director, VeriFuel, gave a presentation on the use biofuels for the marine shipping sector.

Background

The credit for testing biofuels goes to Mr. Diesel himself, who in 1897 conducted the first trial with peanut oil in one of his engines, and some years later came up with this astonishing statement.:

The use of vegetable oils for engine fuels may seem insignificant today. But such oils may become, in course of time, as important as petroleum and the coal tar products of the present time.

Rudolf Diesel, 1912

After many years, the current edition of ISO 8217:2017, in general clause 5, ‘opened’ the door to biofuels. Until then, the fuel composition was assumed to be mostly composed of petroleum hydrocarbons, but it was later expanded to include synthetic or renewable sources such as hydrotreated vegetable oil (HVO), renewable feedstock, and so on.

Most popular biofuels at present

- FAME

Currently, the most prominently used biofuel in marine applications is FAME (Fatty Acid Methyl Ester). At the time of blending, FAME should be compliant with the EN standard 14214.

- HVO (or renewable diesel)

HVO should be compliant with the EN 15940 standard. It shares similarities with FAME but defers in terms of long-term storage because HVO is very stable and not subject to any microbial growth.

Pilot projects on use of biofuels

Biofuel fractions

The B100 Rotterdam product uses 100% renewable fuel. It has a carbon factor of 2.76. LNG has a carbon factor of 2.75. Furthermore, there is a B50 (50% renewable) Rotterdam product, which is low-cost, very stable, and low in metals. Its carbon factor is depending on its components.

Another fuel option is B24 (24% renewable) Singapore, which is a blend of used cooking oil methyl ester (UCOME) and standard 380 cSt fuel oil. Typically, biofuel suppliers present a quality certificate. The product must be compatible with the most recent edition of ISO 8217, with the exception of FAME content, as per the contractual agreement.

The IMO requires that seagoing barges carry up to B25. Any level higher than this necessitates the use of a chemical tanker. Amsterdam, Rotterdam, and Antwerp (ARA) are excluded since their supply vessels are supposed to be river barges and can deliver up to B100.

In terms of volume, Rotterdam sold 800 thousand Mts in 2022. Singapore began with 70 thousand Mts in September 2022, then doubled that quantity from September to December to 140 thousand.

Regulation

The IMO made the following decision during MEPC 78 in order to facilitate the adoption of biofuels in terms of NOx (Nitrogen oxides):

In general, if the product is up to B30, there is no need to be concerned about NOx because it’s considered a petroleum product.

If it is higher, no action is required as long as no critical engine settings are required to maintain the vessel’s NOx technical file.

In both cases, the Flag State should be notified before to the trial.

Sustainability certification

The ability to reduce emissions is determined by the feedstock, production process, and supply chain. However, there is currently no globally recognized standard or certification to validate green production from start to finish.

Suppliers must be accredited by a reputable organization such as the International Sustainability Carbon Certification (ICSS), which establishes numerous conditions such as land, soil, and air preservation. It also considers zero deforestation, traceability across the supply chain, and ethics.

In terms of ethics, you cannot utilize anything that could compete with food or have an influence on wildlife. This is a requirement for the second generation of biofuels that we are now employing.

Well-to-wake emissions

Well-to-wake refers to the entire process from fuel production and delivery to use onboard ships, and all emissions produced therein.

Well-to-wake emissions need to be weighed for MEPC 80 in July. Hopefully, there will be an answer on the carbon factor and a life cycle assessment. There is an interesting interim report in MEPC 79 suggesting that the percentage of the biocomponent in the fuel should be amounted as zero in terms of emissions.

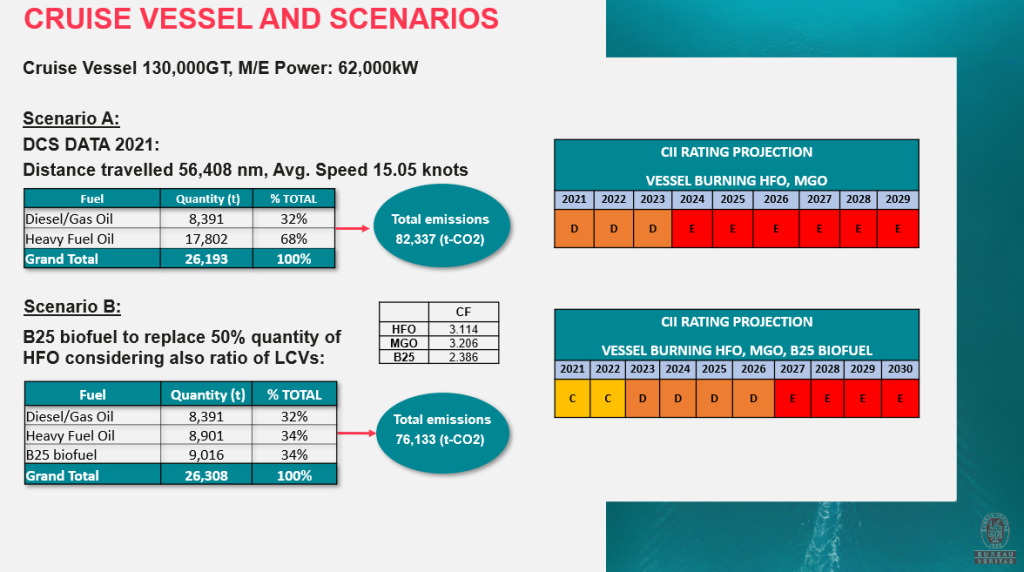

If you look at the typical B25’s carbon content, it will have an emission factor in the range of 2,9-2,95. If this qualifies and gets approval in the next MEPC, the carbon factor will go down to 2,4 and may improve significantly regarding CII (Carbon Intensity Indicator).

You can notice this in the following scenarios:

Biofuel Specs

Singapore came up with their own standards in February. The one standard refers to residual and the other to distillate grades. ISO 8217 is preparing a separate specification to be available in 2024.

Pros and Cons

Pros of biofuels:

- Four-year experience with successful trials since 2019

- No CAPEX is required

- Improved CO2 emission factor

- Limited safety risk as it is not toxic (like ammonia) and the flash point is always higher than 100 degrees, so it meets the SOLAS requirement

- Can use the existing bunkering infrastructure

- Mix with fossil fuels a.k.a. “drop in”

Cons of biofuels:

- Availability

- Cost (20-40% over the VLSFO price)

- Energy content is lower, but they have better ignition and combustion properties

- Technical challenges that are easily tackled in terms of long-term storage, microbial growth and corrosion

- Lack of crew training

- Storage and transfer temperatures above the cloud point

- Aviation may also use them so not all of the available biofuel is for shipping.

Conclusion

The momentum is high for biofuels. We know today that biofuels will never be the dominant fuel of the future but they, along with LNG, are considered to be the best steppingstones on the path to decarbonization.

Above article has been edited from Mr. Bill Stamatopoulos’ presentation during the 2023 SAFETY4SEA Limassol Forum.

Explore more by watching his video presentation here below

The views presented are only those of the author and do not necessarily reflect those of SAFETY4SEA and are for information sharing and discussion purposes only.