BP published its Energy outlook for 2019, exploring key uncertainties that could impact global energy markets up until 2040. The greatest uncertainties over this period regard the need for more energy to support rising global economic growth and prosperity, along with the need for faster transition to a lower-carbon future. The Outlook also analyzes the possible impact of an escalation in trade disputes and the consequences of a tightening in the regulation of plastics.

Namely, the ‘Evolving Transition’ scenario, which assumes that government policies, technologies and societal preferences evolve in a similar manner to the recent past, predicts that:

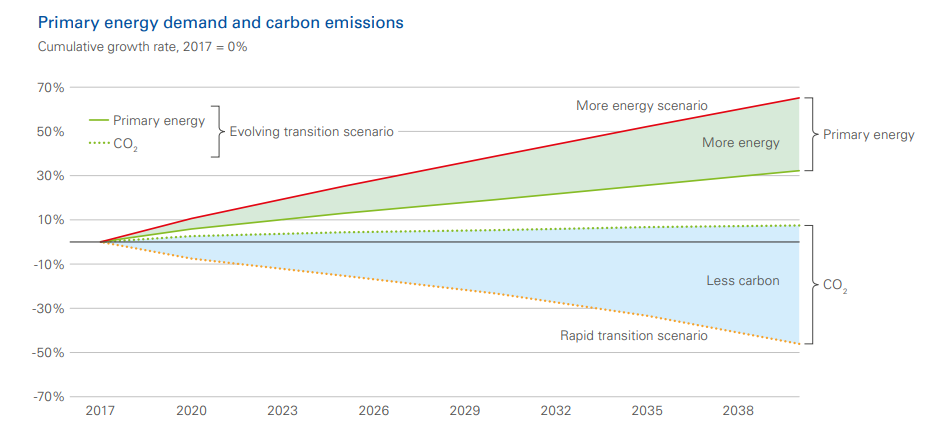

- Global energy demand increases by around a third by 2040, driven by improvements in living standards, particularly in India, China and across Asia;

- Energy consumed by industry and buildings accounts for around 75% of this increase in overall energy demand, while growth in energy demand from transport slows sharply relative to the past as gains in vehicle efficiency accelerate;

- The power sector uses around 75% of the increase in primary energy;

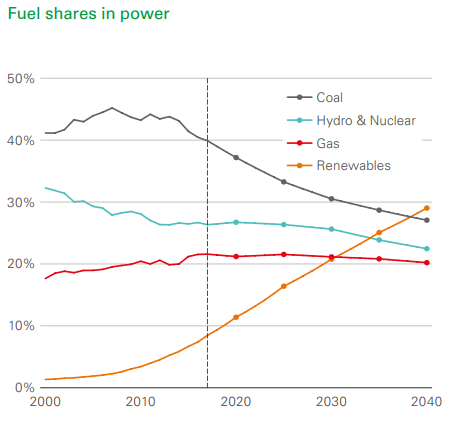

- 85% of the growth in energy supply is generated through renewable energy and natural gas, with renewables becoming the largest source of global power generation by 2040;

- The pace at which renewable energy penetrates the global energy system is faster than for any fuel in history;

- Demand for oil grows in the first half of the Outlook period before gradually plateauing, while global coal consumption remains broadly flat. Across all the scenarios considered in the Outlook, significant levels of continued investment in new oil will be required to meet oil demand in 2040;

- Global carbon emissions continue to rise, signalling the need for a comprehensive set of policy measures to achieve a substantial reduction in carbon emissions.

Moreover, the report says that renewables and natural gas will together account for the vast majority of the growth in primary energy. In the evolving transition scenario, 85% of new energy is lower carbon.

However, the Outlook considers a number of additional scenarios. Some of the key ones are:

More energy

More energy is needed to support growth and help billions of people to move from low to middle incomes. In fact, there is a strong correlation between human progress and energy consumption. Currently, about 80% of the world’s population live in countries where average energy consumption is less than 100 GJ per head. In order to reduce that number to one-third of the population by 2040, the world would need around 65% more energy than today, or 25% more energy than needed in the evolving transition scenario.

The Outlook also highlights the need for more action to reduce carbon emissions.

This is the dual challenge for the world – to provide more energy with fewer emissions

Rapid transition

The rapid transition scenario is the combination of analyses which bring together the policy measures in lower carbon scenarios for industry and buildings, transport and power. This could lead to a 45% reduction in carbon emissions by 2040 in comparison to current levels. This is in the middle of a sample of external projections with aim to be consistent with meeting the Paris Agreement climate goals.

This fall represents a combination of:

- Gains in energy efficiency;

- A switch to lower-carbon fuels; material use of CCUS;

- A articular importance in the power sector, a significant rise in the carbon price.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

According to BP, the power sector is the largest source of carbon emissions from energy use and it is crucial for the world to continue to find ways to reduce emissions from this sector.

However, reductions in carbon emissions from the transport industry in all scenarios to 2040 is relatively small in comparison. Even in the rapid transition scenario, an important level of carbon emissions remain in 2040. To meet the Paris climate goals, in the second half of the century these remaining emissions would need to be greatly reduced and offset with negative emissions.

To achieve this, a near-complete decarbonization of the power sector would be necessary. This will require greater use of renewables and CCUS, along with natural gas and greater electrification of end-use activities. If electrification is not possible, other forms of low-carbon energy and energy carriers will be key, such as hydrogen and bioenergy.

Less globalization

Moreover, international trade underpins economic growth and allows countries to diversify their source of energy. In the less globalization scenario, the Outlook explores the possible result that increasing trade disputes could have on the global energy system.

The scenario notes how a reduction in openness and trade associated with an escalation in trade disputes could reduce worldwide GDP and energy demand as well. What is more, concerns about energy security may cause countries to favour domestically-produced energy, reducing energy trade.

Single-use plastics ban

Finally, the largest projected source of oil demand growth over the next 20 years is from the non-combusted use of liquid fuels in industry, driven by the increasing production of plastics. Growth of non-combusted demand in the evolving transition scenario is, however, slower than in the past.

Considering the increasing environmental concerns regarding single-use plastics, the Outlook analyzes a single-use plastics ban scenario, in which the regulation of plastics is even more strict, leading to a worldwide ban on the use of all single-use plastics from 2040.

In this scenario, oil demand rises slower than in the evolving transition scenario. However, the Outlook warns that the full impact on energy growth and the environment will be based on the alternative materials that may be used in place of single-use plastics.

A ban on single-use plastics could result in an increase in energy demand and carbon emissions without further advances in alternative materials and the widespread use of collection and reuse systems

See more details in the PDF herebelow