ABS recently issued its third in the series of Low Carbon Shipping Outlooks, focusing on the marine sector’s progress towards reducing its emissions.

Specifically, ABS analyzes external decarbonization trends and presents a life-cycle or “value chain” perspective of the leading alternative marine fuels’ greenhouse gas (GHG) footprints.

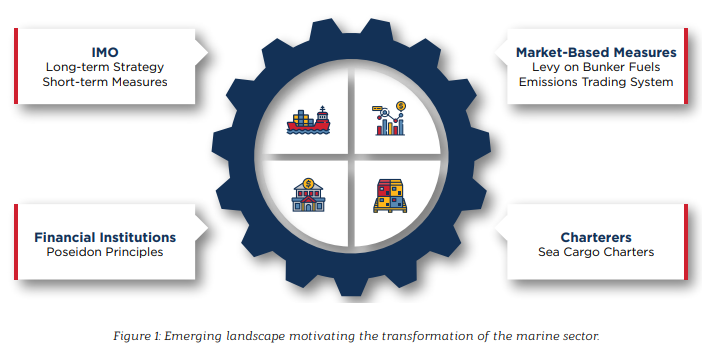

As explained, the maritime industry is undergoing a significant transformation that is being driven by: International Maritime Organization (IMO) regulations; the financial institutions supporting the purchase of new ships and retrofits; the charterers; and market-based measures (MBMs) introduced by local and regional authorities.

In combination, these developments are creating a unique landscape and new challenges for shipowners and operators.

According to the report, despite the challenges faced by the shipping sector globally due to the pandemic (economic crisis, supply chain disruptions, more inwardly focused national policies), reducing emissions and addressing environmental concerns is still a high priority.

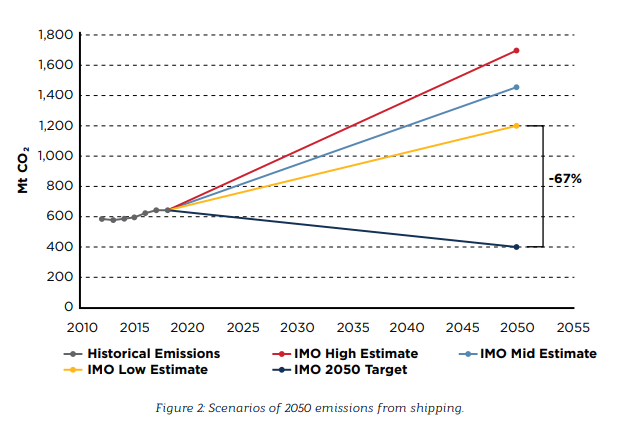

Future projections of emissions from shipping are highly dependent on multiple parameters, including overall fleet growth and demand, improvement of vessel efficiencies, and deployment of new technologies.

To remind, the IMO estimates that emissions from shipping in 2050 will range from 1,200 Mt CO2 /year in a low emission scenario to 1,700 Mt CO2 /year in the high emission scenario.

These scenarios reflect alignment with the high end of the Paris Agreement temperature goal while projecting business as usual growth. Despite this high uncertainty in expected emissions, all scenarios significantly exceed the IMO 2050 target of 50 percent reduction in total emissions by 2050 — as shown in Figure 2. The IMO low estimate still exceeds the IMO targets by 67% in 2050.

The key conclusions of the report can be summarized as follows:

- The maritime industry is undergoing a significant transformation centered around: decarbonization motivated by the International Maritime Organization (IMO) regulations; the financial institutions that support new vessel construction and retrofits; the multinational charterers of such vessels; and market-based measures (MBMs) emerging from local and regional authorities.

- This transformation will be enhanced by the global industry decarbonization efforts to address the impact of climate change. The latter can impact shipping directly or indirectly by affecting the global production of shipped goods, such as agricultural and industrial products or fuels, and their global supply chains.

- It is critical for shipowners and operators to understand the expected changes in the global supply chains in orderto plan their future fleet composition and renewal strategy.

- The short-term IMO measures (Energy Efficiency Existing Ship Index (EEXI) regulations and Carbon Intensity Indicator (CII) create a very challenging landscape for many vessels of the global fleet. Some vessel segments, such as liquefied natural gas (LNG) carriers with steam turbines, may experience early vessel retirement due to their inability to comply with the EEXI and CII regulations.

- A large fraction of the global bulk carrier and tanker fleet may have difficulty in meeting the EEXI regulation. LNG carriers, liquefied petroleum gas (LPG) carriers and containerships are expected to have less difficulty in meeting the EEXI regulation (with the exception of steam turbine LNG carriers).

Analysis of qualified ships from five key shipping categories — bulk carriers, tankers, gas carriers, LNG carriers and containerships — revealed the following about compliance with the IMO’s EEXI regulation:

- A large fraction of the global tanker fleet (60 to 70 percent) is expected to have difficulty meeting the EEXI requirements. Smaller dwt segments, such as aframax tankers, are expected to meet the requirements more comfortably than larger tankers.

- A similarly large fraction of the global bulk carrier fleet (60 to 70 percent) is expected to also have difficulty meeting the EEXI requirements. Again, smaller dwt segments, such as panamax bulker, are expected to meet the requirements more comfortably than larger vessels, such as capesizes or very large ore carriers (VLOCs).

- Gas carriers — particularly those of higher dwt capacity — have proven capable to meet the EEXI requirements.

- LNG carriers with dual-fuel or tri-fuel diesel electric propulsion or two-stroke dual-fuel engines are expected to meet the EEXI regulations. However, those LNG carriers propelled by steam turbines will face significant challenges.

- Containerships above 80,000 dwt are expected to meet the EEXI requirements. However, smaller dwt segments are expected to face some challenges with EEXI compliance.