Against a backdrop of geopolitical tensions and fragile energy markets, the latest edition of the IEA’s World Energy Outlook, explores how structural shifts in economies and in energy use are shifting the way that the world meets rising demand for energy.

China has changed the energy world, but now China is changing

China has an outsized role in shaping global energy trends; this influence is evolving as its economy slows and its structure adjusts, and as clean energy use grows. Over the past ten years, China accounted for almost two-thirds of the rise in global oil use, nearly one-third of the increase in natural gas, and has been the dominant player in coal markets. But it is widely recognised, including by the country’s leadership, that China’s economy is reaching an inflection point.

After a very rapid building out of the country’s physical infrastructure, the scope for further additions is narrowing. The country already has a world-class high-speed rail network; and residential floorspace per capita is now equal to that of Japan, even though GDP per capita is much lower. This saturation points to lower future demand in many energy intensive sectors like cement and steel. China is also a clean energy powerhouse, accounting for around half of wind and solar additions and well over half of global EV sales in 2022.

New dynamics for investment are taking shape

The end of the growth era for fossil fuels does not mean an end to fossil fuel investment, but it undercuts the rationale for any increase in spending. Until this year, meeting projected demand in the STEPS implied an increase in oil and gas investment over the course of this decade, but a stronger clean energy outlook and lower projected fossil fuel demand means this is no longer the case. However, investment in oil and gas today is almost double the level required in the NZE Scenario in 2030, signalling a clear risk of protracted fossil fuel use that would put the 1.5 °C goal out of reach.

Simply cutting spending on oil and gas will not get the world on track for the NZE Scenario; the key to an orderly transition is to scale up investment in all aspects of a clean energy system. The development of a clean energy system and its effect on emissions can be reinforced by policies that ease the exit of inefficient, polluting assets, such as ageing coal plants, or that restrict the entry of new ones into the system. But the urgent challenge is to increase the pace of new clean energy projects, especially in many emerging and developing economies outside China, where investment in energy transitions needs to rise by more than five times by 2030 to reach the levels required in the NZE Scenario.

A renewed effort, including stronger international support, will be vital to tackle obstacles such as high costs of capital, limited fiscal space for government support and challenging business environments.

..said IEA.

Meeting development needs in a sustainable way is key to moving faster

The global peaks in demand for each of the three fossil fuels mask important differences across economies at different stages of development. The drivers for growth in demand for energy services in most emerging and developing economies remain very strong. Rates of urbanisation, built space per capita, and ownership of air conditioners and vehicles are far lower than in advanced economies. The global population is expected to grow by about 1.7 billion by 2050, almost all of which is added to urban areas in Asia and Africa. India is the world’s largest source of energy demand growth in the STEPS, ahead of Southeast Asia and Africa. Finding and financing low-emissions ways to meet rising energy demand in these economies is a vital determinant of the speed at which global fossil fuel use eventually falls.

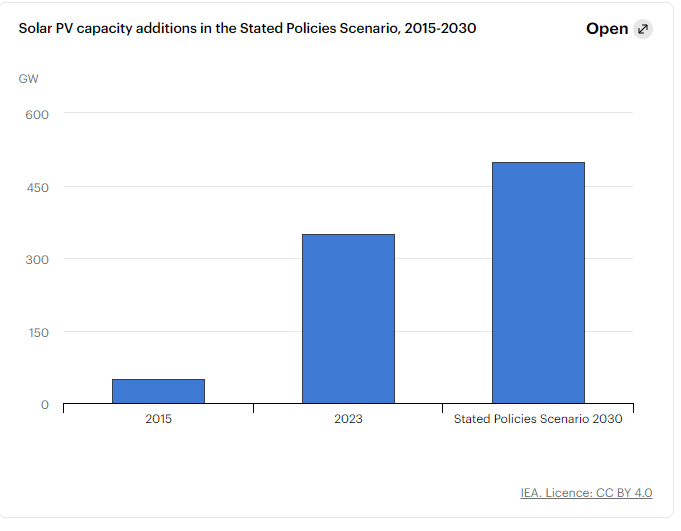

Ample global manufacturing capacity offers considerable upside for solar PV

Renewables are set to contribute 80% of new power capacity to 2030 in the STEPS, with solar PV alone accounting for more than half. However, this uses only a fraction of the world’s potential. Solar has become a major global industry and is set to transform electricity markets even in the STEPS. But there is significant scope for further growth given manufacturing plans and the technology’s competitiveness. By the end of the decade, the world could have manufacturing capacity for more than 1 200 GW of panels per year. But in the STEPS, only 500 GW is deployed globally in 2030. Boosting deployment up from these levels raises some complex questions. It would require measures – notably expanding and strengthening grids and adding storage – to integrate the additional solar PV into electricity systems and maximise its impact. Manufacturing capacity is also highly concentrated: China is already the largest producer and its expansion plans far outstrip those in other countries. Trade, therefore, would continue to be vital to support worldwide deployment of solar.

A wave of new LNG export projects is set to remodel gas markets

Starting in 2025, an unprecedented surge in new LNG projects is set to tip the balance of markets and concerns about natural gas supply. In recent years, gas markets have been dominated by fears about security and price spikes after Russia cut supplies to Europe. Market balances remain precarious in the immediate future but that changes from the middle of the decade. Projects that have started construction or taken final investment decision are set to add 250 billion cubic metres per year of liquefaction capacity by 2030, equal to almost half of today’s global LNG supply. Announced timelines suggest a particularly large increase between 2025 and 2027. More than half of the new projects are in the United States and Qatar.