A new report from UMAS, UCL Energy Institute (UCL) and Global Maritime Forum (GMF) illustrates how green shipping corridors could benefit from a global fuel standard (GFS) and regional policies, but additional support would be needed to drive early adoption.

The report ‘Building a Business Case for Green Shipping Corridors’ looks at the commercial challenges associated with green shipping corridors, how these could change under future regulation, and what additional support may be needed to ensure the viability of such projects.

The report emphasises the important role of regulation in enabling shipping’s energy transition and the wider implications for the industry operating under a future compliance regime where fleet and bunkering strategies will need to become more sophisticated.

Policies such as the IMO’s new global fuel standard, the EU’s Emissions Trading System (ETS), and the US Inflation Reduction Act (IRA) will play a critical role in reducing costs for green shipping corridors but fall short of fully bridging the gap between the cost of e-fuels and the cheapest solution to meet compliance.

Upcoming regulation will shift the business case for green shipping corridors – as well as shaping how the wider shipping industry approaches compliance. To fully bridge the cost gap, however, targeted support for e-fuels is needed. But this short-term support will pay future dividends by ensuring that scalable and sustainable fuels are available to the wider industry when needed.

…said Deniz Aymer, Senior Consultant, UMAS.

Dr Nishatabbas Rehmatulla, Principal Research Fellow at the UCL Energy Institute, stated, “The findings of this study make it very clear that without clear demand signals and additional public support over the near term, closing the cost gap on e-fuels will be challenging.”

The most important role Green Corridors can play is to coordinate and kick-start the value chain for tomorrow’s shipping fuels. Participants in corridors will need to be creative in how they leverage a range of regulations, but it’s clear from this work that the scale of their impact will depend on policymakers delivering targeted support for e-fuels.

…Jesse Fahnestock, Director of Decarbonisation at the Global Maritime Forum, commented.

Key findings

- Current and anticipated policies reduce, but do not eliminate, the cost gap for corridors

- The IMO’s global fuel standard combined with only a flexibility mechanism is unlikely to lead to green shipping corridors before 2040

- Even when an IMO fuel standard is combined with the EU ETS and US IRA, compliance-driven green shipping corridors are unlikely to form

- Remaining cost gap could feasibly be closed through support for efuels and business models that account for escalating compliance

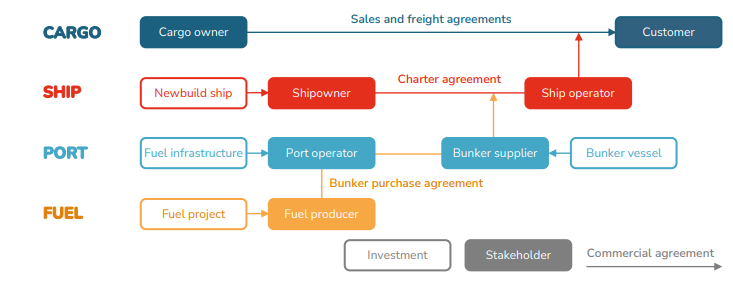

Dry bulk trade is typically fluid, but green shipping corridor projects are developing in pockets of opportunity in this sector. Such projects benefit from a simple value chain with a direct commercial link between cargo owner and customer, but the division of responsibility for the ship and fuel adds complexity to the business case

…the report conlcudes.

Key responsibilities

FUEL: To secure fuel for a green shipping corridor project, an entity from the value chain will need to have the capability and resources to underwrite an offtake agreement with an e-fuel producer. For this stakeholder, an early commitment to offtake e-fuels could be an initial step in developing a long-term bunkering strategy focused on building a diverse portfolio of offtake agreements (potentially covering a range of fuel types, sources, and durations) through which to manage future compliance and fuel price risk exposure as regulation tightens.

PORT: Stakeholders involved in fuel storage and bunker provision at ports rely on customer demand to raise utilisation to a level that ensures a sufficient return on investment in related infrastructure and assets. These ‘last mile’ costs for the storage and supply of bunker fuels are highly sensitive to demand. Green shipping corridor projects can facilitate such investments by providing firmer commitments and potentially greater levels of demand, enabling economies of scale to be reached more swiftly.

SHIP: Shipowners that have invested in ships capable of running on alternative fuels may findit challenging to pass those higher capital costs on through the value chain—whether through direct operations or via chartering agreements. Operators will need to develop their fleet management or chartering strategies in tandem with their bunkering strategies and this could trigger a degree of risk sharing in charter agreements through a balance of premium and tenor.

CARGO: A green shipping corridor could form around a long-term sales agreement for a cargo, particularly if the customer is willing to pay a premium for a decarbonised supply chain. This may be more likely to occur where the cost of shipping is low relative to the value of the cargo, and so where higher costs could potentially be more easily absorbed.

The trade in e-ammonia cargoes presents a low-barrier opportunity for green shipping corridor projects to form. Key elements supporting the business case include:

1. No requirement for a separate bunker offtake agreement

2. The terms of the offtake agreement may be more favourable due to higher volumes or better credit quality

3. Supply and port storage infrastructure investment is underwritten by the e-fuel production and export project

4. No requirement for dedicated bunkering infrastructure

On the other hand, the report mentions that the bulk carrier sector offers fewer opportunities to form green shipping corridors. Much of the fleet (particularly the smaller dry bulk carriers) trades in a random and wide-ranging manner, under short-term charters, and carrying low-value cargoes.

” A large mining company could potentially underwrite an e-fuel offtake agreement and offer long-term mcharters to shipowners for dual fuel bulk carriers in order to manage compliance with an IMO fuel standard across its fleet. Again, the challenge will be the cost of using e-fuels compared to cheaper compliance options”

To accelerate progress, the report outlines actionable solutions for industry and policymakers. It highlights how business models will need to adapt under incoming regulation and how long-term commitments from cargo owners and ship owners and operators can help de-risk investment and drive e-fuel adoption. Strategic partnerships across the value chain will be essential for sharing risks and rewards, ensuring a more equitable cost distribution while advancing green shipping corridor projects.

Despite this, the business case for green shipping corridors will remain challenging without targeted measures to support the uptake of e-fuels. Mechanisms such as Contracts for Difference (CFDs), e-fuel auctions, and/or multipliers for overcompliance with e-fuels will be crucial to the short-term viability of these initiatives. Economic support could be underwritten by the IMO through revenues raised by a levy on shipping industry emissions. In the absence of a global levy, however, national governments may need to step in to directly support corridor projects.