Iran’s recent attack on Israel has escalated the tensions in the Middle East and raised concerns over LNG trade through the Strait of Hormuz (SoH), a key and only feasible passage for Qatar and the UAE to export LNG.

Any further escalation, leading to the closure of the SoH could impact LNG shipping as 21% of the global LNG supply could be affected. The Strait of Hormuz is a vital strategic passage for the Middle East, supporting its international trade and regional integration. The artery is significant for the LNG sector as two key LNG exporters – Qatar and UAE – export their LNG shipments via the SoH with no other possible alternative available.

Thus, any action by Iran, leading to the closure will have significant implications for the LNG market. However, the extent of the impact will differ and depend on the duration of the closure. In 2023, Qatar exported about 81 million tonnes of LNG and the UAE exported 4 million tonnes, contributing 21% to the global supply.

Any supply blockage will not only hurt exporters of these two countries but will also compel key importers to scout for new sources. Between Asia and Europe, the former will have a much greater impact as 70% of Qatar’s volumes are exported to Asia while 20% to Europe.

Some countries, such as India and China, will be at high risk as these countries source about 45% and 25% of their total LNG imports from Qatar every year, respectively (based on the 2023 trade statistics).

Some countries, such as India and China, will be at high risk as these countries source about 45% and 25% of their total LNG imports from Qatar every year, respectively (based on the 2023 trade statistics).

Meanwhile, European importers including, the UK, Italy, and Belgium, will also need to source LNG from other countries, if supply from Qatar becomes impassable.

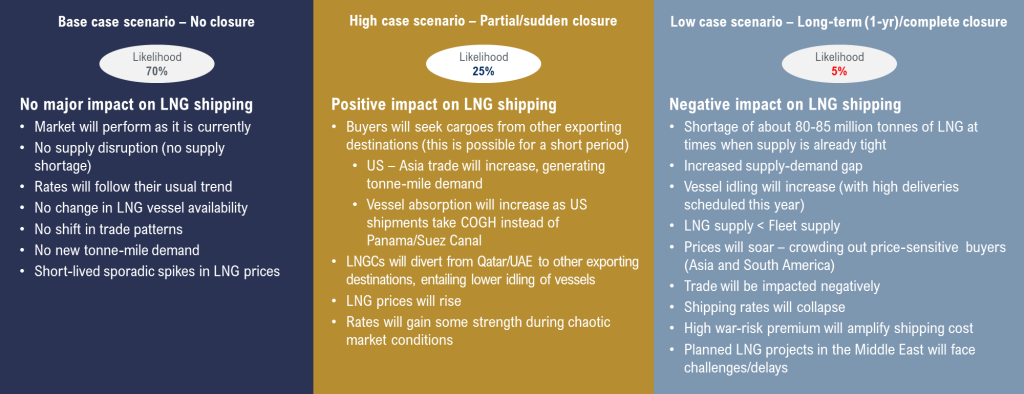

Drewry believes that a complete closure of the Strait of Hormuz is highly unlikely as Iran exports all of its oil and LPG cargoes through it and other Middle Eastern countries traversing via SoH will have severe repercussions if it is blocked. Meanwhile, the global economy will be hit by a massive supply deficit of natural resources as 30% of oil, 20% of LNG and 40% of LPG will be affected by the potential closure. However, this will have short-term repercussions on LNG.

Iran-Israel conflict: Impact on LNG market and shipping

LNG prices spike: Asian Spot and TTF* were up 14% and 15% WoW, respectively, on 20 April 2024 amid the escalated tensions in the Middle East. Prices are now more than $10 per MMBtu, after hovering below this level for the last three months. Drewry expects LNG prices to be volatile in tandem with prolonged conflict in the Middle East, threatening supply cuts, which will keep LNG players on the edge.

Drewry also expects Asian spot to maintain its premium over TTF as any supply cut from the Middle East will impact Asian buyers more than European ones. However, the growth in LNG prices will be moderate due to high storage and stable gas demand in Europe.

The extent of supply shortage will depend on the duration of SoH closure: According to Drewry AIS, Qatar exports about 0.2 million tonnes of LNG per day, while the UAE exports nearly 10 thousand tonnes per day.

Drewry believes the impact of any supply disruption from these countries will be directly proportional to the duration of the closure. If Iran blocks SoH for a few days or weeks, Drewry expects no major impact on the LNG market and shipping as currently, demand remains stable in Europe and Asia.

Drewry also believes the partial closure of the SoH could support LNG shipping amid vessels diverting away from the Middle East in search of new employment as importers will seek substituted cargoes from other destinations, leading to some shifts in current trade patterns.

Although the shift in trade will be sustainable for a short period (assuming up to five months), Drewry expects an increased US-Asia trade, providing impetus to LNG shipping rates – mainly due to huge vessel absorption as US shipments will continue to take the COGH instead of the Panama and Suez Canals, generating extra tonne-mile demand.

Thus, short-term supply disruption will lead to demand alternation, supporting LNG shipping and aiding LNG prices.

However, Drewry is pessimistic about LNG shipping if the complete closure of the SoH extends for a longer period (assuming one year). Any supply shortage for a long duration will harm LNG shipping, further tightening the market. On the other hand, fleet availability will grow with several vessels being idled due to LNG supply shortage while about 60 new LNGCs are expected to join the current fleet this year. Consequently, this will lead to vessel oversupply, which inevitably will dent the LNG shipping rates.