Amid an ongoing trade war between China and the US, as well as major geopolitical tensions globally, it is likely that total ordering activity will be softer near term, representing a downside risk to the positive development of newbuilding prices, according to VesselsValue.

Following increased combined total ordering activity (bulker, tanker, container, gas) in the first half of 2018, the pace slowed down.

While the sentiment is positive and ship prices are seen moving upwards in the forecast, near term uncertainties are likely to have investors taking a more cautious stance on ordering. Though the total orderbook for vessels has picked up from its bottom in 2017, it is still at levels giving the shipyard industry cause for concern, leaving investors and shipowners with the upper hand in newbuilding price negotiations. Implementation of IMO 2020 is expected, through reduced speed and inefficiencies, to shave off supply capacity going forward.

With respect to the above, VesselsValue teamed up with Oslo-based shipping consultancy firm ViaMar to provide Forecasted Market values for each individual vessel in the Tanker, Bulker, Container and LPG fleet:

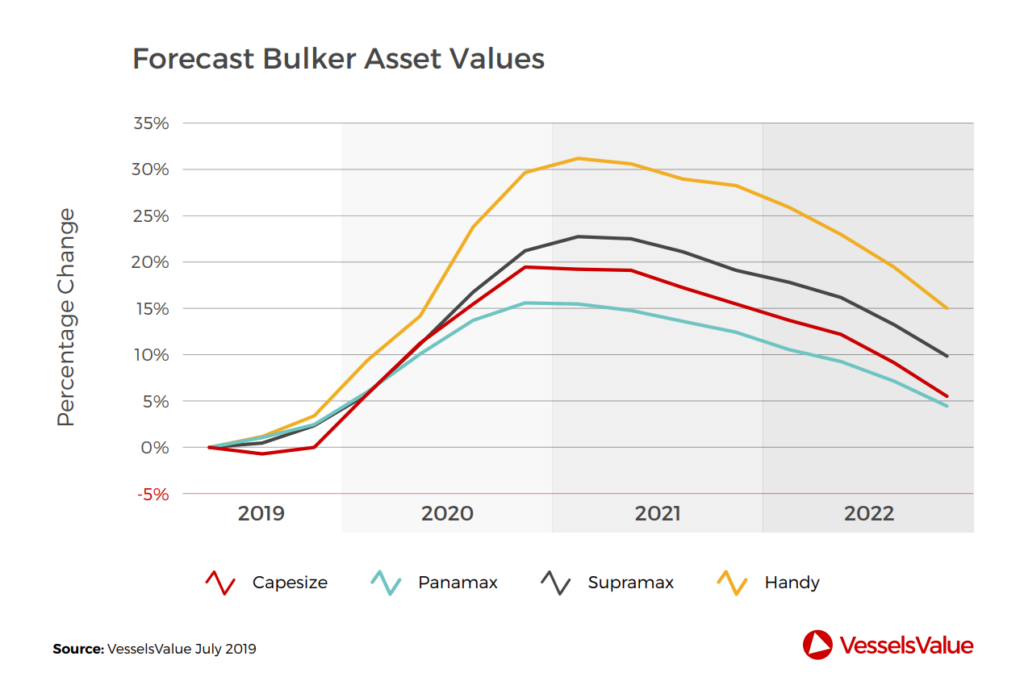

Dry Bulk

Demand, negatively impacted by the Brazilian mine accident, was outpaced by supply growth during the first quarter of 2019.

The iron ore and coal development have put substantial upward pressure on dry bulk freight rates after declining dramatically during most of the first quarter.

Capesize freight rates have more than quadrupled (from USD 3,500/day to USD 19,500/day), while other segments have increased moderately or remained flat through the second quarter.

Dry bulk demand growth should continue to be fueled by global economic growth, Chinese stimulated infrastructure investments, and seaborne trade of coal to China and Asia.

Demand growth is expected to slow during 2021 and 2022 due to slower global economic growth.

On the supply side, scrapping has increased further compared to the first quarter, and ordering has remained low.

However, newbuilding prices have passed their troughs and demand for shipbuilding activity has increased since the 2017 lows, setting the stage for further price increases.

Values marginally weakened during the second quarter after remaining flat during the first quarter.

Deliveries will increase as new vessels ordered during the mini boom of 2017/18 will enter the market during 2019 and 2020 with the dry bulk fleet still growing by an average of 3.3% over the next two years.

Ordering is expected to remain low which should ensure more moderate fleet growth during 2021 and 2022.

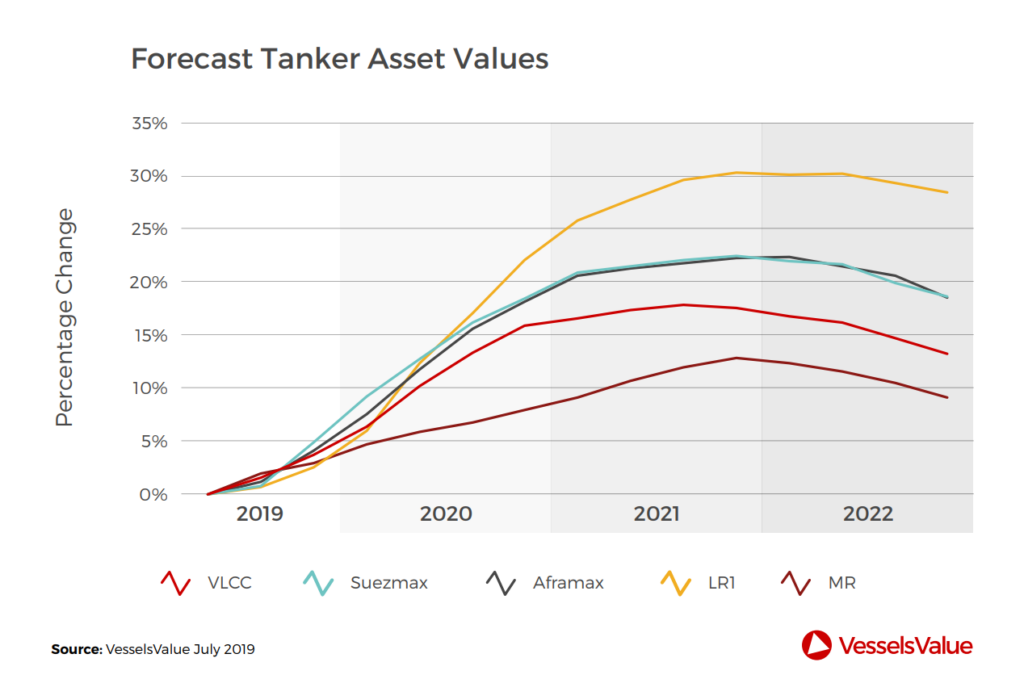

Tankers

Vessel values have shown a positive development, though product tanker vessels have lagged behind the larger vessels. An asset value upside is present during our projection period for both newbuild and secondhand tanker vessels.

At the same time, the ongoing trade war is still casting a shadow on the outlook for economic development.

Now it seems that the trade war is most likely to intensify before easing, giving a potential sentiment boost in the second half of 2020, for which the timing of a resolve remains highly uncertain.

Forecasted ton mile demand growth coupled with slowing fleet growth, in turn helped by increased scrapping, will give improved earnings and values for tankers.

An anticipation of lower ordering activity in 2019 caused by the current unstable geopolitical environment will aid the balance towards the end of the forecast, though the positive momentum may cool as softer demand sets its mark.

The market direction during our forecast period will of course hinge on oil production developments in non OPEC (US) and OPEC countries, the ensuing oil price, and its impact on demand in oil hungry nations like China and India.

Moreover, trading patterns continue to evolve, with the most apparent changes in the Atlantic (US) for crude and in the Far East for refined products.

For the tanker newbuild sector, improved charter earnings and a positive sentiment should ensure that asset values will continue upwards and accelerate towards the end of 2019.

Scrapping activity in the first quarter totaled 1.7m DWT, which is the lowest since the second quarter of 2017.

Ordering activity climbed to 6m DWT in the first quarter of 2019 from 3m DWT in the fourth quarter of 2018.

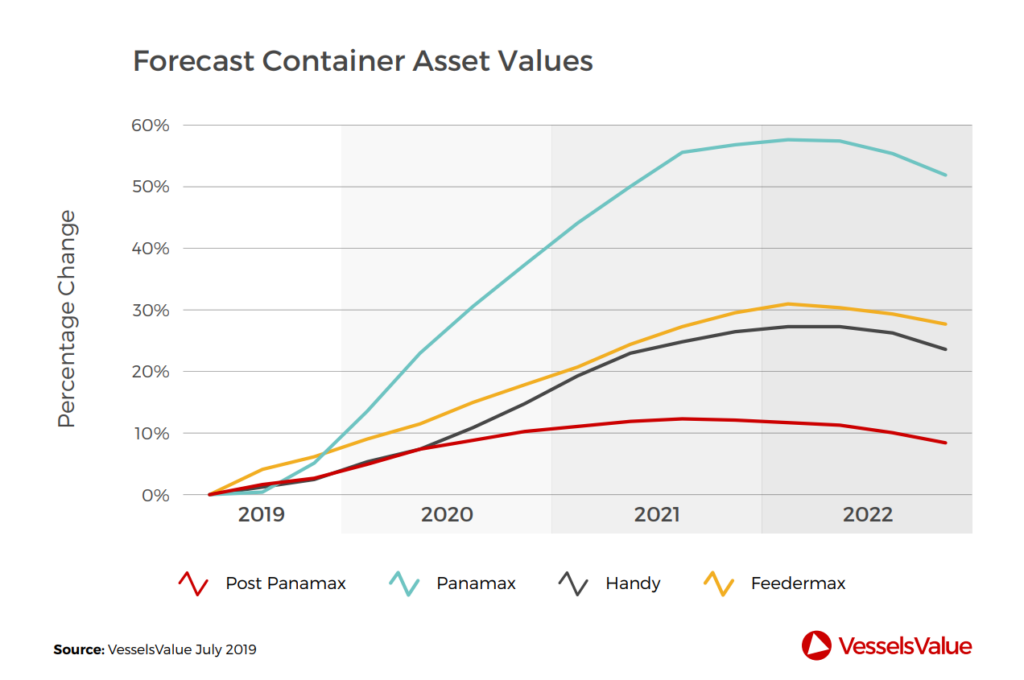

Container

Container trade volumes on the main trade lanes (Asia to North America and Asia to Europe) showed a strong trend over the winter of 2018/19.

The main reason for the stronger growth rates to North America has been the ongoing trade war with China, where shippers were fast forwarding goods ahead of an expected US tariff increase scheduled for March 1, 2019.

Manufacturing has declined dramatically since the end of 2018 and industrial demand indicators are pointing towards even lower levels in the short term. Growth rates will be lower in the second half of 2019 and info the first half of 2020, before rebounding on expectations of a trade war solution.

In Europe, both consumer confidence and industrial demand indicators are declining but imported volumes are growing so far. This positive trend will dampen towards the new year but rebound during 2020.

Six to 12 months timecharter rates for the larger Post Panamax vessels have gained ground and are now on levels comparable to the peak in 2018 for the 6,500 TEU, and above the same peak for the 8,500 TEU. For the smaller feeder vessels, freight rates have moved sideways into the first quarter.

Secondhand values for the larger Post Panamax vessels increased into 2019, while the smaller feeder vessels moved sideways or marginally up.

The development in vessel speed going forward will be vital for the market direction. IMO 2020 implementation is expected to keep speed at current levels or slightly below, and increase off hire in the short term. This will shave off supply capacity in the forecasting period and the market balance will tighten. Hence, freight rates will increase towards 2022.

Scrapping has continued to increase making containers the most popular asset class scrapped this year. 60k TEU has been scrapped in the first quarter this year. More importantly, liners continue to reduce speed to manage costs and reduce capacity, and this will dampen supply growth.

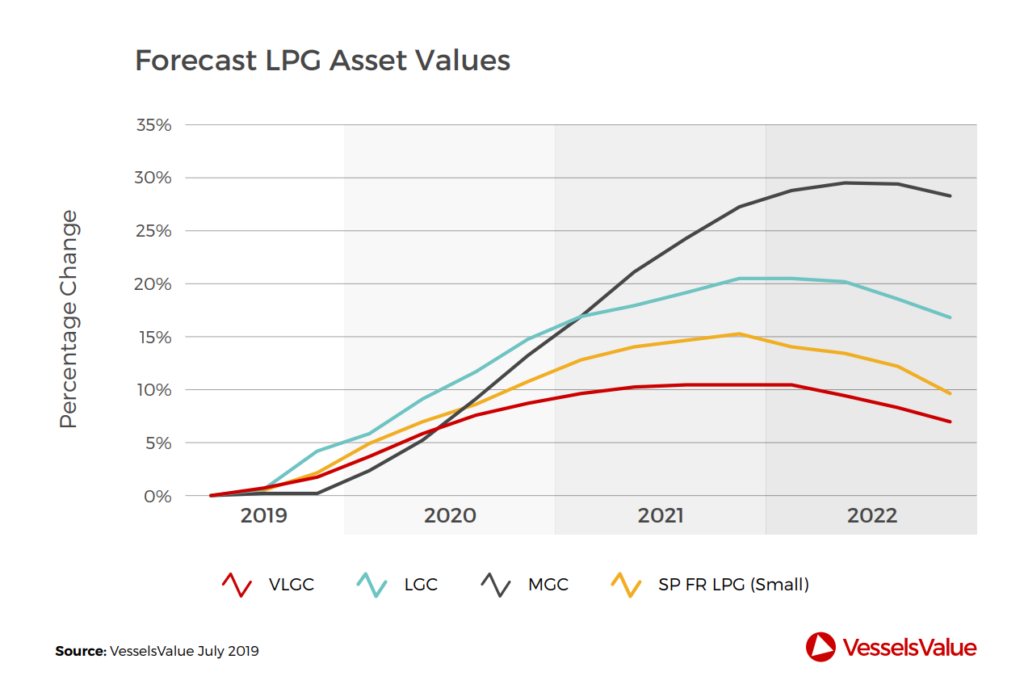

LPG

Earnings for VLGCs improved sharply in the second quarter of 2019 as US production of LPG continued to increase in a period of low local consumption.

The growing surplus of LPG was exported to Asia, Latin America, Africa and Europe and created a firm shipping demand growth. Petchem trade has been muted with reduced export out of the Middle East.

Inter Asian trade, however, is growing, and rate levels have been maintained. Pressurised vessels have seen earnings slightly down in a normal seasonal trend.

We expect earnings for VLGCs to remain strong over the next few years, even though seasonal fluctuations may occur. The main drivers are growth and changes to US exports of primarily propane and butane.

MGCs will benefit from an increasing supply of LPG and a growing ammonia trade as well. For vessels in the petchem gas trade, we expect a moderate tightening of the market balance only, affected by trade wars and reduced manufacturing. Tonnage growth will be moderate.

Newbuilding prices for the VLGC and the MGC segments in the LPG market will be affected by improved charter earnings and a positive sentiment, which should ensure that asset values will continue upwards in 2019 and into 2020.

We also forecast a moderate rise in asset values for Handys and smaller pressurised LPG vessels.

See also: