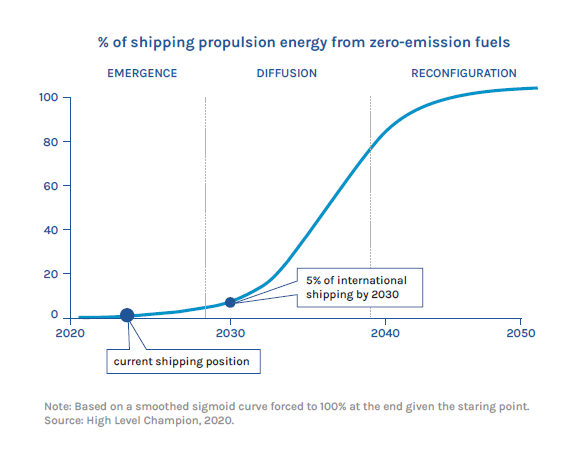

UMAS, the Getting to Zero Coalition, and Race to Zero warn that while it is possible for scalable zero-emission fuels to account for 5% of international shipping fuels by 2030, the window of opportunity is closing quickly, and the industry must act rapidly.

Current landscape

According to the Global Maritime Forum (GMF), the Climate Action in Shipping, Progress towards Shipping’s 2030 Breakthrough report paints a mixed picture when it comes to shipping’s core challenges of sourcing zero-emission fuels and deploying zero-emission vessels. Zero-emission fuel production currently in the pipeline could end up covering just a quarter of the fuel needed to deliver the breakthrough.

The last 12 months have seen a positive shift in maritime decarbonisation efforts. Now is the time to see strong progress in terms of commitment for zero carbon fuels and freight from the industry so that the needed rapid scale-up of these fuels in the energy mix is achieved

… said Dr Domagoj Baresic, Research Associate at UCL and Consultant at UMAS, and lead author of the report

However, if more projects are successful, zero-emission fuel production could be up to twice as much as is needed, even when accounting for other sectors’ fuel needs. Despite headline-grabbing orders for methanol-fuelled ships, continuing the current trajectory of orders might only deliver one-fifth of the needed vessels to achieve the breakthrough target, the report finds.

Key findings

- Overall progress to reach the 5% by 2030 scalable zero emission fuel (SZEF) goal can be considered to have remained partially on track from last year.

- The past 12 months have seen significant developments in terms of international commitments at the IMO, national policy developments, industry announcements, and technological developments.

- In order to reach the 5% goal, significant progress remains necessary, especially in terms of concrete national policies turning the IMO’s level of ambition into specific economic and technical measures.

- There is a need to turn growing appetite for zero carbon freight into concrete demand on the orderbook for SZEF vessels which can send the right signals to SZEF suppliers.

- The strong technological progress observed in recent years must continue to be capitalised on to ensure sufficient supply of SZEF in 2030, both in terms of expanding the announced pipeline of production and ensuring a sufficient proportion of announced capacity passes the final investment decision stage.

- There are multiple financial mechanisms and funding options available now which can be used to support such a challenging but achievable task, but many of the available financial mechanisms and sources of finance are shared across multiple areas and must be tapped into by the industry.

- Policymakers must do their utmost to ensure that specific finance for SZEF developments is earmarked and directed into the right areas.

- The adoption of the 2023 IMO GHG Strategy can be considered as a historical moment in showing that the 5% SZEF goal can be considered a minimum ambition on the pathway of maritime decarbonisation and one for which the utmost efforts must be made to ensure that 5% is reached and, hopefully, surpassed to bring us to 10%.

- It will be important to guarantee that further diversification of funding, policy, and projects is made to ensure more even and equitable geographic distribution of developments, whilst also ensuring that progress in terms of civil society engagement is maintained and further strengthened.

The need for policy

Progress on policy is critical to enabling the needed scale-up of supply and demand. Major progress has been achieved with the adoption of an ambitious greenhouse gas (GHG) emissions reduction strategy by the International Maritime Organization (IMO), which will be followed in 2025 by the adoption of concrete global measures to achieve the strategy’s goals.

With the revision of the IMO’s greenhouse gas strategy, the industry’s direction of travel is clear. Especially in these early years, we need to be able to assess how fast we’re moving in that direction. This report shows that the industry is progressing, but that action still needs to accelerate

… supplied Jesse Fahnestock, Project Director at the Global Maritime Forum

In an exclusive interview to SAFETY4SEA, Mrs Ingrid Sidenvall Jegou, Project Director, Global Maritime Forum, had also explained how industry action and technological development alone are not enough. She had pointed out that a supporting policy framework is vital to make maritime decarbonization possible. Furthermore, collaboration, coordination, and co-investment with other industries and new entrants will be necessary, she added.

Because these measures are to be implemented after 2027, industry and national governments will need to make concerted, immediate efforts (e.g. through green corridors and national policy) to stimulate supply and demand in the intervening period and ensure that the industry is prepared to deliver on the IMO strategy before 2030.

Dominant trading nations have a monumental opportunity to regain our stalled climate momentum by scaling the efforts that leading vessel owners, operators and shipping manufacturers have already begun. These urgent actions are also very important to protect nature and our oceans, unlocking a myriad of benefits for coastal communities across the globe

… said H.E. Razan Al Mubarak, UN Climate High-Level Champion for COP28

The report also indicates that financing for achieving the breakthrough is partially on track, with the amount of shipping finance covered by the Poseidon Principles surpassing US$200 billion and the climate alignment of these investments improving from 4% to 6% on a weighted average basis. The ability of the industry to continue to improve alignment as requirements tighten remains to be seen.

Although there is progress towards its 2030 breakthrough target – for zero-emission fuels to make up 5% of international shipping’s energy demand by 2030 – we need to see policy makers create incentives for scaling up, for example, green hydrogen.

… concluded Mahmoud Mohieldin, UN Climate Change High-Level Champion for COP27

To remind, this is not the only report to find the industry’s current action inadequate to meet targets. DNV’s Energy Transition Outlook 2023 also noted that between 2017-2022 renewables met 51% of new energy demand, whilst the remaining demand was supplied by fossil fuels. Limiting global warming to 1.5°C warming is less likely than ever. To reach the goals of the Paris Agreement, CO2 emissions would need to halve by 2030, but DNV forecasted that this will not even happen by 2050.