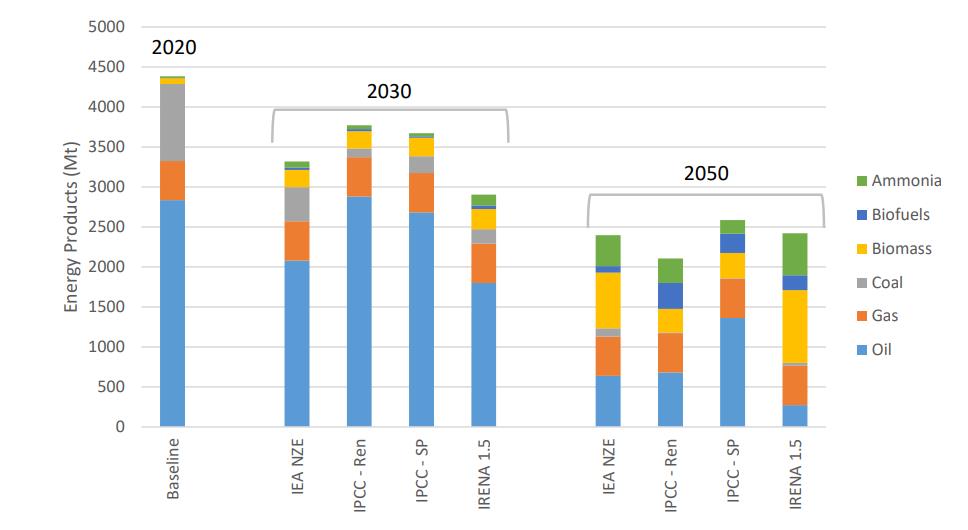

A new report acknowledges that shipping will play a key role in transporting the green fuels necessary to meet global climate goals, highlighting the need for stronger national policies on low-carbon fuels.

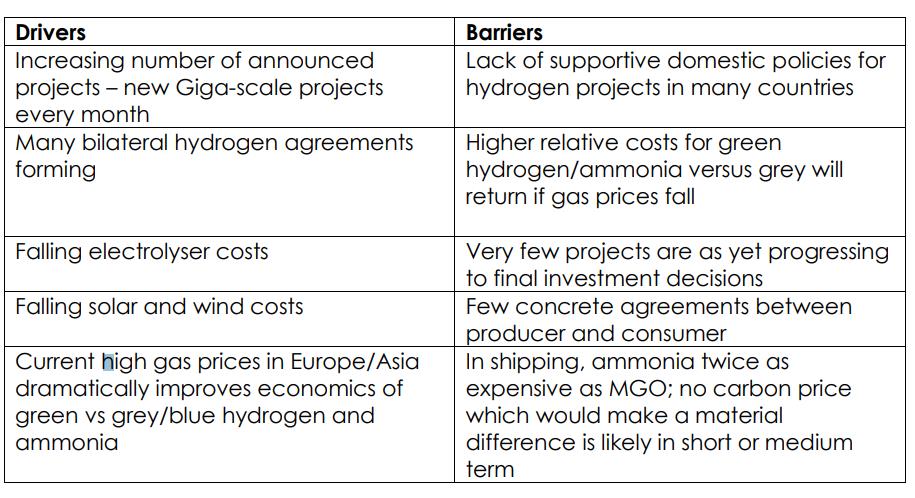

The report, published from the Tyndall Centre at the University of Manchester and titled ‘Shipping’s Role in the Global Energy Transition’ , identifies growth in low-carbon hydrogen and sustainable bioenergy as essential to meet the Paris Climate Agreement’s goals. However, the authors found that a lack of enabling policies from governments, such as guaranteeing markets and prices for producers and consumers, was holding back investment in the shipping infrastructure needed to support the global energy transition.

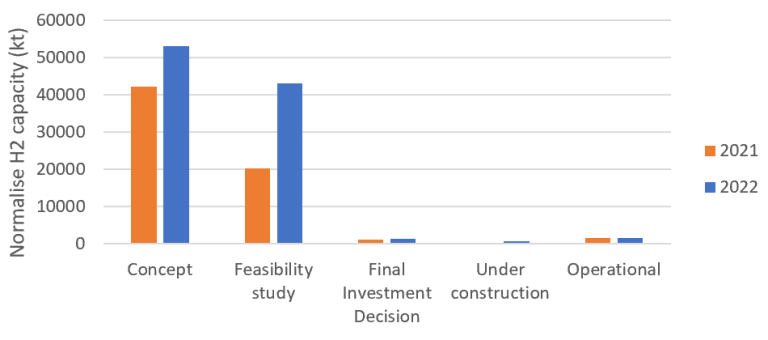

The world needs 50-150 million tonnes of low-carbon hydrogen by 2030, but there is a major gap between this and what is planned to date: already-announced projects will only produce 24 million tonnes by 2030, according to the International Energy Authority. Worryingly, only 4% of these projects have a final investment decision. Researchers at the Tyndall Centre called for stronger Government policies to give low-carbon hydrogen producers, shippers and consumers the confidence they need to invest.

New green fuels are essential to meet the Paris climate goals, and there is a pivotal role for the shipping sector in transporting them. But production of green fuels must be scaled up – there is a yawning gap between current plans and what is needed to meet the Paris goals

…report co-author Professor Alice Larkin said.

The report was commissioned and welcomed by the International Chamber of Shipping who called on governments attending COP27 to send “stronger market signals” to the shipping industry to reduce fears that any new ships built to transport low-carbon fuels would never be used.

The Tyndall Centre’s report identified several potential considerations for government policy to increase their effectiveness at enabling investment. These include introducing mandates for increasing percentages of green hydrogen, creating ‘production credits’ for the production of hydrogen, or providing guaranteed markets and prices for producers and consumers. Such measures are already being trialled in the USA, Germany, and India.

In particular:

#1 Using quotas and mandates: up until 2030, the biggest potential source of demand for new low-carbon hydrogen projects will be through replacing grey hydrogen in existing industrial processes, with green hydrogen

#2 Contracts for difference: two problems for low-carbon hydrogen are uncertainty for suppliers that they will have long-term buyers, and demand-side concerns regarding price. Contract for difference-style policy mechanisms can overcome both.

#3 Hydrogen production credits: on the production side, in August 2022 a mammoth US Inflation Reduction Act was passed – including a package of measures aimed at boosting the hydrogen economy. The major element of this package is the Clean Hydrogen Production Credit, which introduces a 10-year sliding-scale of credits for hydrogen production

#4 Prioritising end-uses: given the short- and medium-term gap between low-carbon hydrogen requirements for 1.5˚C, and likely production volumes, government clarity on the priority end-uses for hydrogen is particularly important. Hydrogen’s production and storage is too energy-intensive for it to be wasted on sectors where there are alternatives

measures to reassure investors of a future market-place, such as national targets and hydrogen strategies;

standards and certification policies to ensure robust sustainability benefits;

policies to stimulate demand for low-carbon hydrogen;

supply-side support, to accelerate investment in low-carbon hydrogen production, storage and transportation infrastructure;

RD&D support for demonstration projects for elements of the hydrogen supply chain not yet fully market-ready

“The shipping industry knows it has a huge part to play in global decarbonisation in the coming decades, transporting the new green fuels the world’s economy needs. But for us to invest, governments need far stronger policies to de-risk green hydrogen production. Guy Platten, Secretary General of the International Chamber of Shipping said and highlighted that:

National Hydrogen strategies must include an explicit focus on supporting the transport infrastructure needed for both imports and exports. Industry is ready to respond but we urgently need stronger market signals and infrastructure investment to make this a reality.