The global energy crisis triggered by Russia’s invasion of Ukraine is causing profound and long-lasting changes that have the potential to hasten the transition to a more sustainable and secure energy system, according to the latest edition of the IEA’s World Energy Outlook.

Russia’s invasion of Ukraine led to a global energy crisis

Prices for spot purchases of natural gas have reached levels never seen before, regularly exceeding the equivalent of USD 250 for a barrel of oil. Coal prices have also hit record levels, while oil rose well above USD 100 per barrel in mid-2022 before falling back.

High gas and coal prices account for 90% of the upward pressure on electricity costs around the world. To offset shortfalls in Russian gas supply, Europe is set to import an extra 50 billion cubic metres (bcm) of liquefied natural gas (LNG) in 2022 compared with the previous year.

This has been eased by lower demand from China, where gas use was held back by lockdowns and subdued economic growth, but higher European LNG demand has diverted gas away from other importers in Asia

says IEA.

Policy responses fast-tracking emergence of clean energy economy

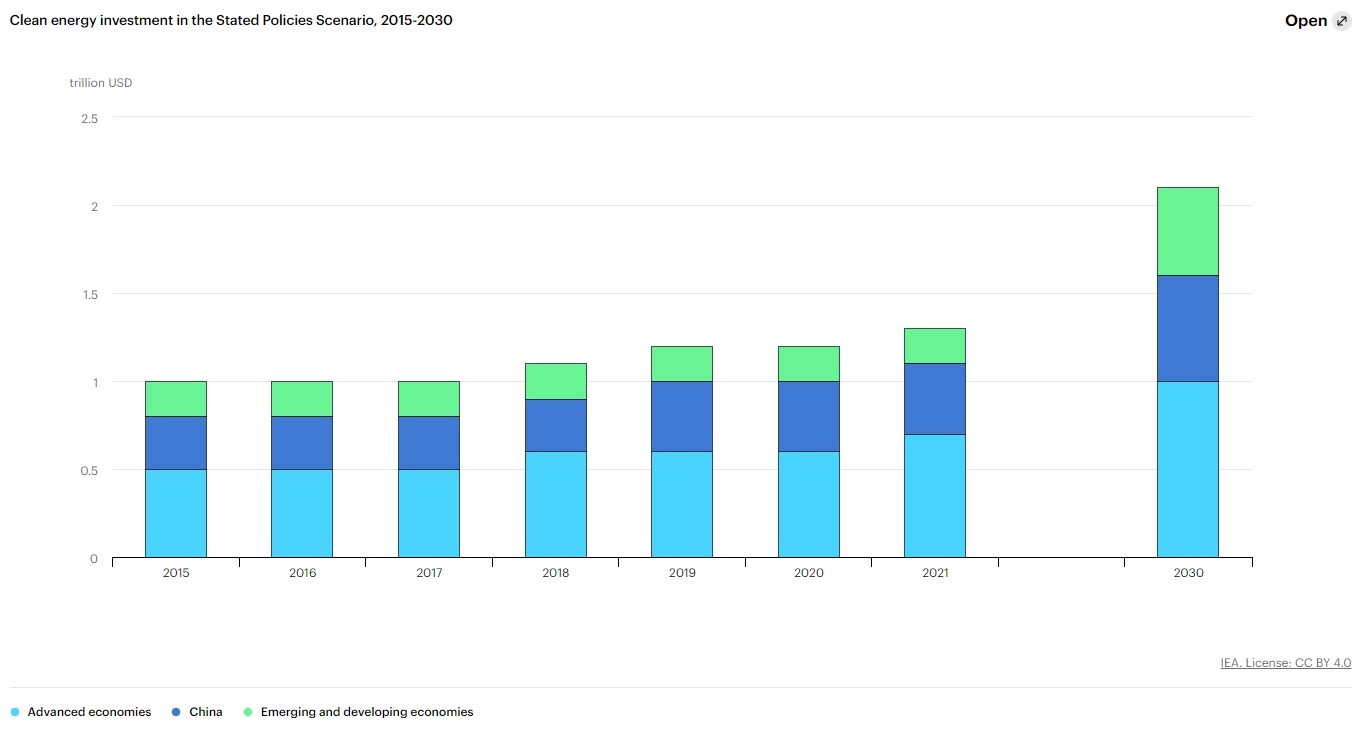

According to the report, new policies in major energy markets help propel annual clean energy investment to more than USD 2 trillion by 2030 in the STEPS, a rise of more than 50% from today.

By 2030, thanks in large part to the US Inflation Reduction Act, annual solar and wind capacity additions in the United States grow two-and-a-half-times over today’s levels, while electric car sales are seven times larger.

New targets continue to spur the massive build-out of clean energy in China, meaning that its coal and oil consumption both peak before the end of this decade.

Faster deployment of renewables and efficiency improvements in the European Union bring down EU natural gas and oil demand by 20% this decade, and coal demand by 50%, a push given additional urgency by the need to find new sources of economic and industrial advantage beyond Russian gas.

Japan’s Green Transformation (GX) programme provides a major funding boost for technologies including nuclear, low-emissions hydrogen and ammonia, while Korea is also looking to increase the share of nuclear and renewables in its energy mix.

India makes further progress towards its domestic renewable capacity target of 500 gigawatts (GW) in 2030, and renewables meet nearly two-thirds of the country’s rapidly rising demand for electricity.

Efficiency and clean fuels get a competitive boost

Investment in low-emissions gases is set to rise sharply in the coming years. In the APS, global low-emissions hydrogen production rises from very low levels today to reach over 30 million tonnes (Mt) per year in 2030, equivalent to over 100 bcm of natural gas.

Much of this is produced close to the point of use, but there is growing momentum behind international trade in hydrogen and hydrogen-based fuels.

Projects representing a potential 12 Mt of export capacity are in various stages of planning, although these are more numerous and more advanced than corresponding projects to underpin import infrastructure and demand.

Carbon capture, utilisation and storage projects are also advancing more rapidly than before, spurred by greater policy support to aid industrial decarbonisation, to produce low- or lower-emissions fuels, and to allow for direct air capture projects that remove carbon from the atmosphere.

Focus on affordable, secure transitions based on resilient supply chains

As the world moves on from today’s energy crisis, it needs to avoid new vulnerabilities arising from high and volatile critical mineral prices or highly concentrated clean energy supply chains.

If not adequately addressed, these issues could delay energy transitions or make them more costly

IEA warns.

Demand for critical minerals for clean energy technologies is set to rise sharply, more than doubling from today’s level by 2030 in the APS.

Copper sees the largest increase in terms of absolute volumes, but other critical minerals experience much faster rates of demand growth, notably silicon and silver for solar PV, rare earth elements for wind turbine motors and lithium for batteries.

Continued technology innovation and recycling are vital options to ease strains on critical minerals markets.

High reliance on individual countries such as China for critical mineral supplies and for many clean technology supply chains is a risk for transitions, but so too are diversification options that close off the benefits of trade.