A new study from the West Australia – East Asia Iron Ore Green Corridor Consortium finds that ships powered by clean ammonia could be deployed on the iron ore trade routes between West Australia and East Asia by 2028 and reach 5% adoption by 2030.

According to GMF (Global Maritime Forum), the study indicates that the core elements for implementation of a West Australia-East Asia green corridor – including deployment of ammonia-powered ships, access to clean ammonia (as the most likely zero-emission fuel to power the corridor), and the availability of bunkering infrastructure – are within reach, provided that the safety case for the use of ammonia as marine fuel is validated and accepted.

Key findings

- It is possible to get clean ammonia-powered bulk carriers on the water by 2028, provided the development of key technologies, such as suitable engines, and regulations remain on track.

- Enough clean ammonia will likely be available to meet the corridor’s near and long-term requirements.

- Should production scale up as expected, the corridor’s demand could be fully met by Australian clean ammonia but could also be imported from other production locations globally.

- The Pilbara region of Australia is a viable option for bunkering on the route, avoiding costly deviations from the trade route, whilst Singapore remains well-positioned to serve as a bunkering hub.

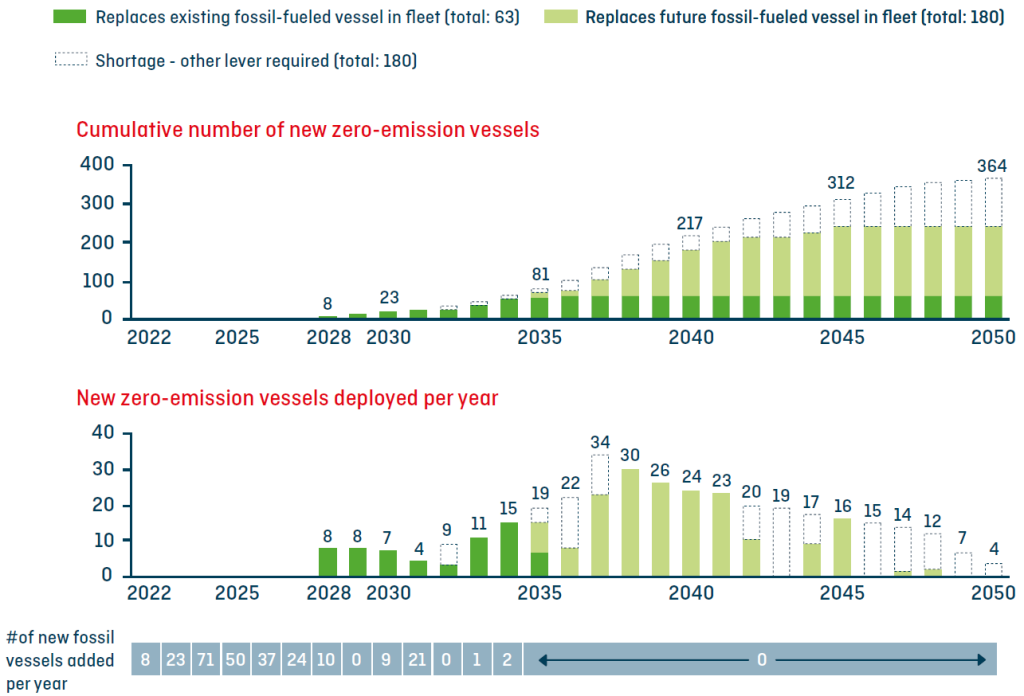

- Should the corridor develop in accordance with the scenario in the analysis, more than 20 vessels could operate on clean ammonia on the corridor by 2030, scaling up to roughly 360 vessels by 2050.

The study demonstrates the industry’s keen interest to decarbonise their supply chain in the region. What is needed now to accelerate the development of this green corridor is public sector support.

… said Johannah Christensen, CEO of the Global Maritime Forum

#1 Vessel prerequisites

It would be feasible to have clean ammonia-powered bulk carriers on the water by 2028, if action is taken to mitigate several risks.

- Key technologies, including suitable engines, and regulations, including IMO safety guidelines, covering ammonia-powered vessels should be in place when needed.

- There is a low risk around a suitable design for an ammonia-powered bulker carrier being available and updates to the IMO’s IGF Code to include ammonia-powered vessels being made on time.

- A medium risk is associated with the following elements:

A) Securing a slot for the construction of ammonia-powered vessels, which may be challenging due to a lack of shipyard berths. Shipowners should consider ordering as soon as feasible.

B) Crew upskilling, with the STCW Convention needing to be updated to include ammonia when it is reviewed starting this year.

- Finally, there is likely to be a significant cost premium between clean ammonia-powered and conventionally-fuelled vessels for the foreseeable future, posing a high risk to hitting a 2028 kick-off for the corridor. Policymakers’ actions over the coming few years will be essential to create a viable investment case for ordering ammonia-powered vessels.

Credit: GMF

While outside the scope of this report, the safety concerns and environmental risks of ammonia have yet to be adequately addressed. As the safety of our crew is paramount, these challenges must be overcome to enable adoption.

… said Scott Bergeron, Managing Director Global Engagement & Sustainability at Oldendorff Carriers

#2 Vessel availability

- Following the initial kick-off in 2028, it is estimated that a total of 23 clean ammonia-powered vessels would need to be operational on the corridor by 2030, 81 by 2035, and approximately 360 by 2050 to meet the decarbonisation scenario.

- Enough vessels will be retired to enable the introduction of most of the clean-ammonia vessels required. If orders were placed over the coming years, almost all clean ammonia-powered vessels on the corridor up to 2035 could be deployed in this way.

- After this point, some retrofits and/or early retirements would be required, supported by regulatory clarity and policy incentives.

In line with our net zero ambitions, we seek to influence this supply chain, with our ecosystem partners, by creating demand for low- and zero-GHG emission fuels and energy efficient vessels.

… said Rashpal Bhatti, Vice President Maritime and Supply Chain Excellence at BHP

Laure Baratgin, Head of Commercial Operations at Rio Tinto, also pointed out that it is important for the their company to remain committed to collaborating with value chain partners in support of this initiative as we work to deliver our climate commitments on shipping.

#3 Bunkering

- Two potential locations for bunkering on the corridor – Singapore and the Pilbara – were examined in the report. It was found that both locations could introduce ammonia bunkering in the next 5 years, making them among the first ports worldwide to do so.

- Ammonia bunkering in the Pilbara would represent a competitive option for the corridor, with the potential for clean ammonia to be efficiently delivered to the port from local production sites and fuel savings from bunkering directly on the trade route.

- Singapore would also be well-positioned to serve as a bunkering location for the corridor, with the high level of activity to pilot and develop ammonia bunkering creating a strong likelihood the fuel will become available in the coming years, potential for competitive last mile costs, and the availability of multiple advantageous services.

- Other bunkering locations for the corridor are possible, particularly in the medium to long-term, but were not in scope for this study.