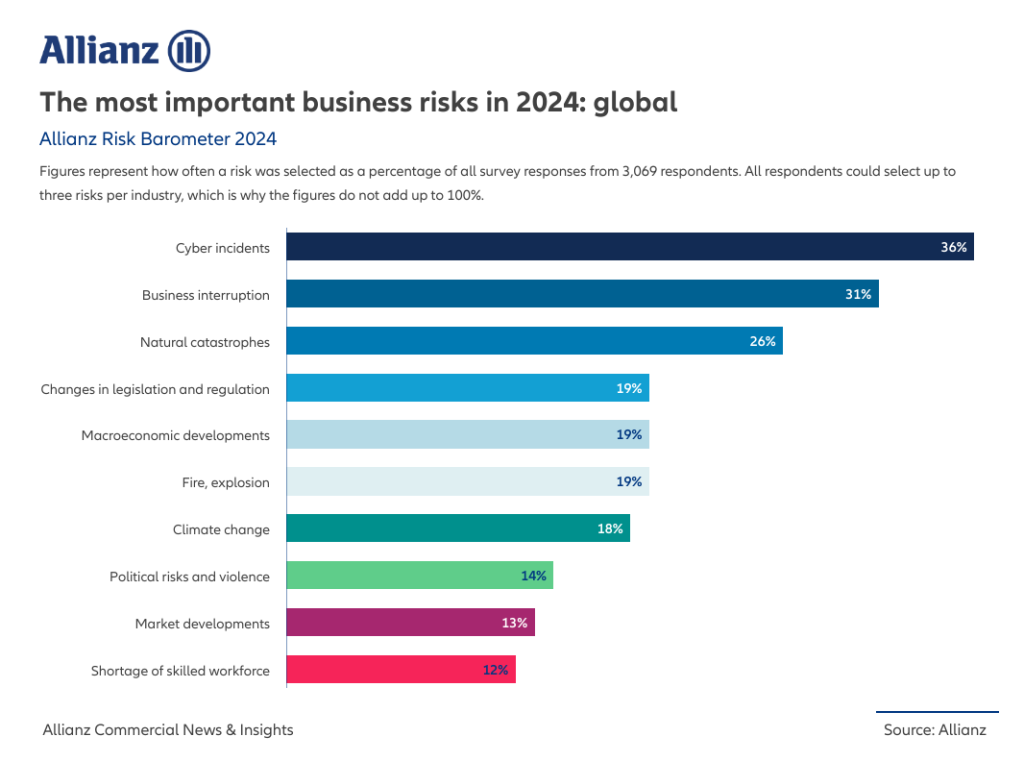

Cyber incidents such as ransomware attacks, data breaches, and IT disruptions are the biggest worry for companies globally in 2024 (36% of responses), according to the Allianz Risk Barometer 2024.

Global trends overview

The closely interlinked peril of Business interruption ranks second. Natural catastrophes (up from #6 to #3 year-on-year), Fire, explosion (up from #9 to #6), and Political risks and violence (up from #10 to #8) are the biggest risers in the latest compilation of the top global business risks, based on the insights of more than 3,000 risk management professionals.

The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment.

… said Petros Papanikolaou, Allianz Commercial CEO

Large corporates, mid-size, and smaller businesses are united by the same risk concerns – they are all mostly worried about cyber, business interruption and natural catastrophes. However, the resilience gap between large and smaller companies is widening, as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience, the report notes.

Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.

… noted Petros Papanikolaou, Allianz Commercial CEO

#1 Cyber activity in 2024

Cyber incidents (36% of overall responses) ranks as the most important risk globally for the third year in a row – for the first time by a clear margin (5% points). It is the top peril in 17 countries, including Australia, France, Germany, India, Japan, the UK, and the USA. A data breach is seen as the most concerning cyber threat for Allianz Risk Barometer respondents (59%) followed by attacks on critical infrastructure and physical assets (53%).

The recent increase in ransomware attacks – 2023 saw a worrying resurgence in activity, with insurance claims activity up by more than 50% compared with 2022 – ranks third (53%).

The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024

… explained Scott Sayce, Global Head of Cyber, Allianz Commercial

To remind, according to research conducted by DNV, less than half (40%) of maritime professionals think their organization is investing enough in cyber security at a time when vessels and other critical infrastructure are becoming increasingly networked and connected to IT systems.

#2 Business interruption

Despite an easing of post-pandemic supply chain disruption in 2023, Business interruption (31%) retains its position as the second biggest threat in the 2024 survey. This result reflects the interconnectedness in an increasingly volatile global business environment, as well as a strong reliance on supply chains for critical products or services. Improving business continuity management, identifying supply chain bottlenecks, and developing alternative suppliers continue to be key risk management priorities for companies in 2024.

#3 Natural catastrophes

Natural catastrophes (26%) is one of the biggest movers at #3, up three positions. 2023 was a record-breaking year on several fronts. It was the hottest year since records began, while insured losses exceeded US$100bn for the fourth consecutive year, driven by the highest ever damage bill of US$60bn from severe thunderstorms.

Around the world, natural catastrophes is the #1 risk in Croatia, Greece, Hong Kong, Hungary, Malaysia, Mexico, Morocco, Slovenia, and Thailand, many of which sustained some of the most significant events of 2023. In Greece, a wildfire near the city of Alexandroupolis in August was the largest ever recorded in the EU. Meanwhile, severe flooding in Slovenia resulted in one of the biggest supply chain events, causing production delays and parts shortages for European car manufacturers.

#4 Changes in legislation and regulation

Despite vows to reduce bureaucracy, companies will still face new rules and regulations in 2024 that will not only require a high administrative burden but could also impose restrictions on their business activities, ensuring changes in legislation and regulation (19%) rises one place to #4 in the 2024 survey.

In the case of shipping organisations, one has to look no further than the revised 2023 IMO GHG Strategy, which includes an enhanced common ambition to reach net-zero GHG emissions from international shipping close to 2050, a commitment to ensure an uptake of alternative zero and near-zero GHG fuels by 2030, as well as indicative check-points for 2030 and 2040.

Furthermore, the EU has expanded the scope of the European Union Emissions Trading System (EU ETS) to include the maritime sector starting this year. This move has been raising all sorts of reactions and thoughts on the implications for the shipping industry due to the challenges and opportunities it presents.

#5 Macroeconomic developments

Despite the ongoing uncertain global economic outlook, rising insolvency levels (global insolvencies are forecast to increase by +8% in 2024) and still high interest rates, macroeconomic developments (19%), which ranked #3 last year, falls to #5 in 2024.

#6 Fire, explosion

Ranking #6 overall, fire, explosion (19%), up from #9 in 2023, is a significant peril for companies and global supply chains, particularly where critical components are concentrated geographically and among a small number of suppliers.

In the shipping sector, the transportation of lithium ion batteries, especially in electric vehicles, has been increasing due to a rise in demand. However, the transportation of such batteries poses a significant safety challenge. For instance, the Fremantle Highway, a ship carrying 3,000 cars, caught fire off the Dutch island of Ameland on 25 July 2023. The ship was loaded with 2,500 cars and heavy cargo, including nearly 500 electric cars. The Dutch media reported 3,783 new cars on board, making electric car batteries more difficult to extinguish.

#7 Climate change

Climate change (18%) may be a non-mover year-on-year at #7 but is among the top three business risks in countries such as Brazil, Greece, Italy, Turkey, and Mexico. Physical damage to corporate assets from more frequent and severe extreme weather events are a key threat. The utility, energy and industrial sectors are among the most exposed.

Case in point, the severe impact of drought due to rising temperatures, which became very apparent to shipping organisations this year, as the operation of one of the world’s most crucial waterways, the Panama Canal, was affected.

In addition, net zero transition risks and liability risks are expected to increase in future as companies invest in new, largely untested low-carbon technologies to transform their business models.

#8 Political risks and violence

Unsurprisingly, given ongoing conflicts in the Middle East and Ukraine, and tensions between China and the US, Political risks and violence (14%) is up to #8 from #10. 2024 is also a super-election year, where as much as 50% of the world’s population could go to the polls, including in India, Russia, the US, and UK.

The persistent assaults on commercial ships navigating the Southern Red Sea represent a concerning pattern that has raised alarm within the industry, leading to changes in routes and disturbances in global supply chains.

Dissatisfaction with the potential outcomes, coupled with general economic uncertainty, the high cost of living, and growing disinformation fueled by social media, means societal polarization is expected to increase, triggering more social unrest in many countries.

#9 Market developments

Protectionism is one of three paradigm shifts identified as being behind market developments (13%) rising to #9 in the top global risk rankings in 2024 (#11 in 2023).

However, there is some hope among Allianz Risk Barometer respondents that 2024 could see the wild economic ups and down experienced since the Covid-19 shock settle down, resulting in Macroeconomic developments (19%), falling to #5 from #3. Yet economic growth outlooks remain subdued – just over 2% globally in 2024, according to Allianz Research.

This will give central banks some room to maneuver – lower interest rates are likely in the second half of the year. Not a second too late, as stimulus cannot be expected from fiscal policy. A caveat is the considerable number of elections in 2024 and the risk of further upheavals depending on certain outcomes.

… said Ludovic Subran, Chief Economist at Allianz

#10 Shortage of skilled workforce

In a global context, the shortage of skilled workforce (12%) is seen as a lower risk than in 2023, dropping from #8 to #10. However, businesses in Central and Eastern Europe, the UK and Australia identify it as a top five business risk.

Shipping is no exception, as a historic peak has been reached in the shortage of officer supply, and there are no anticipated improvements, resulting in an increase in manning costs, as indicated in the Manning Annual Review and Forecast 2023/2024 report by Drewry.

Moreover, there is a need for the industry to train seafarers on the necessary skills and competencies for the successful implementation of new technologies related to decarbonization, such as alternative fuels and automation.

Given there is still record low unemployment in many countries around the globe, companies are looking to fill more jobs than there are people available to fill them. IT or data experts are seen as the most challenging to find, making this issue a critical aspect in the fight against cyber-crime.