A new report released at the margins of COP28 by UMAS, details the annualised total costs of zero emission container vessels and the cost difference on a per container basis for transpacific and coastal ships under different fuel pathways.

The report titled Cost of zero emission container freight shipping: A study on selected deep-sea and short-sea routes shows that there is initially a significant cost gap between conventional fossil fuels and scalable zero emission fuels (SZEF) and there are differences across the scalable zero emission fuels considered.

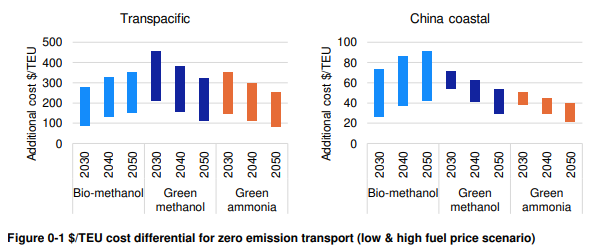

For example, in 2030 on the transpacific route, under the best-case fuel price scenario, the cost difference can be $150/TEU (Twenty Equivalent Unit) for green ammonia and $210/TEU for green methanol, and as high as $350/TEU for green ammonia and $450/TEU for green methanol in a high fuel price scenario.

Key findings

The additional costs of a zero-emission ship in 2030 ranges between $90 to $450 per TEU on the transpacific route and $30 to $70 per TEU on the Chinese coastal route. Considering this cost differential against average freight rates since 2010 (excluding the pandemic period), it suggests a potential increase of between 9% to 17% in freight rates (cost per TEU) for the Chinese coastal route2 and between 17% and 50% increases in cost per TEU in the case of the Shanghai to LA route in 20303 .

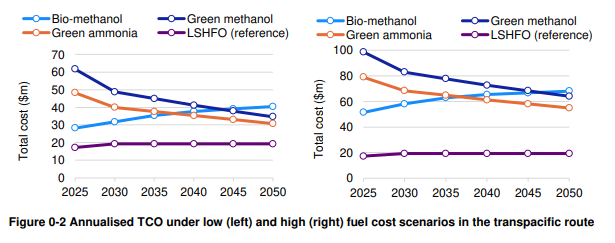

Fuel cost plays the most prominent part in determining the overall cost; thus, this is the primary driver of the TCO, especially when considering regional differences in the cost of fuel production. In 2030, TCO for vessels on a transpacific route operating on green ammonia and methanol is two to four times that of a reference vessel operating on low sulphur heavy fuel oil (LSHFO) (See Figure 0-2). It’s worth noting that these estimates are expected to decrease significantly if local subsidies, as provided by the US Reduction Inflation Act (IRA), are factored in.

Over time, the cost differential is expected to narrow due to declining SZEF fuel costs. In 2050, most scenarios show a TCO that is 1.5 to 2 times that of conventional fuel.

Early work suggests that the difference could drop as low as 1.6 to 2.4 times if subsidised hydrogen used for e-ammonia production ranged from $1 to $3/kgH2. On the China coastal route, the TCO difference drops to 1.75 to 2.5 times for the low and high fuel cost scenarios respectively. These numbers would be significantly lower if further GHG policy is applied. Over time, the cost differential is expected to narrow due to declining SZEF fuel costs. In 2040, most scenarios show a TCO that is 2 to 2.5 that of conventional fuel, which goes down to 1.5 to 2 times the TCO in 2050.

However, with the right demand signals and willingness to pay the cost difference in the next few years which initiates the scaling up of production of the scalable zero emission fuels and policy support that follows in the diffusion phase, the cost gap is expected to narrow out to 2050. The role of early movers including cargo owners, and their willingness to pay is therefore vital in setting up a zero-emissions shipping market.

The Total Cost of Operation (TCO) approach, which considers both the capex investment in the vessels and operational expenditure (including fuel prices), shows that by 2030, in the best-case scenario, to get a single vessel running on SZEF on the transpacific route would require an additional $20 to $30m per annum (of which $18m to $27m is fuel costs) and an additional $4.5m to $6.5m per annum (of which $3.6 to $5.2m is fuel costs) on the coastal route. This indicates the magnitude of freight purchase commitments required in the early stages of the emergence phase.

The role of early movers

Early movers in the transition who are willing to pay an additional cost for lower GHG transport have a choice to make: to go for cheaper but non-scalable fuels such as bio-methanol, which will become more expensive as demand outstrips supply, or invest in fuels with a higher capital expenditure, thus stimulating a more likely long-term solution that will become cheaper as production ramps up and demand grows.

There could be an argument to deploy a methanol pathway that begins with bio-methanol in the emergence phase (on the grounds of lower cost relative to SZEF), which gradually moves to Direct Air Capture (DAC) methanol. However, whilst this pathway is cheaper in the short-run, the initial use of bio-methanol does not significantly improve the long run costs of DAC-methanol. This is because they use different production pathways meaning that any early investments, learning and advantages of scale translate poorly from bio-methanol to DAC-methanol.

The fuel cost gap is now acknowledged as the main blocker for shipping’s transition and tackling it requires of a frank conversation about the dimension of the challenge. We need “numbers on the table” and more visibility on how stakeholders can help to cover it.

… said Camilo Perico, Consultant at UMAS, author of the report

With the right demand signals and corporate action during the emergence phase, production and supply of zero emission fuels and freight services can make a head start in lowering the cost gap that this work has shown

… agreed Dr Nishatabbas Rehmatulla, Principal Research Fellow at UCL and co-author of the report

The cost burden can appear to be high during the emergence phase but there are already policy supports appearing that can close the gap between conventional fuels and SZEF, such as the US IRA and the EU ETS have the potential to cover much of the current cost difference along specific routes of US-EU routes.

Furthermore, the revision of the GHG strategy at MEPC 80 commits the IMO to adopt a policy package and a target of 5-10% zero and near zero emission fuel use by 2030. Both are mechanisms that can help to create a business case for early action. The window of opportunity for corporate action before regulation increasingly closes the gap is now only around a handful of years.