Failure to manage the earth’s natural resources or “natural capital” has consequences that extend beyond environmental effects. For businesses, it can bring new interruption and liability scenarios which can wipe out profits and impact business models, as resource scarcity, regulatory action and pressure from communities and wider society grows, warns Allianz Global Corporate & Specialty (AGCS) in a new report. The report has categorized the transportation sector into the ‘danger zone’ in terms of natural capital risk exposure, because of its biodiversity impact and GHG emissions.

In the report, entitled ‘Measuring And Managing Environmental Exposure: A Business Sector Analysis of Natural Capital Risk’, AGCS analyzes data from research provider MSCI ESG Research, covering more than 2,500 companies, in order to assess the natural capital risk exposure in 12 industries.

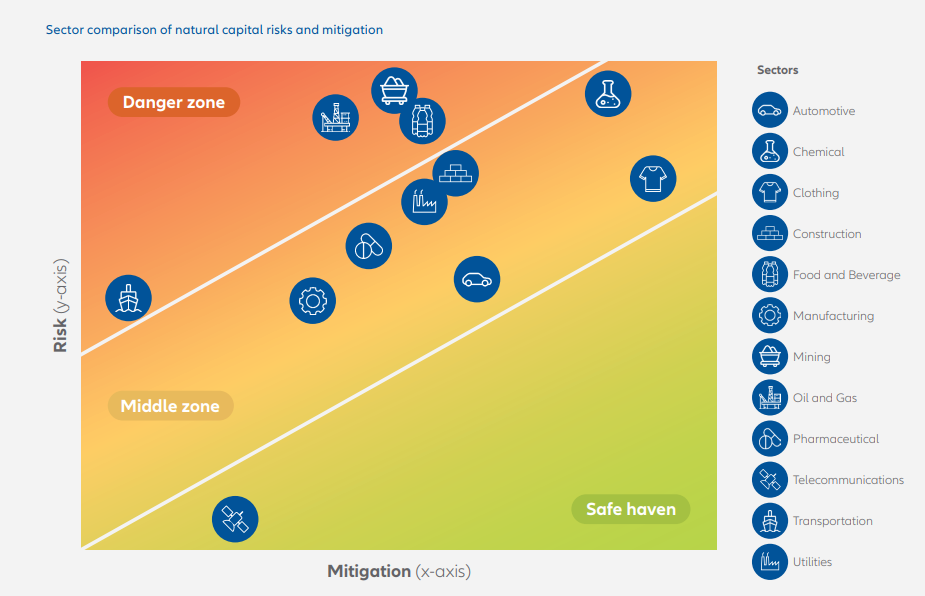

The report indicates that the oil and gas, mining, food and beverage and transportation sectors rank highest in terms of natural capital risk exposure, and are in the “danger zone”, meaning the natural capital risks businesses face are, on average, greater than the mitigation options currently employed.

Highlights

- Companies increasingly face new threats from “natural capital” depletion, such as higher costs from resource scarcity, regulatory action, as well as pressure from communities and wider society

- Allianz industry-specific analysis of 2,500+ companies finds oil and gas, mining, food and beverage and transportation sectors have highest natural capital risk exposure

- Against a backdrop of growing stakeholder pressure around sustainability, a key challenge for businesses is to measure and manage their natural capital impact and dependency

Chris Bonnet, Manager, Environmental, Social and Governance (ESG) Business Services, AGCS, said:

Companies around the world are increasingly confronted with the negative implications of natural capital depletion. Sustainable use of natural resources is critical for the future success of most businesses. Yet while corporates’ awareness of their natural capital footprint is growing, many still need to gain a better understanding of the specific threats that can impact their industry sector and company in particular, as well as the mitigation options available.

As explained, companies in the oil and gas and mining sectors have a high level of natural capital risk exposure due to the nature of their business. For example, in the mining sector, over 90% of global iron ore production is derived from areas that have a high risk of water stress and biodiversity impact.

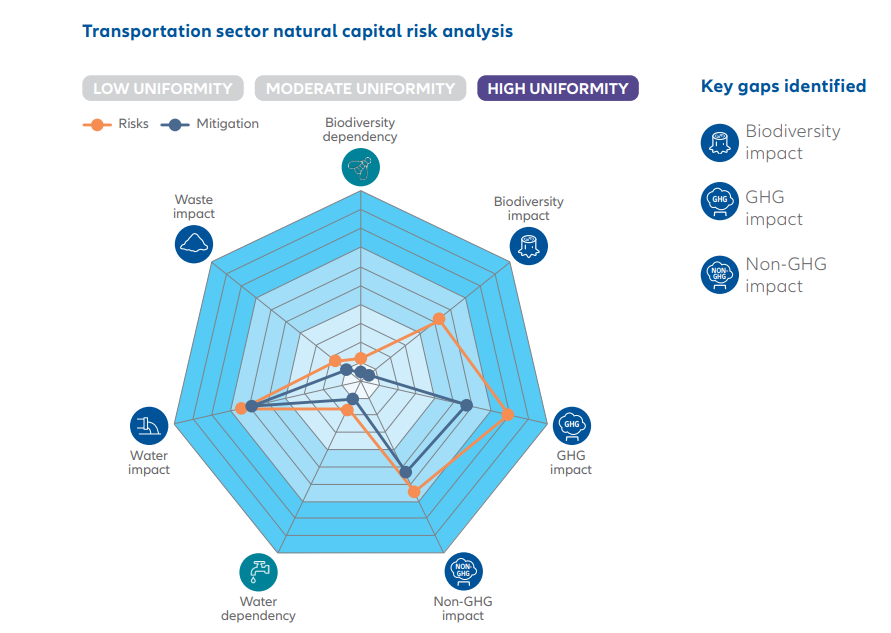

The transportation sector also falls into the “danger zone” because of its biodiversity impact and GHG and non-GHG emissions. Transportation-related carbon emissions have increased by 250% since 1970 and now account for 23% of all global emissions, so there is room for further steps to be taken by the sector, such as emissions control or mitigation measures to reduce the impact on flora and fauna.

The transportation sector has a relatively high impact on biodiversity, and on GHG and non-GHG emissions, as well as on water. While less exposed compared with other sectors when it comes to natural capital risks, the awareness and preparedness to mitigate the issues is relatively low, the report underlines.

Transportation-related carbon emissions have increased by 250% since 1970 and account for 23% of total global emissions. The majority of the transport sector’s emissions are generated through road transport and largely through the combustion of petroleum-based products such as gasoline, diesel or heavy fuel. Road and rail and marine companies that rely on the combustion of fossil fuels face growing regulatory pressure to lower their carbon footprint.

According to the report, the seven risks surrounding the five factors of natural capital are:

According to the report, the seven risks surrounding the five factors of natural capital are:

- Biodiversity

-Dependency on biodiversity: The dependency a company has on flora and fauna, ranging from direct resource input (such as wheat, cotton, biomass, but also cattle or fish) to indirectly related biodiversity services (such as pollination by bees).

-Impact on biodiversity: The impact a company has on flora and fauna by destroying or limiting the quality and amount of flora and fauna through its activities, either directly (such as extinction of a certain species) or indirectly (such as damaging the resistance of fauna through toxic emissions).

- GHG emissions

-Impact through greenhouse gas emissions: This could be directly through a company’s production process or indirectly in its supply chain or consumption of products (such as during the extraction, refining and consumption of oil/oil-based products).

- Non-GHG emissions

-Impact through non-GHG emissions: This could be directly through a company’s production process or indirectly in its supply chain or consumption of products (such as nitrogen oxides [NOX] during the extraction and burning of coal).

- Waste

-Impact a company has through its waste: This could be directly through its production processes or indirectly in its supply chain or by consumption of products (such as electronic waste or packaging waste in a supply chain).

- Water

-Dependency on water: The dependency a company has on sufficient amounts of clean water for its production processes and in its supply chain (such as irrigation for crops or cooling water).

-Impact on water: The impact a company has through the amount of water it extracts, as well as through water pollution. This can be directly through the production process, as well as through its supply chain (such as the affluent discharge or water extraction for crops).

In order to manage operational risk effectively, organizations need to introduce some form of measurement. This requires a full understanding of the risks insurance companies face in running their business and of the impacts of these risks on the company’s capital needs. Therefore, quantifying operational risk is important as it sets a metric which is easily understood by business managers, allows for comparison with other risks and makes its impact on business clearly defined.

Explore more herebelow: