Shipping CO2 emissions will continue to rise, as most of the efficiency gains possible by the shipping industry to drive down its carbon footprint over the past decade have already been made, Swedish-based Marine Benchmark says in a new study.

The analysis of CO2 emissions based on AIS, vessel specification data and the vessel order book, shows the proportion of eco-ship newbuildings entering the global fleet are projected to drop to historic lows; and the use of LNG as a transitory fuel remains relatively small.

Although shipping has reduced its carbon intensity by more than 30% since 2008, the results show that, between 2011 and 2019, international AIS-tracked maritime CO2 emissions rose at an average annual rate of 2.1% to approximately 800mt CO2 annually (fuel consumption for main engines and aux engines, without boilers).

Then, the pandemic weakened this growth to 1.7%, as emissions in the first nine months of 2020 have fallen by approximately 2% from 2019 levels. This is despite slower steaming speeds, the increased economies of scale of larger vessels, eco-vessel designs and the use of LNG as a fuel.

Meanwhile, global emissions continue to be dominated by the ‘big three’ vessel types, which together account for 82% of international emissions. Between 2011 and 2019, tankers, bulkers and container vessels emissions grew at 3%pa, 2%pa and 0%pa, respectively. Over the same period, capacity increased 4% pa in each of these sectors.

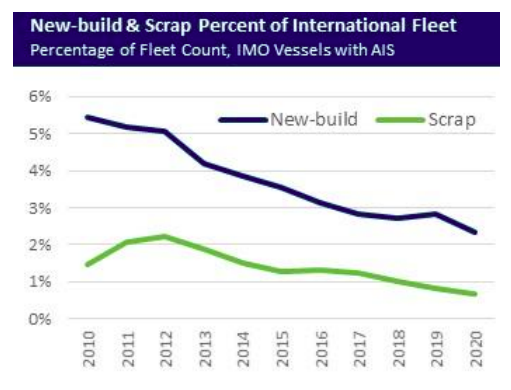

According to Alastair Stevenson, Head of Digital Analysis at Marine Benchmark, the current lack of investment in modern tonnage and a potential economic rebound implies lower ship scrapping activity over the next couple of years.

We’re going to see older and older vessels on the water and the impact of the marginal gains already made from running ships more efficiently have already been felt. To bring down absolute emissions without impacting global trade, scalable low carbon fuels and new ships and engines to run them are needed. However, many shipping investors are sitting on their hands waiting for technological breakthroughs and regulatory certainty. The implications are that the shipping industry cannot deliver an absolute reduction in CO2 emissions by 2030,

…he explained.

Explore more herebelow: