Amid an increasing debate on shipping decarbonization, ABS issued a detailed life-cycle, or value-chain, analysis of the GHG footprint of the leading alternative marine fuels, which showed that LNG is not as environmentally friendly as originally considered.

The first-of-its-kind analysis ‘Setting the Course to Low Carbon Shipping – View of the Value Chain’ is the third edition of the ABS Low Carbon Shipping Outlook series and results from collaboration with Herbert Engineering to explore the feasibility of transitioning from three conventional vessel designs (Chinamax Bulk Carrier, an Aframax Tanker and a Feeder Containership) to low carbon variants.

Shipowners need to be conscious of using the lessons from the transition to decarbonization to build a cycle of continuous process improvement. They can do this by understanding the impact of decarbonization on all aspects of their business and using that information to power the cycle,

…said Christopher J. Wiernicki, ABS Chairman, President and CEO.

Among the key findings of the report is that the short-term IMO measures (Energy Efficiency Existing Ship Index (EEXI) regulations and Carbon Intensity Indicator (CII)) create a very challenging landscape for many vessels of the global fleet. More specifically:

- 60-70% of the global tanker fleet is expected to have difficulty meeting the EEXI requirements. Smaller dwt segments, such as aframax tankers, are expected to meet the requirements more comfortably than larger tankers.

- 60-70% of the global bulk carrier fleet is expected to also have difficulty meeting the EEXI requirements. Again, smaller dwt segments (e.g. Panamax bulker), are expected to meet the requirements more comfortably than larger vessels, such as capsizes or VLOCs.

- Gas carriers — particularly those of higher dwt capacity — have proven capable to meet the EEXI requirements.

- LNG carriers with dual-fuel or tri-fuel diesel-electric propulsion or two-stroke dual-fuel engines are expected to meet the EEXI regulations. However, those LNG carriers propelled by steam turbines will face significant challenges.

- Container ships above 80,000 dwt are expected to meet the EEXI requirements. However, smaller dwt segments are expected to face some challenges with EEXI compliance.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

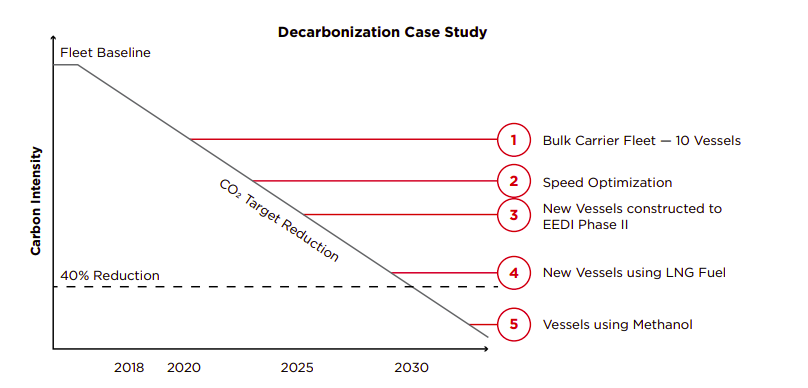

According to the study, the modern dual-fuel engine technology makes the transition to low- and zero-carbon fuels easier to achieve than in the past and this transition can be made more attractive if it is planned at the newbuilding design stage, with specified fuel tank design.

Fuel life-cycle analysis

- The life-cycle analysis revealed green ammonia and hydrogen production provide meaningful GHG emissions reduction from these zero-carbon fuels.

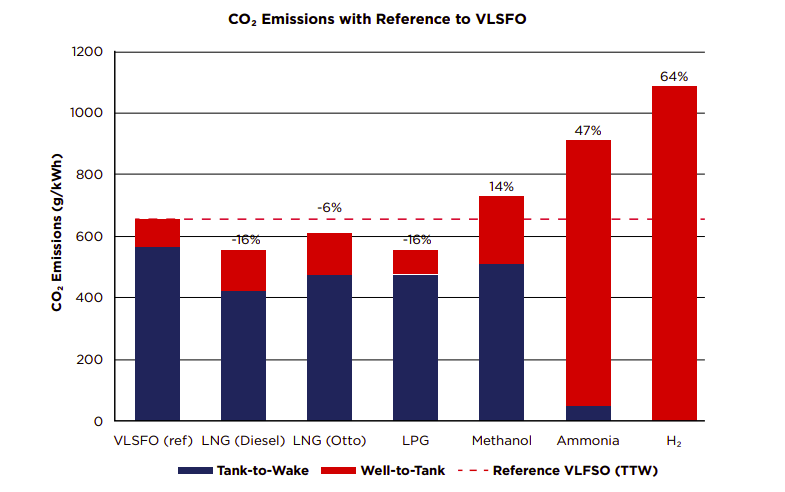

- On a life-cycle basis, LNG is not as environmentally friendly as originally considered, due to methane slip and fugitive emissions to GHG emissions. Specifically, LNG can provide almost 25% reduction in carbon emissions on a tank-to-wake basis; however, on a well-towake basis — including methane slip and fugitive emissions — the reduction drops to six to 16% depending on the engine technology.

- Methanol can be made carbon neutral on a well-to-wake basis.

- Ammonia offers very low well-to-wake emissions, but the use of pilot oil contributes to carbon emissions from the vessel.

- Biofuels do not offer any tank-to-wake emissions reduction, but they can offer benefits on the well-to-tank component. However, the feedstock and production pathway greatly affect the well-to-tank emissions of biofuels.

- Also, a number of variables involved in biofuel production can shift the estimated well-to-tank emissions.

As noted, in 2019, the global production of wind power was reported to be 651 GW11, while solar power production was 586 GW12. That same year, the consumption of HFO, MGO and LNG from shipping was 238 Mt of HFO equivalent, which corresponds to 2,749 GW of power.

In order to replace HFO, MGO and LNG with green fuels industry would need the same amount of energy. Assuming that green fuels can be produced from renewable energy at 60% efficiency, the required renewable power production would be 4,582 GW or an amount approximately equal to seven times the wind power produced in 2019, and eight times the solar power produced that year.

As many of the new fuel technologies will take time to prove their worth and as there is uncertainty on adequate infrastructure and/or supply of some new fuels, the report notes, shipowners are counseled to expect five or more years to pass before decarbonization goals can be fully met.

Designing a low-carbon fleet is a process. Shipowners need to be conscious of using the lessons from the transition to decarbonization to build a cycle of continuous process improvement: they can do this by getting to know the impact of decarbonization on all aspects of their business and using that information to power the cycle,

…the report concludes.

View of the Value Chain is a response to how shipowners’ strategic industry partners are encouraging them to intensify their focus on the entire value chain, not just the combustion cycle, when deciding which measures to take to reduce their collective carbon footprint. Meanwhile financiers and charterers increasingly appear poised to set the requirements for the environmental performance of vessels in connection with the financing of new ships and new chartering agreements,

…said Georgios Plevrakis, ABS Director, Global Sustainability.