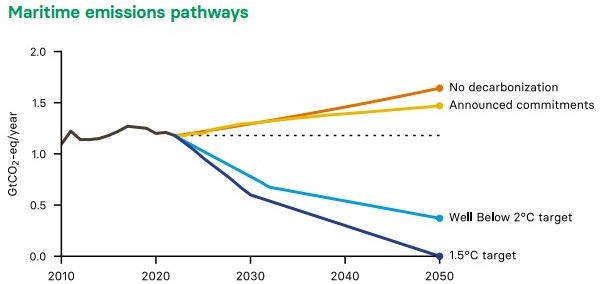

Analysis by the Center for Zero Carbon Shipping shows there are plausible pathways to fully decarbonize shipping by 2050. These require that stakeholders take more ambitious action now to accelerate the adoption curve for low-carbon fuels.

According to the report, as globalization continues to drive rapid growth in shipping demand, emissions from shipping could increase 20% by 2050, a trajectory incompatible with pathways that limit global warming to the Paris Agreement targets of 1.5 degrees or well below 2 degrees Celsius.

For investors with net zero targets, addressing shipping-related emissions will be necessary to reach them.

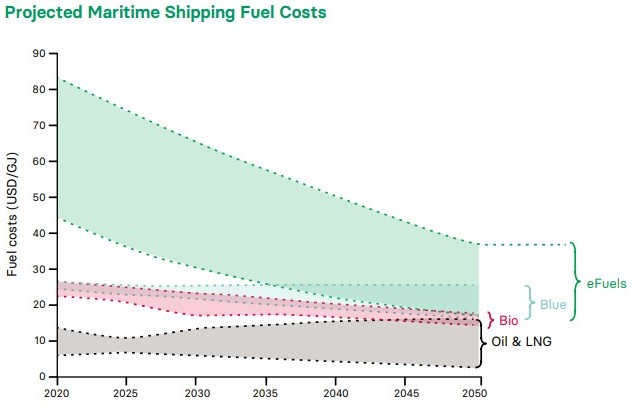

By taking steps now to test and de-risk new fuel pathways, stakeholders can reduce long-term costs and manage the risk of price or fuel supply shocks in the future

In fact, ambitious policy leadership can reduce transition costs by helping to organize the market. Policy authority is diffused among the IMO and the many countries across which global shipping companies operate. In its most recent strategy the IMO calls for emissions to peak “as soon as possible” and begin to decline; engagement by investors and others on zero-by-2050 climate targets can help achieve these goals.

Measures offering significant emissions reductions are available today, and shipping companies should adopt them, the analysis notes. However, dramatic emissions reductions will require transitioning the global industry from using oil-derived bunker fuel to alternative non-fossil fuels such as ammonia, methanol, biomethane or bio-oil that are not yet widely available.

A range of such fuels are in various stages of development and demonstration; some are “drop-in” fuels compatible with existing vessels, while others require engine or vessel modifications

What is more, alternative fuel costs are expected to fall significantly in the coming years but current projections suggest they will remain more expensive than fossil-based fuels well into the future.

There are differences in the performance, cost, operational capabilities and scalability of these potential fuel solutions and a single winner has not emerged; rather, it’s likely that the industry will rely on a variety of fuels, adding complexity to the transition.

To lay the groundwork for introducing alternative fuels at scale, stakeholders including shipbuilders, ship owners and operators, ports, fuel providers and shipping customers must work together to address technical, logistical and institutional barriers.

Given the many parties involved, close coordination is needed to deploy and expand these solutions, aligning factors such as shipbuilding timeframes, the deployment of new vessels, and cost/willingness to pay.

Some leaders in the maritime shipping industry have committed to a low-carbon transition and begun to chart a path to achieve it. Twelve of the largest 94 ship owners have set a net zero target, and dozens more have adopted emissions reduction goals. Many more should follow. Waiting too long to begin the transition exposes a company to significant technological, financial and reputational risk

Finally, the report highlights that “investors have an important role to play in pushing companies that provide or use maritime shipping services to set ambitious decarbonization targets, and holding them accountable to achieve them.”