The Global Maritime Forum (GMF) has released an insight brief outlining IMO policy measures and key topics for discussion at the upcoming MEPC 83 (April 7–11, 2025). GMF emphasizes that while the transition to e-fuels offers the most scalable and effective path to reducing emissions, its success depends on establishing a viable business case.

In 2023, IMO Member States agreed on a new pathway for shipping’s decarbonisation. The IMO’s revised GHG strategy (2023 IMO Strategy on Reduction of GHG Emissions from Ships) calls for ending fossil fuel consumption and reaching net-zero GHG emissions by or around, i.e., close to, 2050.

The policy measures to deliver on the targets set in the 2023 IMO GHG strategy are currently being negotiated and are set to be agreed upon at the 83rd meeting of the IMO’s Marine Environment Protection Committee (MEPC 83) in April 2025, adopted in autumn 2025, and enter into force in 2027 at the earliest.

#1 Early adoption of e-fuels is key to avoiding an inefficient energy transition towards zero-emission shipping with costly technology lock-in.

#2 Upcoming policy measures from the International Maritime Organization (IMO) should create certainty, ensure e-fuels are cost-competitive, and reduce investment risks.

#3 Only a universal price on greenhouse gas (GHG) emissions with targeted rewards for e-fuels can close the price gap.

#4 Ensuring a just and equitable transition requires an equitable revenue disbursement mechanism:

What is currently on the table?

Over recent months, IMO Member States have worked together to find commonalities among their positions. But key questions remain, including on the following essential elements of the measures:

- Establishing regulations for the greenhouse gas content of fuels in a global fuel standard (GFS)

- Designing an economic instrument such as a universal levy on emissions

- Designing mechanism, including those for revenue-sharing, that ensure a just and equitable energy transition.

Within these areas, many more details need to be decided, including penalties for non-compliance with the GFS, alternative compliance (i.e., whether to adopt a flexibility mechanism within a GFS), a definition of zero- and near-zero GHG emission fuels (ZNZ fuels), the emissions factors of different fuels, and the objectives and modalities of revenue disbursement.

In addition, while the overall design of the measures is expected to be developed as a regulatory text in MARPOL Annex VI, many of the details will likely end up in supporting guidelines, which are set to be developed in the period between the measures’ adoption and implementation.

Going into MEPC 83, negotiations have converged on a global fuel standard, with discussions ongoing on the exact levels of the GHG intensity reduction limits. However, areas of divergence remain, particularly regarding the nature of the economic element required to deliver on the IMO strategy.

Enabling an early, just, and equitable energy transition

However, the production of e-fuels is at a nascent stage, and they currently face challenges related to cost, risk, and availability. An early transition to e-fuels that features a gradual ramp-up in their use is therefore critical as this allows for:

-

Cost reduction through learning and scale: Early deployment allows producers and technology providers to climb the learning curve, which means technological improvements and economies of scale can reduce production costs over time. If adoption is delayed, these cost reductions also get delayed, prolonging dependence on fossil fuels.

-

Developing skills and workforce: Building a robust labour force capable of producing, handling, and distributing e-fuels takes time. Early action means that skills and expertise can grow organically, avoiding a future scramble to train workers in a compressed time frame when demand spikes.

-

Building global supply chains: E-fuels require global value chains — for example, production in areas rich in renewable energy (like wind or solar) and transportation to end-users. Starting the development of these value chains early help controlled growth, reducing possible bottlenecks later.

-

Avoiding technology lock-ins: Without a clear pathway to e-fuels, industries might invest heavily in transitional technologies (e.g., fossil-based synthetic fuels or hybrid solutions) that risk becoming stranded assets when cleaner alternatives arrive. By signalling and starting the shift to e-fuels now, policymakers and businesses can avoid sinking capital into short-lived, less sustainable pathways.

The transition to maritime decarbonisation must also be done in a just and equitable way, with the global nature of shipping requiring a level playing field that leaves no country behind. This has several implications in practice, from addressing disproportionate increases in trade costs to supporting access to the required infrastructure and technologies and minimising further impacts of climate change on vulnerable states by reducing GHG emissions as quickly as possible.

What is needed to get there?

- Shipowners will need to invest in new vessels based on capital, fuel costs, and residual value across fuel and technology options.

- Fuel producers will invest in production facilities based on projected demand.

- Ports must invest in bunkering and storage infrastructure, while cargo owners will choose fuels based on short-term cost and availability.

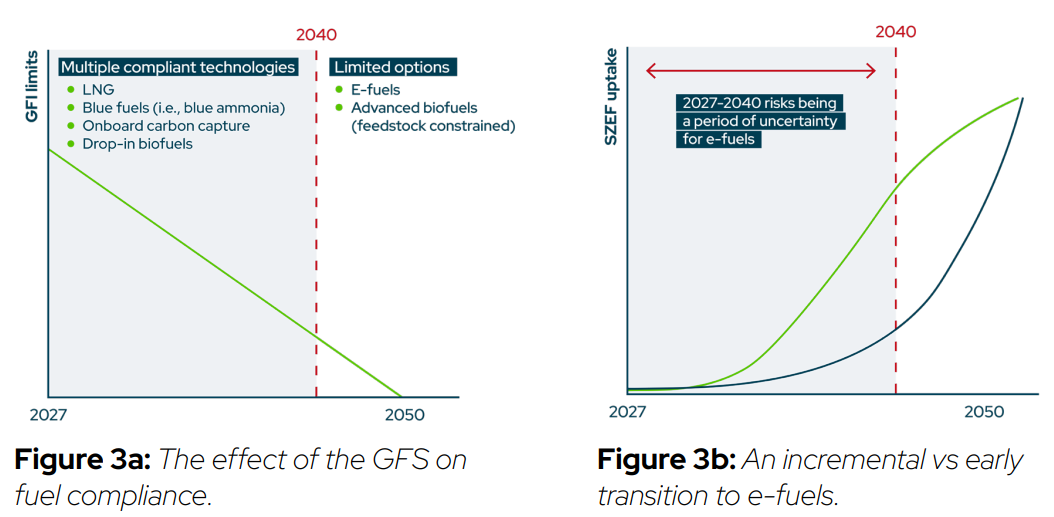

The cost of the compliant fuels will be a deciding factor. Deep-sea shipping is a highly competitive market with relatively low profit margins. In the context of IMO policy, this means that shipowners and operators will be driven to choose the lowest-cost fuels and technologies to comply with the GFS over the short term.

A universal levy and rewards can make e-fuels competitive early on. In the first decade of the GFS, the GHG intensity targets will allow multiple fuels to comply with IMO ambitions. Shipowners have several options:

- Conventional vessels, with or without onboard carbon capture and storage (OCCS), or bio-marine gas oil (MGO) as a drop-in fuel.

- Dual-fuel methanol vessels, using bio-methanol first, then switching to e-methanol, or using e-methanol from the start.

- LNG-fuelled vessels, transitioning from bio-LNG to e-LNG, or using e-LNG immediately.

- Dual-fuel ammonia vessels, starting with blue ammonia and switching to e-ammonia, or using e-ammonia from the start.

Furthermore, the transition to e-fuels offers the most scalable path to reducing emissions, but its success depends on creating a viable business case.

This requires addressing factors like cost, investment risk, and fuel availability to encourage long-term commitments from shipowners, fuel producers, ports, and cargo owners.

Current scenarios, like a GFS with flexible compliance, may not reduce risk for e-fuel investments, however a robust regulatory framework with a levy-and-reward mechanism can provide the necessary stability and incentives for e-fuel adoption.