European Maritime Safety Agency (EMSA) released its monthly report focusing on the impact of COVID-19 pandemic in shipping traffic. By analyzing ship calls at EU ports it was found that when comparing year 2021 with 2019, the number of ships calls at EU ports increased by 3.2%.

With international transport at the forefront of trade and dependent on travel and human interaction, the shipping industry has been impacted both directly and indirectly from the outbreak of COVID-19. Using data mainly from the Union Maritime Information and Exchange System (SafeSeaNet), and in certain cases combined with LRIT and MARINFO data, EMSA issues a report providing figures on the impact of COVID-19 on shipping traffic. The report is based on solid vessel movements statistics showing the port call trends without interpreting the statistical data.

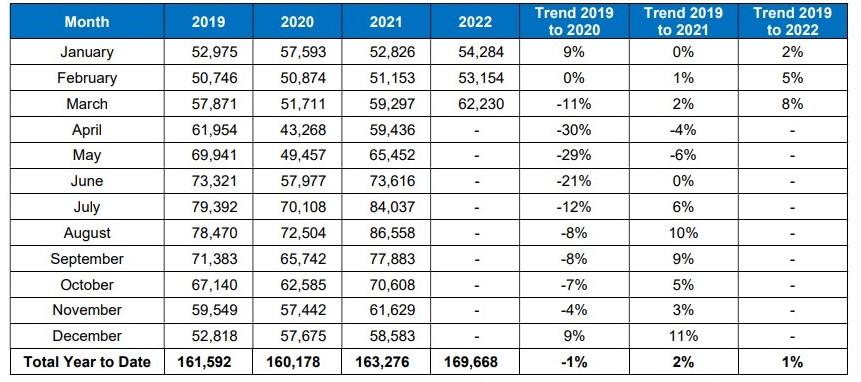

By analysing ship calls at EU ports it was found that the number of ships calls at EU ports declined by 10% in the 2020 compared to 2019. When comparing year 2021 with 2019, it was observed the number of ships calls at EU ports increased by 3.2%. The number of ships calls in March 2022 increased by 8% compared to the same month in 2019. The most significant decrease in the number of ships calls was detected for Containerships, Refrigerated cargo ships and Vehicle carriers.

In 2022 there was a general increase of the values of port calls worldwide under EU flag until February, but in March the trend inverted for many countries and ship types (or at least deaccelerated the recovery), probably affecting more the tonnages travelling over sea than the number of calls. The number of port calls (worldwide) observed is above the pre-pandemic year of 2019 for almost all the EU-MS flagged fleets by February 2022. Some countries are still showing increases in March 2022 compared with homologous period in 2019 (Poland, Latvia and Estonia) while other countries inverted from Jan/Feb to March to port values below 2019, being the case with Lithuania, Malta and Finland. Romania was still negative in 2022 but in March the decrease accentuated severely (-15% to -69%). This is without doubt a consequence of the current Ukraine conflict.

According to the report, in the year of 2022 there is a general uptake to values of port calls above 2019 that has been deaccelerated or even inverted to values below 2019. Bulk carriers are the ship type that has diminished more their port calls in March compared with 2019 inverting a recuperation trend. In 2022 it is still observed a reduction of the trade between China and the EU, comparing both with 2021 and 2019. This may result from the methodology in view of the diminishing of the trans-shipments that could have originated in the past a higher number of port calls compared with current days. For the US, in 2022 it is observed a continuous increase of the trade between USA and the EU. The EU exports to USA seem to have fully recovered and increased beyond 2019, but the imports although increasing compared with last year, are still below the values of 2019.

The EMSA analysis put focus on cruise ships which were mostly affected by COVID-19. Every major cruise line in the world suspended departures in mid-March of 2020 as the coronavirus outbreak grew, with some returning to operations in limited number of vessels and areas. The number of cruise ships calling at EU ports declined by 60% in the 2021 compared to 2019. The first quarter of 2022 shows that the number of cruise ships calling the EU port is higher than number of calls in the same period of 2019. The number of persons on board cruise ships is still lower than in 2019 but significantly higher than in 2021.

As disclosed, ports calls for cruise liners from 2020 and for 2021 are almost of the same magnitude with reductions of -52.7% and -50.5% compared with 2019, meaning that the recovery for the Cruise sector in 2021 was very modest. It is expected that 2021 will improve significantly based on the number of this first quarter. The year of 2022 shows a significant recovery in the months from January to March reducing the negative variation of ports calls in this first quarter to -15.6%.

Additionally, the European continent presents the most significant recovery from all continents in 2021. Even if the number of calls is still below 2019 values there is an increased share of port calls taking place in 2021 in Europe compared with other continents. America appears to be very far from the number of port calls pre-pandemic, but 2022 is already at half of the values of the full year of 2021, therefore significant recovery is expected this year

Impact on ship calls to EU ports

In March 2019, there were 57,871 ship calls at EU ports, and in March 2022 there were 62,230 ship calls. The number of calls increased by 8% in comparison with 2019.

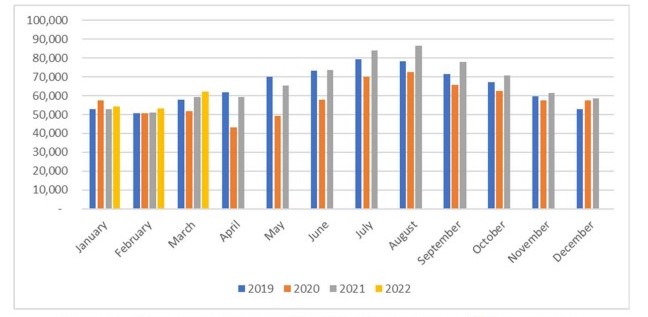

The table below shows the number of ship calls per month in 2019, 2020, 2021 and 2022 and the trends between 2020 and 2019, between 2021 and 2019 and between 2022 and 2019. It has been decided to use year 2019 as a reference since it was the last year without COVID-19 in Europe.

Total Year to Date row presents only comparison of data from between January and March and will be updated over the year with months that are completed in 2022.

The significant decrease in the number of ship calls began in week 12 (16-22 March 2020). This was the week after the WHO declared the COVID-19 outbreak a pandemic (12 March 2020). Since June 2021 the number of ship calls is higher than in 2019, the last year prior to Covid-19 pandemic.