As part of the Zero-Emission Shipping Mission, the Danish Maritime Authority (DMA) conducted a study titled ‘Mapping Global Financial Support Opportunities for Zero-Emission and Energy-Efficient Ships’.

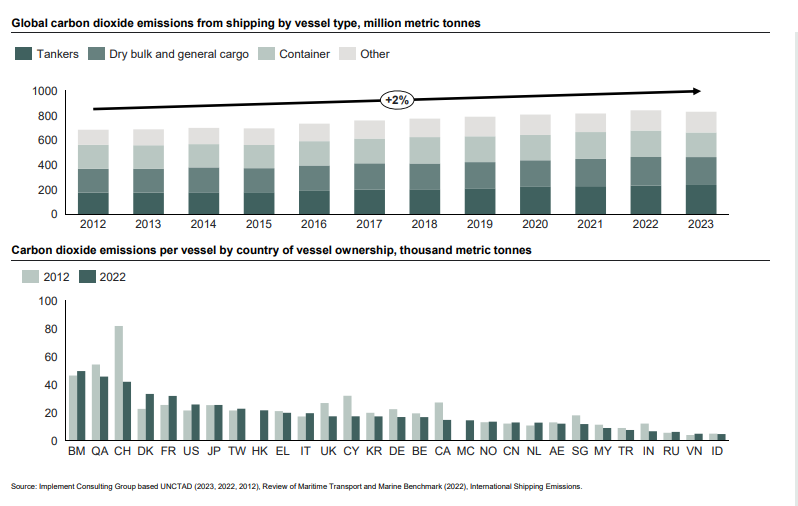

According to the study, the shipping industry may be a cornerstone of the global economy, however, it also accounts for approximately 3% of GHG emissions, prompting ambitious decarbonisation targets from the International Maritime Organization (IMO) and global governments. From 2012 to 2023, global CO2 emissions from shipping steadily increased at a compound annual growth rate of around 2%.

By 2023, emissions reached approximately 830 million metric tonnes across various vessel types, driven by the continued growth in global trade and reliance on maritime transport.

When looking at CO2 emissions from shipping by country of vessel ownership relative to fleet size, most countries have shown stagnation or slight reductions, while a few continue to see emissions rise.

Decarbonising the global shipping fleet by 2050 requires substantial investment

Decarbonising the global shipping fleet by 2050 requires substantial investment

With annual costs estimated between USD 8 and 28 billion for vessel construction and operations, achieving decarbonisation of the global shipping fleet by 2050 demands significant investment. Additionally, scaling onshore production, fuel distribution, and bunkering infrastructure to support a 100% carbon-neutral fuel supply by 2050 demands an estimated additional USD 30 to 90 billion per year.

Shipping is challenging to decarbonize due to long voyages and limited electrification. Shipowners are turning to alternative fuels like green ammonia and methanol, energy-efficient systems, and electric propulsion through new builds, retrofits, and upgrades.

However, financing remains difficult, as traditional bank lending has become harder to access due to stricter regulations, high perceived risks, fluctuating fuel prices, and an uncertain business case for zero-emission ships.

Furthermore, alternatives such as leasing, private equity, and export finance offer flexibility but may also come with higher costs and stricter terms, disadvantaging smaller players and developing economies.

Despite these challenges, operational improvements and existing technologies could cut emissions by up to 75%. Bridging the financing gap requires innovative funding mechanisms, policy support, and global collaboration.

Key points of the study:

- The global decarbonisation drive has spurred financing opportunities from a number of different sources, ranging from more generic to maritime-specific initiatives

- Financial support is predominantly concentrated in areas with strong environmental regulations, such as Europe and North America

- Europe is home to a diverse range of ship financing opportunities, encompassing both broad, cross-sectoral programs and specialised initiatives

- The United States offers major programmes supporting global decarbonization and developing countries, but few relate specifically to shipping

- The APAC region has a growing number of ship financial support opportunities, particularly in South Korea

- There are fewer financial support opportunities in LATAM and Africa, highlighting a major gap relative to the rest of the world

- Global and regional initiatives are helping to bridge gaps in financial support for developing regions

The Danish Maritime Authority concludes with recommendations on where shipowners can prioritise focus.

Monitor emerging pilot programmes

The PAYS Scheme for Energy Efficiency Retrofits and the Zero Emission Shipping Fund are innovative pilots that demonstrate promising models for future funding. Though not yet widely accessible, shipowners should keep an eye on their development as they could become gamechangers in maritime financing. Likewise, the GreenVoyage2050, currently scaling up to provide financial mechanisms, can potentially become a very relevant opportunity for developing countries.

Leverage global initiatives

While regional opportunities in Africa and Latin America remain limited, global initiatives like the Climate Investment Funds and the Global Environment Facility provide grants and concessional loans to support energy-efficient retrofits and clean fuel adoption in developing regions. These programmes are particularly relevant for smaller shipowners facing financial and infrastructural challenges.

Consider private equity opportunities

The scale and focus of private equity has changed. Private equity funds, such as EURAZEO Sustainable Maritime Infrastructure Fund and Breakthrough Energy Ventures, are somewhat new entrants and are also worth exploring for innovative or high-impact projects. Shipowners should approach these funds with clear environmental metrics and a strong business case.

Blend financing mechanisms for flexibility

Shipowners should combine grants, concessional loans, and leasing mechanisms to reduce upfront costs and financial risks. Leasing options, such as those offered by the EURAZEO Sustainable Maritime Infrastructure Fund, provide access to green technologies without the need for full ownership. Pairing these with public grants or concessional loans ensures affordable financing while supporting decarbonisation projects.

Understand and prepare for eligibility requirements

Shipowners should carefully review programme eligibility criteria, such as vessel type, emissions targets, and project scope. Investing in proper documentation and seeking technical or legal support can enhance application success, especially for programmes like KfW IPEX-Bank and the Green Climate Fund, which require clear environmental impact metrics.

Collaborate through strategic partnerships

Smaller shipowners can improve their funding eligibility by partnering with technology providers, governments, or larger operators. Public-private partnerships, such as the Pacific Blue Shipping Partnership, enhance credibility and simplify applications. In Africa, the African Guarantee Fund collaborates with local financial institutions to provide partial guarantees, helping SMEs secure financing for sustainable maritime projects while reducing risks for lenders.