The resurgence in oil and gas production from the United States, deep declines in the cost of renewables and growing electrification are changing the face of the global energy system and upending traditional ways of meeting energy demand, according to IEA’s World Energy Outlook 2017. A cleaner and more diversified energy mix in China is another major driver of this transformation.

In its World Energy Outlook for 2017, the US International Energy Agency says that, over the next two decades, the global energy system is being reshaped by major forces:

- the United States is set to become the undisputed global oil and gas leader;

- renewables are being deployed rapidly thanks to falling costs;

- the share of electricity in the energy mix is growing, and

- China’s new economic strategy takes it on a cleaner growth mode.

Highlights

- Over the next 25 years, the world’s growing energy needs are met first by renewables and natural gas, as fast-declining costs turn solar power into the cheapest source of new electricity generation.

- Global energy demand is 30% higher by 2040 – but still half as much as it would have been without efficiency improvements.

- The boom years for coal are over — in the absence of large-scale carbon capture, utilization and storage (CCUS) — and rising oil demand slows down but is not reversed before 2040 even as electric-car sales rise steeply.

- Solar PV is set to lead capacity additions, pushed by deployment in China and India, meanwhile in the European Union, wind becomes the leading source of electricity soon after 2030.

- A new phase of economic and energy policy in China’s development results in an economy that is less reliant on heavy industry and coal.

- As demand growth in China slows, other countries continue to push overall global demand higher – with India accounting for almost one-third of global growth to 2040.

- The shale oil and gas revolution in the United States continues thanks to the remarkable ability of producers to unlock new resources in a cost-effective way. By the mid-2020s, the United States is projected to become the world’s largest LNG exporter and a net oil exporter by the end of that decade.

- Global oil demand continues to grow to 2040, although at a steadily decreasing pace – while fuel efficiency and rising electrification bring a peak in oil used for passenger cars, even with a doubling of the car fleet to two billion. But other sectors – namely petrochemicals, trucks, aviation, and shipping – drive up oil demand to 105 million barrels a day by 2040.

- While carbon emissions have flattened in recent years, the report finds that global energy-related CO2 emissions increase slightly by 2040, but at a slower pace than in last year’s projections. Still, this is far from enough to avoid severe impacts of climate change.

Growing energy demand

- In the New Policies Scenario, global energy needs rise more slowly than in the past but still expand by 30% between today and 2040. This is the equivalent of adding another China and India to today’s global demand.

- The largest contribution to demand growth – almost 30% – comes from India, whose share of global energy use rises to 11% by 2040 (still well below its 18% share in the anticipated global population).

- Southeast Asia is another rising heavyweight in global energy, with demand growing at twice the pace of China.

- Overall, developing countries in Asia account for two-thirds of global energy growth, with the rest coming mainly from the Middle East, Africa and Latin America.

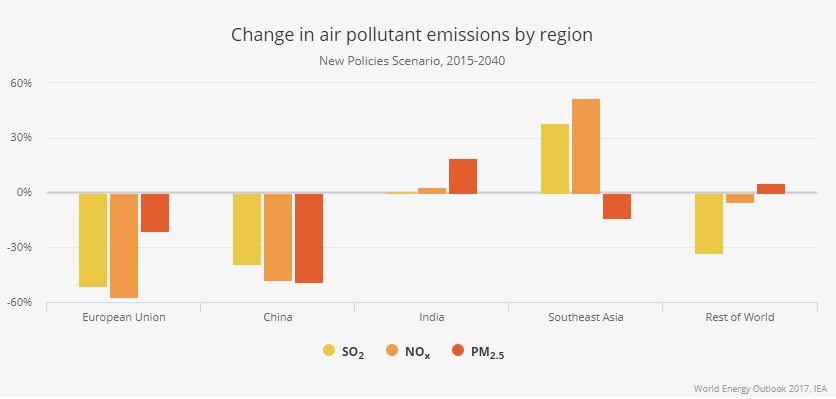

GHG emissions

- Despite their recent flattening, global energy-related CO2 emissions increase slightly to 2040 in the New Policies Scenario. This outcome is far from enough to avoid severe impacts of climate change, but there are a few positive signs.

- Projected 2040 emissions in the New Policies Scenario are lower by 600 million tonnes than in last year’s Outlook (35.7 gigatonnes [Gt] versus 36.3 Gt).

- In China, CO2 emissions are projected to plateau at 9.2 Gt (only slightly above current levels) by 2030 before starting to fall back.

- Worldwide emissions from the power sector are limited to a 5% increase between now and 2040, even though electricity demand grows by 60% and global GDP by 125%.

- However, the speed of change in the power sector is not matched elsewhere: CO2 emissions from oil use in transport almost catch up with those from coal-fired power plants (which are flat) by 2040, and there is also a 20% rise in emissions from industry.

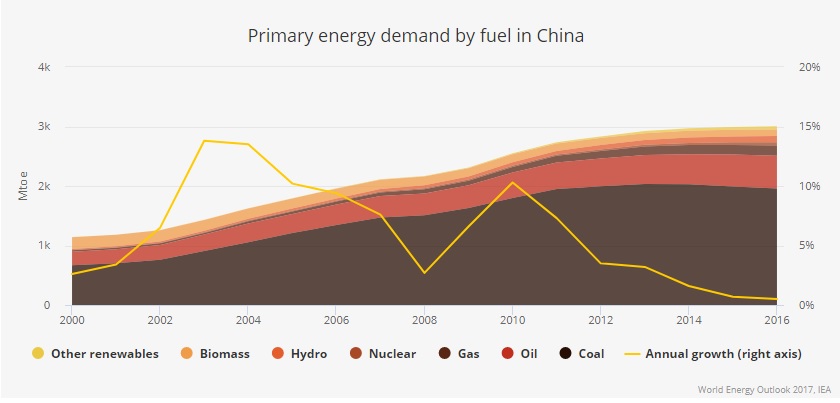

When China changes, everything changes

When China changes, everything changes

- China is entering a new phase in its development. The president’s call for an “energy revolution”, the “fight against pollution” and the transition towards a more services-based economic model is moving the energy sector in a new direction

- Demand growth slowed markedly from an average of 8% per year from 2000 to 2012 to less than 2% per year since 2012, and in the New Policies Scenario it slows further to an average of 1% per year to 2040. Energy efficiency regulation explains a large part of this slowdown. Without new efficiency measures, end-use consumption in 2040 would be 40% higher. Nonetheless, by 2040 per-capita energy consumption in China exceeds that of the European Union.

- China’s choices will play a huge role in determining global trends, and could spark a faster clean energy transition. The scale of China’s clean energy deployment, technology exports and outward investment makes it a key determinant of momentum behind the low-carbon transition: one-third of the world’s new wind power and solar PV is installed in China in the New Policies Scenario, and China also accounts for more than 40% of global investment in electric vehicles (EVs).

- China overtakes the US as the largest oil consumer around 2030, and its net imports reach 13 million barrels per day (mb/d) in 2040. But stringent fuel-efficiency measures for cars and trucks, and a shift which sees one-in-four cars being electric by 2040, means that China is no longer the main driving force behind global oil use – demand growth is larger in India post-2025.

- China remains a towering presence in coal markets, but our projections suggest that coal use peaked in 2013 and is set to decline by almost 15% over the period to 2040.

The report can be found here.