The United Nations Conference on Trade and Development (UNCTAD) finds that maritime trade volume contracted marginally by 0.4 per cent in 2022, but expects it will grow by 2.4 per cent in 2023.

As explained in the Review of Maritime Transport 2023 report, global shipping continues to confront multiple challenges, including heightened trade policy and geopolitical tensions and is dealing with changes in globalization patterns. However, the industry remains resilient and UNCTAD expects continued but moderated growth in maritime trade volume for the medium term (2024–2028). Furthermore, UNCTAD has analyzed global maritime trade trends, which were presented as follows:

Containerized trade

- Overview

During 2022, containerized trade, measured in metric tons, declined by 3.7 per cent. UNCTAD projects it will increase by 1.2 per cent in 2023 and expand by over 3 per cent during the 2024–2028 period, although this rate is below the long-term growth of about 7 per cent over the previous three decades.

Weakened containerized trade reflects the slowdown in global economic growth, high inflation and normalizing of demand after the unusual surge during the COVID-19 pandemic.

- Distances

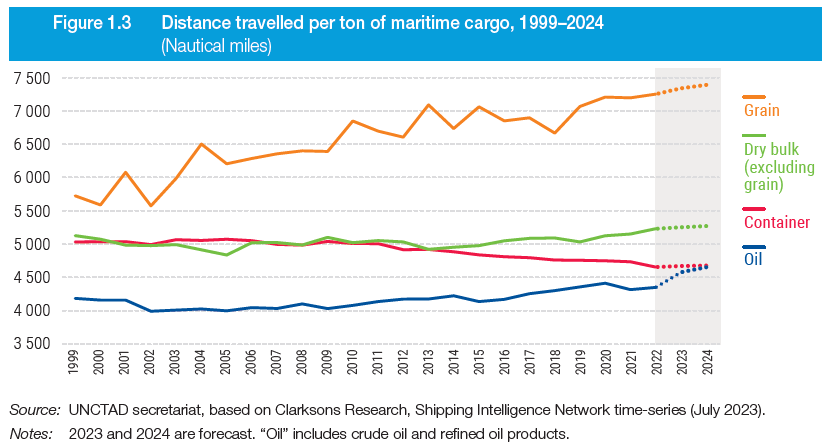

Containerized trade distances have tumbled since 2020 but increased marginally in 2023. Intra- Asian containerized trade, which accounts for the majority of intraregional trade, saw its share increase over the years. As intra-Asian trade is carried over shorter distances, the average distances travelled per ton of container cargo of global containerized trade are relatively low.

The predominance of intra- Asian containerized trade flows reflects global manufacturing patterns with China continuing to serve as the leader in global manufacturing, supported by neighbouring East Asian countries. It also reflects the growing participation of several East Asian countries in regional and global value chains.

- Overview

Starting in early 2022, seaborne trade, in particular dry bulk and tanker shipments, has been impacted by the war in Ukraine. The war led to changes in shipping patterns and increased the distances travelled for commodities, especially oil and grain. Growth in ton-miles exceeds growth in tons in 2022, 2023 and for 2024 projections.

In 2022, oil and gas trade volumes witnessed robust annual growth rates, of 6 per cent and 4.6 per cent, respectively. The increase can be attributed to heightened demand for fuel as the pandemic eased and related restrictions were lifted.

As spending on energy-intensive services like transport and travel gradually recovered, a return to normalcy contributed to the surge in oil demand. In contrast, containerized and dry bulk shipments declined in 2022.

- Distances

In 2023, oil cargo distances reached long-term highs, driven by disruptions from the war in Ukraine. Crude oil and refined products travelled longer distances, as the Russian Federation sought new export markets for its cargo and Europe looked for alternative energy suppliers.

Shipments of grains travelled longer distances in 2023 than any other year on record. Although grain shipments from Ukraine resumed in 2022 thanks to the Black Sea Initiative, several grain-importing countries had to rely on alternative grain exporters. They are instead buying from the United States of America, or Brazil, which requires longer hauls.

Shipments of grains travelled longer distances in 2023 than any other year on record. Although grain shipments from Ukraine resumed in 2022 thanks to the Black Sea Initiative, several grain-importing countries had to rely on alternative grain exporters. They are instead buying from the United States of America, or Brazil, which requires longer hauls.