A new paper by Ricardo on behalf of Transport and Environment (T&E) examines the potential public support mechanisms that can enable shipping and aviation to shift to these renewable fuels, with a focus on supply-side support, appropriate policy frameworks, and strategic investments.

As explained, the uptake of sustainable and scalable fuels (hydrogen-derived fuels, known as ‘RFNBOs’) in shipping and aviation is currently hampered by competition with cheap and untaxed fossil fuels. The European Commission has therefore proposed to subsidise RFNBO production to kickstart the use of these fuels.

In this context, Transport & Environment commissioned Ricardo to explore suitable design options for public support mechanisms to enable the shipping and aviation sectors to transition to RFNBOs. While this paper focuses on policy action in the EU and is relevant in the context of the ongoing discussions on the design of the EU’s Hydrogen Bank auctions, the conclusions are equally relevant for policy-makers considering subsidising RFNBOs in these sectors in other jurisdictions, such as the UK, US, and the IMO.

Proposed solution for e-ammonia production in maritime

Considering both the existing policy landscape across each sector and alternative public support mechanisms (including carbon contracts for difference (CCfD), and fixed premiums), this study found that contracts for difference (CfDs) offer a favourable and flexible way to mitigate the high costs traditionally associated with low and zero carbon fuels in aviation and maritime sectors.

- A supply-side CfD can incentivise e-ammonia production, with producers entering purchase agreements for green hydrogen and nitrogen.

- To incentivise uptake of e-ammonia in the maritime sector, a demand-side CfD could be used instead of a supply-side CfD.

- The demand-side CfD would ensure sufficient support for vessel operators and help determine demand for e-ammonia.

- This approach would ensure the wholesale price of e-ammonia is at a level that supports investment in production capacity.

- There is a risk that without clear price signals, e-ammonia supply could lag behind demand, at a higher cost to governments.

- A total cost of ownership (TCO) demand-side CfD would support vessel operators with the cost of retrofitting and adapting ships to run on ammonia.

Supply-side support for RFNBOs

This briefing argues that supply-side support (where the subsidy is awarded to RFNBO producers) is most appropriate. For shipping, it can ensure the initial availability of renewable fuels in the select few ports where the lion’s share of bunkering takes place. In aviation, supply-side support is necessary to secure business cases for nascent fuel production projects ahead of the 2030 RFNBO target. Lack of investment in aviation fuel projects means that public authorities should take more risk by using Contracts for Difference (CFDs), while more private interest in shipping projects means that policy-makers could consider either CFDs or fixed premiums, where more risk is taken on by the private investor over the public authority.

Bridging the price gap

Policy-makers should also consider bridging only a part of the price gap between RFNBO and conventional fuels so that the market absorbs some of the cost in the form of green premiums. This could be done by organising the auctions in the form of ‘pay-as-clear’, where the same subsidy amount is awarded to all successful bidders.

The role of the policy framework

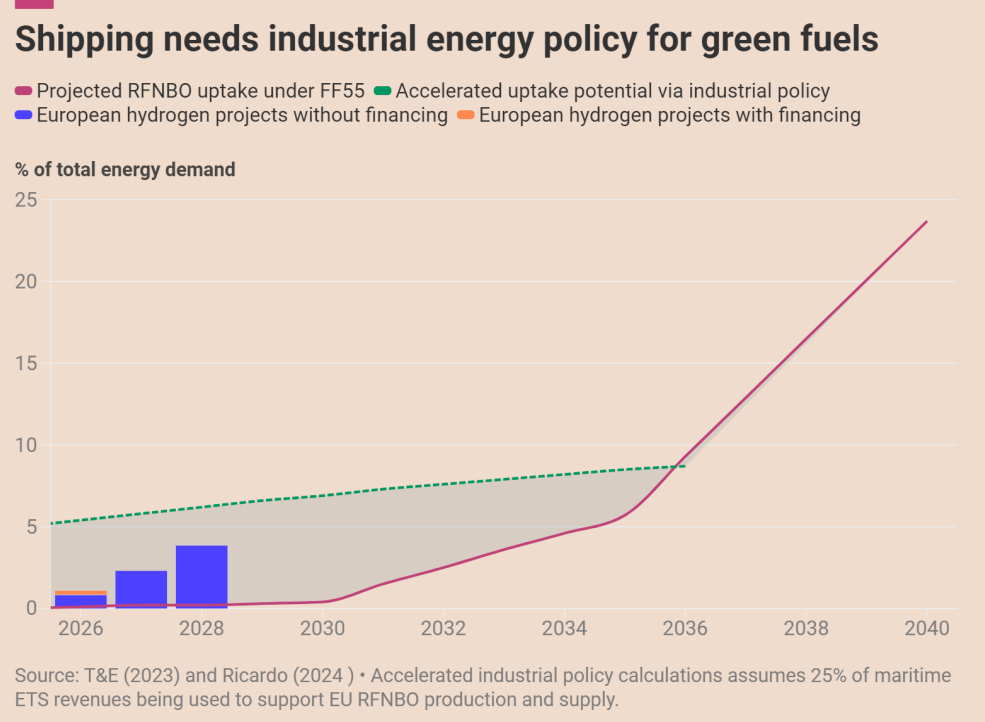

The analysis makes clear that the surrounding policy framework is key for the successful implementation of public financial support. Analysis of the shipping sector shows that using 25% of ETS revenues can help to significantly boost RFNBO uptake in the short to medium term, but from the late 2030s, existing targets under FF55 could be sufficient to make RFNBOs competitive with conventional fuels if early uptake drives economies of scale.

The analysis demonstrates that higher RFNBO mandates (under FuelEU Maritime) significantly reduce the amount of subsidies given to the sector to achieve the same climate targets.

Supporting aviation fuel projects

Analysis of the aviation sector shows that using 25% of ETS revenues to fund a CfD would cover half of the mandated volumes until 2040, using a 20% price gap coverage level. This would strengthen the business models of the first projects and help them reach final investment decisions, launching the sector.

Exploring CFDs and strategic technologies

More generally, policy-makers should explore deploying CFDs to prioritise marine and aviation RFNBOs as strategic net-zero technologies as part of the implementation of the Net-Zero Industry Act (NZIA) and the future development of the Clean Industrial Deal. T&E also argues that European policy-makers should set the right surrounding policy framework to increase ambition and to ensure a level playing field between firms receiving subsidies and those not.

This means internalising the external costs of fossil fuels, for example through the Emissions Trading System (ETS) and Energy Taxation Directive (ETD); removing exemptions for international flights and smaller ships in the ETS and increasing the mandates for RFNBOs in FuelEU Maritime and ReFuel Aviation at the same time as implementing bespoke measures on energy efficiency improvements in shipping and demand management in aviation.