Shell has published its LNG Outlook for 2025, finding that global demand for liquefied natural gas (LNG) is forecast to rise by around 60% by 2040, largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence.

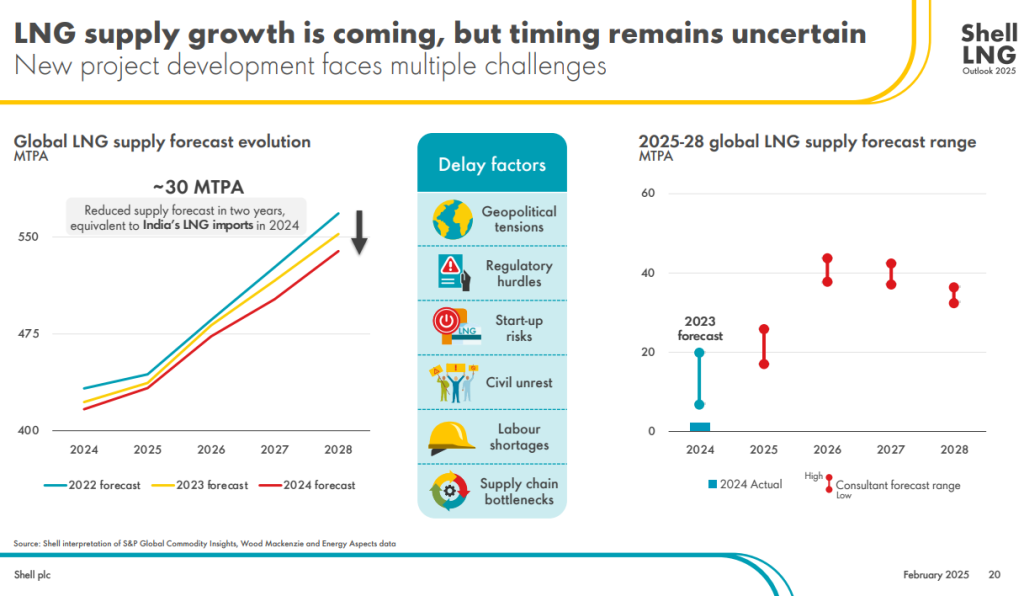

Global LNG trade grew by only 2 million tonnes in 2024, the lowest annual increase in 10 years, to reach 407 million tonnes due to constrained new supply development. More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain.

Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonisation goals. LNG will continue to be a fuel of choice because it’s a reliable, flexible and adaptable way to meet growing global energy demand.

… said Tom Summers, Senior Vice President for Shell LNG Marketing and Trading

China is significantly increasing its LNG import capacity and aims to add piped gas connections for 150 million people by 2030 to meet increasing demand. India is also moving ahead with building natural gas infrastructure and adding gas connections to 30 million people over the next five years.

Key findings of the report include:

LNG enables lower emissions in hard-to-electrify sectors and paves the way for net-zero emissions

- The global trade in LNG is set to rise significantly by 2040, driven by Asian economic growth, the need to decarbonize heavy industry and transport, and the emerging growth in the energy-intense tech sector.

- LNG is becoming a cost-effective fuel for shipping and road transport that can bring down emissions. Longer term, existing gas infrastructure could be used to import bio-LNG or synthetic LNG and also repurposed for the import of green hydrogen.

Negligible supply growth and resilient Asian demand kept prices elevated in 2024

- Global trade in LNG reached 407 million tonnes in 2024, an increase of just 3 million tonnes from 2023, the lowest annual supply addition for 10 years.

- Demand for LNG strengthened in Asia during the first half of 2024 as China took advantage of lower prices and India bought more cargoes to help meet strong power demand due to hot summer weather.

- European imports fell by 23 million tonnes, or 19%, due to strong renewable energy generation and continued weakness in industrial gas demand.

With rising global demand, LNG is a fuel of choice to ensure energy system resilience

- Demand for gas continues to gather pace across Asia, with China and India significantly increasing their regasification and downstream infrastructure.

- More than 170 million tonnes of new LNG supply is set to come on to the market by 2030, helping to meet growing long-term global demand for gas. But project start-up timings remain uncertain.

- Europe and Japan will continue to require LNG to fill a widening gap between energy diversification ambitions and actual investment levels.

Paving the way for lower-carbon gases

In the marine sector, a growing order book of LNG-powered vessels will see demand from this market rise to more than 16 million tonnes a year by 2030, up 60% from the previous forecast. LNG is becoming a cost-effective fuel for shipping and road transport, bringing down emissions today and offering pathways to incorporate lower-carbon sources such as bio-LNG or synthetic LNG.

Europe will continue to need LNG into the 2030s to balance the growing share of intermittent renewables in its power sector and to ensure energy security. In the longer term, existing natural gas infrastructure could be used to import bio-LNG or synthetic LNG and be repurposed for the import of green hydrogen.

Significant growth in LNG supply will come from Qatar and the USA. The USA is set to extend its lead as the world’s largest LNG exporter, potentially reaching 180 million tonnes a year by 2030 and accounting for a third of global supply.

Market tightness in 2024

The early part of 2024 saw spot LNG prices fall to their lowest level since early 2022, but prices recovered by mid-year due to delays in the development of new supply capacity.

Demand for LNG strengthened in Asia during the first half of 2024 as China took advantage of lower prices, importing 79 million tonnes during the year. India bought record volumes to help meet stronger power demand due to hotter weather in early summer. Its imports rose to 27 million tonnes, a 20% increase from 2023.

While LNG continued to play a vital role in European energy security in 2024, imports fell by 23 million tonnes, or 19%, due to strong renewable energy generation and a limited recovery in industrial gas demand.

However, cold winter temperatures and spells of low wind power generation towards the end of the year drove strong gas storage withdrawals which, combined with the expiry of Russian pipeline gas flows to Europe through Ukraine on Dec 31, 2024, drove up prices.

Europe is expected to increase imports of LNG in 2025 to refill its gas storage.