Colombo Stock Exchange (CSE) in collaboration with the Global Reporting Initiative (GRI) launched the updated version of the publication ‘Communicating Sustainability’. The publications aims to assist listed companies effectively integrate Environmental, Social and Governance (ESG) factors in capital market communications.

This guide aims to help companies listed in the Colombo Stock Exchange mitigate topics related to environmental, social and governance (ESG) issues in their communications, as these aspects are influencing investment decisions by institutional and retail investors.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The guide describes the current practices of investors and issuers and provides guidance. It also consists of useful recommendations regarding sustainability reporting for companies.

Listed companies are guided on how to approach the topic of sustainability when they include it into their capital market communication. Listed companies will also focus and limit their ESG-related reporting to the content that is really material as this is what investors and analysts are interested in.

The guide seeks to help the issuer navigate the complex process of identifying the content that is most appropriate and relevant to their capital market communication

The CSE said.

Companies should also consider that the substance of their disclosures will be based on their industry or sector and on an individual analysis of the materiality of the information to their specific stakeholders. With its focus on capital market communication, this guide is written with the investors and analysts in mind.

Best practice recommendations

As the report notes, the following best practice recommendations for ESG reporting aspire to support companies in developing more holistic, integrated corporate reporting, in order to achieve a more effective capital market communication. CSE encourages all listed companies to consider sustainability reporting with a special emphasis on the following recommendations.

- Leadership and Drive: The board of directors of a company may define and control key topics and key performance indicators (KPIs) that reflect the company’s economic, environmental, social and governance impacts. This means that the senior management needs to set the sustainability agenda and ensure that line organisations understand and embrace the goals that have been set and the targets that have been agreed;

- Consider stakeholder interests: When considering reporting information to investors, it is important to remember that while all investors can benefit from ESG information, different investors can have distinct information needs. Companies can therefore benefit from clarifying themselves on matters such as current top investors, the investors whom the company would desire to have in the future and their interests;

- Identify and prioritize material ESG issues: In sustainability reporting, materiality is the principle that determines which relevant topics are sufficiently important that it is essential to report on them. Not all material topics are of equal importance, and the emphasis within a report is expected to reflect their relative priority. The degree to which each indicator is relevant will vary greatly among companies, and the materiality of each factor should be determined by the board and management of the company itself taking considerations from priority stakeholders into account.

- Adopt Relevant Performance Indicators: Once a company has established which ESG topics to report on, it can begin to disclose specific performance indicators to demonstrate progress;

- Reporting Integrity and Transparency: Companies should describe to investors any standards that they have applied in the preparation of key ESG metrics. This should be supplemented with details of key definitions and assumptions used in the calculation of metrics where an external standard does not exist or has not been applied.

- Proper Communication: Companies may use various communication channels including integrated reports, standalone sustainability reports, websites or any other publications to disclose relevant, comparable and timely information on ESG matters.

Overall, in all business sectors, organizations develop sustainable business aiming at improving their social conscience and environmental responsibility, well beyond the financial.

Lately, the industry has been driven by raised ambitions and accelerated actions with respect to sustainability. These ten key practices for shipping organizations aim to ignite a new era of leadership:

- Focus on decarbonization targets;

- Provide education to mobilize action;

- Unleash innovation;

- Say yes to diversity;

- Embed the SDG;

- Be transparent;

- Create partnerships;

- Aim towards a circular economy;

- Get nominated for an award;

- Envision the future.

In addition, SAFETY4SEA’s annual survey, the so called ‘Shipping CSR500 Survey’ highlighted once again the many benefits that CSR practices offer to the industry’s organizations which realize their responsibility as part of the society and their contribution to the environmental sustainability in order to move forward.

What is more, the US’s Governance & Accountability Institute revealed that 82% of the S&P 500 (Standard & Poor’s 500) Index issued sustainability reports in 2016, but corporates are not divulging what’s imporant: 76% of the reports failed to disclose any metrics, and 53% simply used bland, boilerplate language that offered no insight.

Namely, finding solutions to one problem, involves tackling other related challenges.Sustainability measurement is the quantitative basis for the informed management of sustainability. The metrics used for the measurement of sustainability are still evolving including indicators benchmarks, audits, indexes and accounting, as well as assessments and appraisals or other reporting systems.

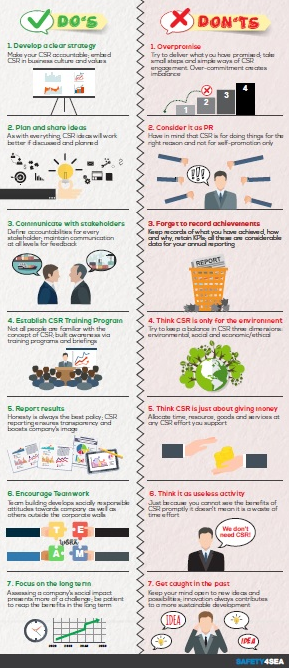

In order to help organisations understand the do’s and don’ts for CSR, SAFETY4SEA has issued an informative infographic citing key points for both consideration and avoidance, illustrating how organisations may integrate CSR effectively into their operations.

Key points for consideration include the planning and sharing of ideas and promotion of team work, in order to develop socially responsible attitudes inside the organisation as well as others outside the corporate walls. Operators should have in mind that although the benefits may not be seen promptly, CSR should never be seen as a waste of time.

Click herebelow to explore more:

You can see further information in the following PDF