The Sustainable Shipping Initiative (SSI) published the report “Exploring shipping’s transition to a circular industry”, discussing the potential of circular economy principles for shipping.

Accelerating trends and patterns

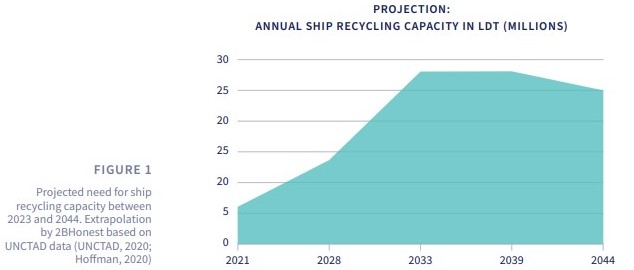

The past two decades have seen continuous growth in the global fleet in terms of size and number. As these vessels approach end of life, global recycling volumes are expected to grow significantly, doubling by 2028 to 14 million light displacement tonnes (ldt) and near quadrupling by 2033 to 28 million ldt.

For existing ship recycling facilities, this means at least doubling their capacity and potential capabilities to handle larger size ships to meet the increased demand. This rise in demand provides high potential for new entrants. For shipowners (and in particular EU-flagged vessels that must recycle in EU approved facilities), this means challenges in finding facilities that have the actual capacity and capability to ensure that vessels are recycled in a responsible, timely and economically viable manner. In the current scenario, a sustainable solution for EU SRR-compliant recycling will likely emerge from non-OECD countries, where inherent steel demand with minimal last-mile costs and lower carbon emissions leads to comparable quality recycling with substantially higher steel-scrap prices on offer.

The global recycling volumes are expected to double by 2028 and nearly quadruple by 2033. In the short term, global solutions aimed to resolve the outlined ‘stalemate’ regulatory, capacity, and capability challenges are necessary for responsible ship recycling, especially of the larger size vessels. These are likely to emerge in countries with an inherent demand for steel scrap and existing strong downstream markets that support the implementation of the circular economy principles and reduces carbon emissions

noted Captain Prashant S. Widge, Head of Responsible Ship Recycling, Fleet Technology at A.P. Moller-Maersk.

Circular economy principles should be built into every stage of the ship lifecycle

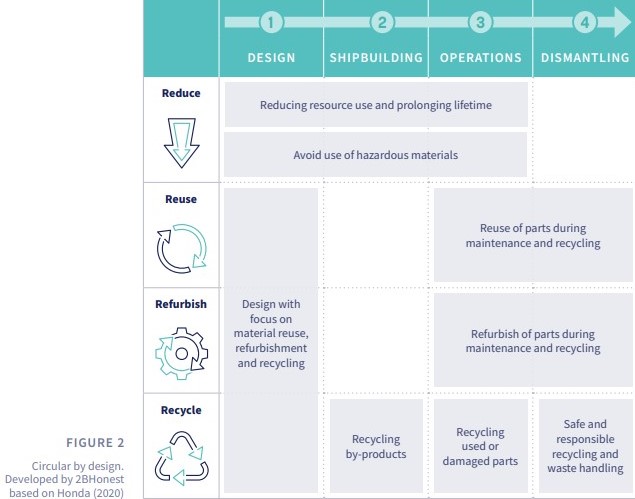

Although over 95% of shipping’s carbon emissions currently occur during the operating phase as a result of fuel combustion, the industry’s decarbonisation is expected to shift this balance, leading to carbon emissions from components, building and recycling taking up a larger share of a vessel’s total lifecycle emissions. The figure below illustrates some of the processes that can be implemented across the ship lifecycle, improving circular material flows which would further reduce emissions associated with the ship itself.

The world needs to pivot away from a linear to a circular economy. For shipping this means working to create awareness, policies, business models and technologies towards an industry that is circular by design

stated Pieter van t’Hoff, Responsible strategy and supply chain consultant at 2BHonest.

Global regulation and multi-stakeholder collaboration are essential

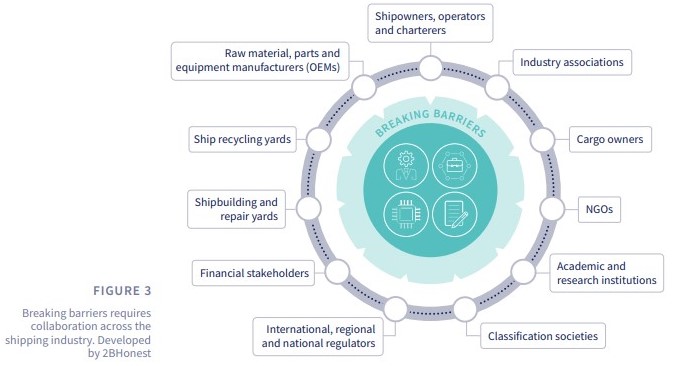

The report identifies four main building blocks to a circular industry: knowledge and awareness, business model innovation, technological advancement, and the need for a global regulatory framework. As with the ongoing decarbonisation challenge, no single stakeholder group can act alone, and there is a need for dialogue and collaboration within and beyond the shipping industry. By learning from comparable sectors such as automotive and working with regulators, financial stakeholders, and industry, major steps can be taken to improved circularity and higher value realisation across the ship lifecycle.

By investing early to build circular economy principles into every stage of the ship’s lifecycle, the industry will realise the potential for transformation including the social, environmental, and economic rewards. Consumers and investors will look to the shipping industry for practical examples and inspiration about how to future-proof the maritime supply chain

explained Oriana Brine, Trustee at the Sustainable Shipping Initiative.

EXPLORE MORE INFORMATION ON SSI’S REPORT ON CIRCULAR ECONOMY