The Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMMCZCS) has analyzed the current fuel mix and the potential for meeting the 2025 FuelEU reduction targets.

What does the MRV data show?

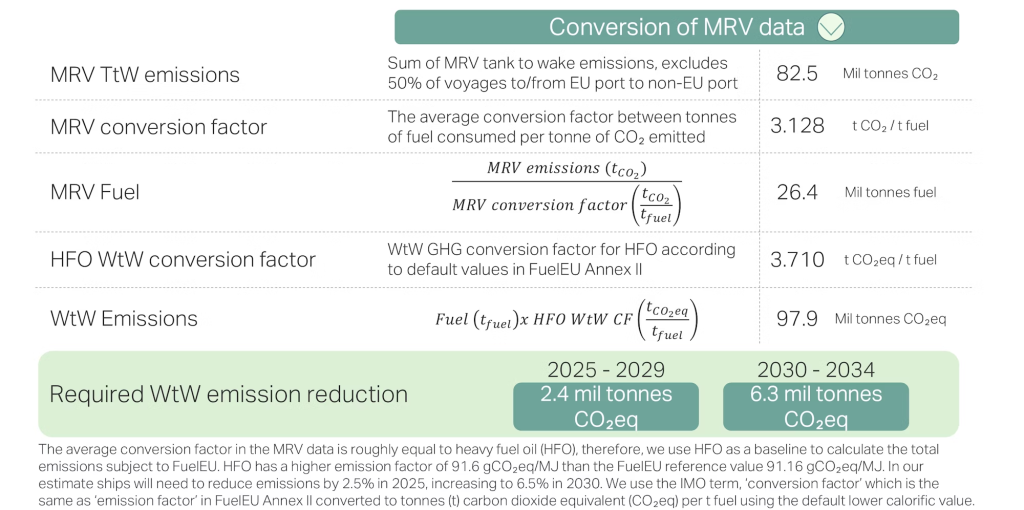

To estimate needed reductions, MMMCZCS used reported emissions of all 13,000 vessels sailing to EU ports in 2023, publicly available through the EU Monitoring, Reporting, and Verification (MRV) database. As shown below in Figure 1, MMMCZCS converted 2023 tank-to-wake (TtW) CO2 MRV data into well-to-wake (WtW) GHG emissions regulated by the FuelEU. To do this, MMMCZCS increased the values to include upstream emissions and two other GHGs: nitrous oxide (N2O) and methane (CH4).

Key facts about the FuelEU regulation

- The FuelEU Maritime Regulation (EU 2023/1805) promotes the use of renewable, low-carbon fuels and clean energy technologies for ships to support decarbonization.

- Applies to ships over 5,000 gross tonnage calling at European ports, regardless of their flag.

- Sets maximum yearly average greenhouse gas (GHG) intensity limits for ships, with gradual targets:

- 2% reduction by 2025

- Up to 80% reduction by 2050

- Targets cover CO2, methane, and nitrous oxide emissions, using a Well-to-Wake (WtW) approach across the full fuel lifecycle.

- Mandates zero-emission requirements for ships at berth (passenger ships and containerships) through on-shore power supply (OPS) or alternative technologies to reduce port air pollution.

- Encourages innovation through a life-cycle, goal-based, and technology-neutral approach, giving operators flexibility in fuel choices.

- Supports existing fleets with flexibility mechanisms and rewards early adopters of sustainable energy technologies.

- Enters into force on 1 January 2025, with monitoring plan provisions (Articles 8 and 9) applying from 31 August 2024.

After adjusting to exclude 50% of voyages to or from non-EU ports, MMMCZCS found that 97.9 million tonnes of GHG emissions coming from 26.4 million tonnes of fuel will be subject to FuelEU. Assuming all vessels sail on heavy fuel oil (HFO) as a baseline, this would require 2.4 million tonnes CO2eq of abatement in 2025.

How much low-carbon fuel is currently being used?

Biodiesel, which can be blended with fuel oil and used in conventional engines, is increasingly used by companies to meet regulatory requirements as well as voluntary decarbonization goals. In addition, fossil LNG provides emissions reductions, albeit limited, for vessels equipped to operate on the fuel.

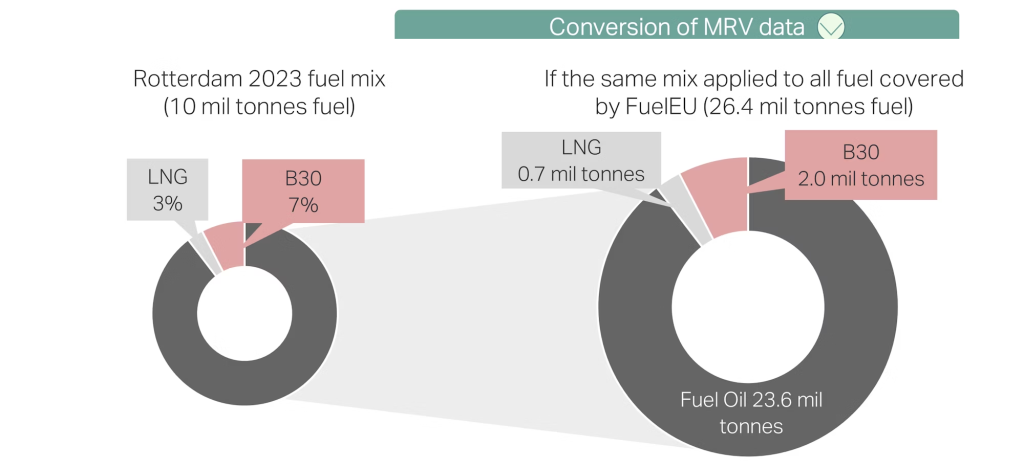

MMMCZCS used 2023 bunker sales in Rotterdam, Europe’s largest bunkering hub, to understand how much abatement can be expected from the existing use of LNG and biodiesel. B30, a blend of 30% biodiesel and 70% fuel oil, made up 7% of the total 10 million tonnes of bunker fuel sold in Rotterdam. LNG represented 3% of sales, and a small amount of bio-methanol was bunkered for the first time by Laura Mærsk.

As shown in Figure 2, if MMMCZCS extrapolates Rotterdam’s fuel sales to the 26.4 million tonnes covered by FuelEU, the industry can expect a demand of 0.7 million tonnes of LNG and 2 million tonnes of B30 blend in 2025 (equal to 600,000 tonnes of B100 or 100% biodiesel).

Will there be enough biodiesel?

There are several views on whether supply can meet demand for biodiesel. Industry experts MMMCZCS spoke to noted that it will be difficult for EU ports to procure and provide 600,000 tonnes of biodiesel in 2025 due to competition from other sectors. Furthermore, concerns over the quality of used cooking oil, which is the primary feedstock for biodiesel, could lead to a tightening of the market.

However, the strain on supply could be alleviated as other ports increase volumes to meet demand. For example, Singapore sold roughly 500,000 tonnes of bio-blended fuel oil in 2023, and the Spanish port of Algeciras-Gibraltar started offering a B24 blend in 2023. These developments suggest ports may be able to meet rising demand.

Another consideration is that a significant portion of the biodiesel bunkered in Rotterdam is marketed to customers as emission reductions. Additionality guidelines will likely prevent companies from using biofuel sold to cargo owners as emission reductions towards FuelEU compliance.

If companies continue to use biodiesel and sell the emission reductions to customers, then more volumes of biodiesel will be needed to meet both voluntary emission reductions targets as well as FuelEU compliance targets. High demand for both FuelEU compliance and voluntary emission reduction markets could strain supply.

How much more abatement is needed?

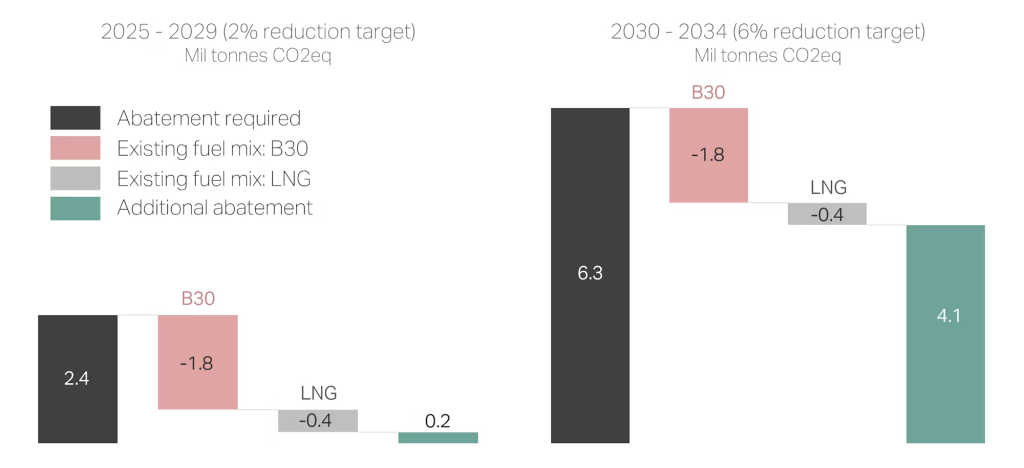

If we translate the 2023 Rotterdam fuel mix into emissions reductions across the full EU fleet, the current use of B30 can cover 1.8 million tonnes and LNG can cover 0.4 million tonnes (2.2 million tonnes in total) of the 2.4 million tonnes of CO2eq required. Shown in Figure 3, this represents 90% of needed CO2eq reductions between 2025 and 2029 but only 35% of reductions in 2030.

MMMCZCS’s estimates assume that the reductions from biodiesel and LNG are uniformly distributed across the full fleet of 13,000 vessels. However, some ships are likely to bunker more biofuel than is necessary and bank the surplus instead of allocating it to other vessels through pooling.

This could initially create a surge in biofuel demand, exceeding the volumes needed to meet the reduction targets. However, as companies use banked surpluses over time, MMMCZCS expects demand to align with the actual reduction requirement.

Alternatively, if other compliance pathways become prominent, Figure 3 may overestimate needed abatement. Other compliance pathways include:

- Biomethane: The current use of biomethane is limited; however, demand is gaining momentum and could play a significant role in helping LNG-powered vessels meet FuelEU targets.

- Onshore power: Currently, 10% of ships calling at EU ports are equipped with onshore power, which is considered to have zero emissions for FuelEU compliance, thereby reducing some of the demand for alternative fuels.

- Wind-assisted propulsion: The growing adoption of wind technologies, such as rigid and rotor sails, are eligible for a reward factor that can reduce the intensity of energy used onboard.

- Borrowing: MMMCZCS expects some vessels will borrow a portion of compliance from future years with a 10% penalty added.

- Penalty: For some, the simplest compliance option is to pay the penalty. However, the penalty’s cost is designed to be a disincentive for inaction and is typically more expensive than other options.

Given the range of compliance options and the existing fuel mix, MMMCZCS does not expect compliance to be a significant burden in the first five years. However, by 2030, companies will face significantly higher costs and will benefit from strategies to source potentially scarce low-carbon fuel.

Money well spent?

MMMCZCS estimates the total cost of 2.4 million tonnes of abatement is $350 million in 2025 and growing to $1.7 billion in 2030. MMMCZCS assumes LNG has no cost premium and biodiesel prices are in line with an LR and UMAS price projection.

Spending on FuelEU is relatively low compared to what companies will pay for ETS allowances. If MMMCZCS assumes a $100 per tonne for 60 million tonnes, and factors in the 70% phase-in, then the EU fleet can expect to pay a total of $6 billion in 2025. However, unlike the ETS, compliance spending can be paid directly to ships that use alternative fuels through the pooling mechanism.

The FuelEU regulation is structured to encourage investments in more advanced alternatives—such as e-fuels—through mechanisms like pooling and the multiplier for renewable fuels of non-biological origin (RFNBO). A pooling market which allows companies to buy and sell credits can redirect some of the $350 million estimated for biofuels to more advanced alternatives such as e-fuels.

If enough e-fuel vessels receive compliance spending through pooling, then it can create a business case for locking-in supply of e-fuels through offtake agreements, which producers often require to build a facility.