In the past two years, the war in Ukraine and the subsequent energy crisis have changed the energy conversation. Energy security, affordability, and industrial competitiveness are now critical focus points alongside sustainability, McKinsey’s Global Energy Perspective 2023 highlights.

In particular, the outlook for the energy transition depends on multiple variables and interdependencies. Uncertainties in cost evolutions, speed of technological progress, and policy developments translate into a wide range of possible scenarios, particularly regarding the outlook for fossil fuels.

Key insights

#1 Wide-ranging scenarios point to an unclear path ahead

The energy transition has gathered pace, but the path ahead is full of uncertainty in everything from technology trends to geopolitical risk and consumer behavior—making it difficult to shape resilient investment strategies that work in multiple scenarios. It is therefore increasingly challenging for decision makers to address multiple objectives at once, such as meeting long-term goals for decarbonization as well as short-term expectations for economic returns.

The Global Energy Perspective 2023 explores the outlook for demand and supply of energy commodities across a 1.5° pathway (modelled as part of McKinsey’s Climate Math effort) , as well as four bottom-up energy transition scenarios. These scenarios sketch a range of outcomes based on varying underlying assumptions—for example, about the pace of technological process and the level of policy enforcement. Despite significant reductions in carbon emissions, all energy transition scenarios remain above the 1.5⁰ pathway and result in warming of between 1.6⁰ and 2.9⁰C.

#2 Fossil fuel demand is projected to peak soon, but the outlook remains uncertain

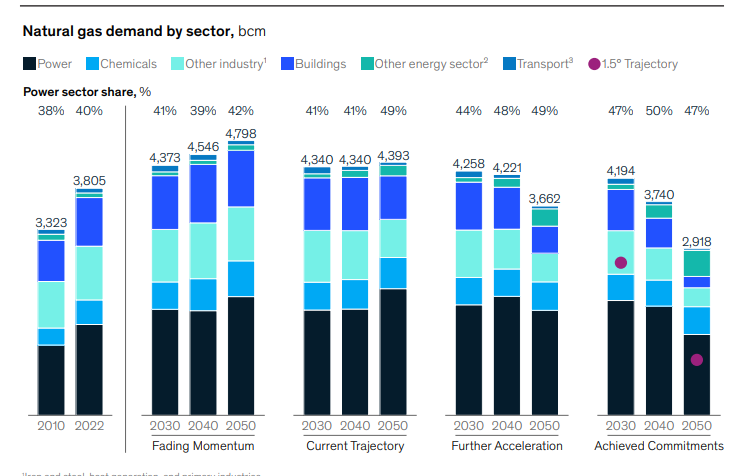

Total demand for fossil fuels is projected to peak by 2030 in all scenarios. Although a sharp decline in coal demand is expected under all scenarios, natural gas and oil are expected to grow further in the next few years and then remain a core part of the world’s energy mix for decades to come.

Total natural gas demand to 2040 is projected to increase under most scenarios, driven in large part by the balancing role that gas is expected to play for renewables-based power generation until batteries are deployed at scale. In the decade to 2050, the outlook for gas demand differs widely by scenario, from a steady increase under slower transition scenarios to a steep decline under scenarios in which renewables and electrification advance faster.

#3 Renewables will make up the bulk of the power mix by 2050

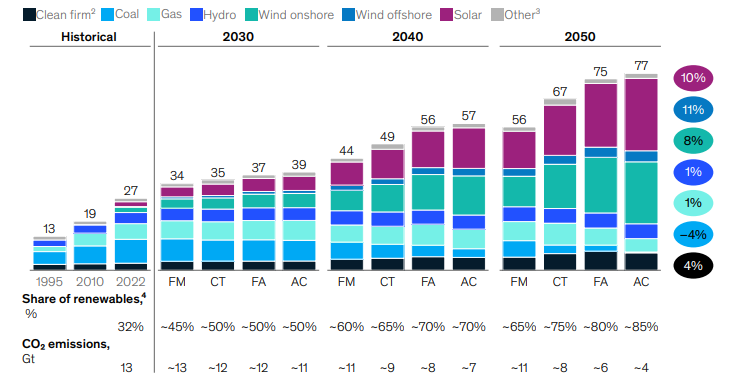

Renewables are expected to continue their rapid growth, driven in part by their cost competitiveness—in many regions they are already the lowest-cost option for incremental new-build power generation. Renewable energy sources are expected to provide between 45 and 50 percent of global generation by 2030, and between 65 and 85 percent by 2050. In all scenarios, solar is the biggest contributor of renewable energy, followed by wind.

The ramp-up of renewables could see emissions from power generation reduced by between 17 and 71 percent by 2050 compared to present levels, despite a doubling or even tripling of demand. However, the renewables build-out faces challenges, from supply-chain issues to slow permitting and grid build-out implications.

#4 Major investments in the energy sector will be needed, but remain stable as a share of GDP

Despite the increasing regulatory push for decarbonization and a declining demand for fossil fuels, between 25 and 40 percent of energy investments in 2040 will still be deployed in fossil fuels and conventional power generation to meet demand, offset declines in existing production fields, and balance the energy system. There will be a gradual but continued shift of investment focus from fossil fuels to green technologies and electric transmission and distribution. While accounting for only 20 percent of total investments in 2015, power renewables and decarbonization technologies are projected to make up between 40 and 50 percent of total investments by 2040.

Decarbonization technologies show the highest growth at between 6 and 11 percent per annum, mainly driven by the strong uptake of EV charging infrastructure and CCUS, which together are projected to account for the bulk of decarbonization investments by 2040.

#5 Achieving a successful energy transition would require a major course correction to overcome bottlenecks and reach the goals aligned with the Paris Agreement

To deliver on the steep climate commitments made globally, substantial pivots are needed across industries and geographies. Even the more modest transition scenarios require that multiple bottlenecks are overcome. Potential bottlenecks include land availability, energy infrastructure, manufacturing capacity, consumer affordability, investment willingness, and material availability. The adoption of green hydrogen faces steep challenges mainly due to infrastructure needs and the high investments required to achieve largescale deployment. Rare materials are required for most energy transition technologies, with EVs and wind generation both highly impacted by materials bottlenecks.

Gas demand is expected to increase to 2040 across scenarios but varies by around 2,000 bcm by 2050

Power, industry, and buildings remain core sectors driving gas demand to 2050. In the longer term, the growing importance of gas used for blue hydrogen production is also likely to drive demand. Chemicals and blue hydrogen production are the only sectors expected to show continuous growth in gas demand until 2050. In the power sector, gas is projected to increasingly assume a balancing role for renewables generation until batteries are deployed at scale. Thus, demand is expected to grow aggressively in the AC and FA scenarios before declining after 2035. In contrast, the more conservative FM and CT scenarios will see more moderate growth to 2050. In the buildings sector, electrification and biogas are likely to displace gas as more energy efficient designs are applied. While demand in the FM and CT scenarios grows until the late 2030s, demand already declines by the 2020s in the FA and AC scenarios.

Renewables are projected to make up the bulk of the power mix into the future, while clean firm and gas power generation increase across most scenarios

Renewables are expected to continue to grow rapidly, and are projected to provide ~45–50% of generation by 2030 and ~65–85% by 2050. By 2050,

emissions could be reduced by 18–72% compared to present levels. However, renewables build-out poses several challenges, from supply chain issues

to slow permitting and local resistance. The uptake of nuclear and CCUS technologies could lower the burden on renewables build-out, but depends on the political landscape and future cost development.

Amongst the thermal technologies, coal (without CCS) is expected to be phased out gradually. Power generation from H2-ready gas plants is likely to rise

due to their importance for grid stability.