Singapore has recently implemented the 1996 Protocol to the Convention on Limitation of Liability for Maritime Claims 1976 (LLMC 1976). Therefore, effective from 29 December 2019, operators can expect increased limits of liability for maritime claims.

According to the Shipowners’ Club, the applicable limitation amount is typically calculated based on:

- The gross tonnage of the vessel that is involved;

- The applicable daily conversion rates for Special Drawing Rights (SDR). SDR is not a currency in itself but is a recognised monetary unit. The daily conversion rates for SDRs can be found on the International Monetary Fund (IMF) website.

After Malaysia adopted the 1996 Protocol to the Convention on Limitation of Liability for Maritime Claims of 1976 (as amended in 2012 and effective from 2015) (1996 Protocol) in 2014, Singapore became a comparatively more popular jurisdiction to anchor a shipowners’ defence following a collision or an allision, because of the lower applicable limits of the LLMC 1976.

[smlsubform prepend=”GET THE SAFETY4SEA IN YOUR INBOX!” showname=false emailtxt=”” emailholder=”Enter your email address” showsubmit=true submittxt=”Submit” jsthanks=false thankyou=”Thank you for subscribing to our mailing list”]

The Singapore Government has now announced that the 1996 Protocol came into law on the 29 December 2019. While the entry into force of the 1996 Protocol does not change operators’ right to limit their financial liabilities as per the usual course, they can expect increased limits of liability for maritime claims in the future. The implementation of the 1996 Protocol does not apply in relation to any liability arising out of an occurrence which took place before 29 December 2019.

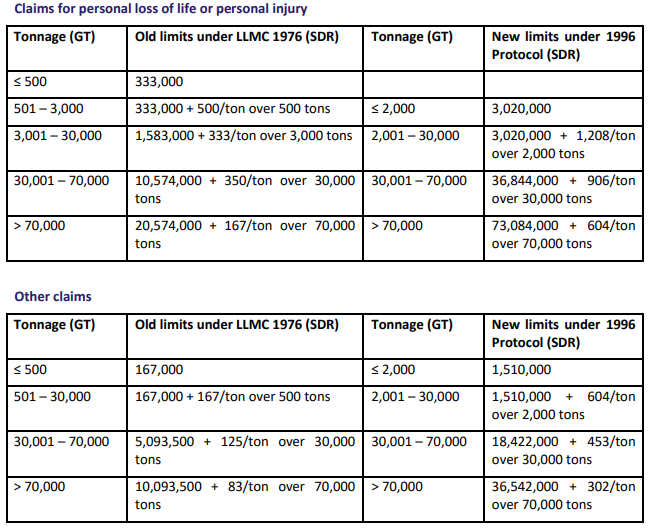

Illustrating the effect of the increased limits of liability, Fazlina Sapuan, Claims Executive – Singapore, Shipowners Club, presents the scenario of a crew death or personal injury claim involving a tug with a gross tonnage of 266 tons. As she explains, according to the LLMC 1976, a shipowner can expect to be entitled to limit its liability to 333,000 SDR (or approx. US$ 458,403 / S$ 621,136*). After the increase in limits under the 1996 Protocol, a shipowner’s liability would be 3,020,000 SDR (or approx. US$ 4,157,282 / S$ 5,632,286*). This is nearly a ten-fold increase.

If the same tug were to damage a buoy or hit a jetty, the LLMC 1976 limit would be 167,000 SDR (or approx. US$ 229,890 / S$ 311,455*) whereas the limit under the 1996 Protocol would be 1,510,000 SDR (or approx. US$ 2,078,642 / S$ 2,816,145*). Again, this is nearly a ten-fold increase.

Exceptions

Shipowners’ Club advises operators that separate limits apply to harbour craft and port limit passenger vessels. As of now, the applicable limits of liability for vessels registered as harbour craft remain unchanged and would still be as per the declared or insured value of hull and machinery.

This is subject to a minimum of S$ 200,000 in any one marine incident, plus additional coverage of S$ 500 per ton for every ton or part thereof above 300 GT.

Different limits may also apply for registered Port Limit Passenger Vessels licensed to carry more than 12 passengers, Port Limit Tankers and Oil Barges.

While the increased limits put Singapore on a par with other signatories of the 1996 Protocol, Members now face significantly more financial exposure arising out of maritime incidents. Members can be reassured by the fact that the limitation regime remains practically unbreakable and that the right to limit is almost a certainty in most cases

Ms. Sapuan claims.