Gavin Thompson, Vice Chair of Asia Pacific in its monthly blog discusses the upcoming IMO 2020 sulphur cap, the scrubber installations through the years and how ready the industry is to keep up with the changes.

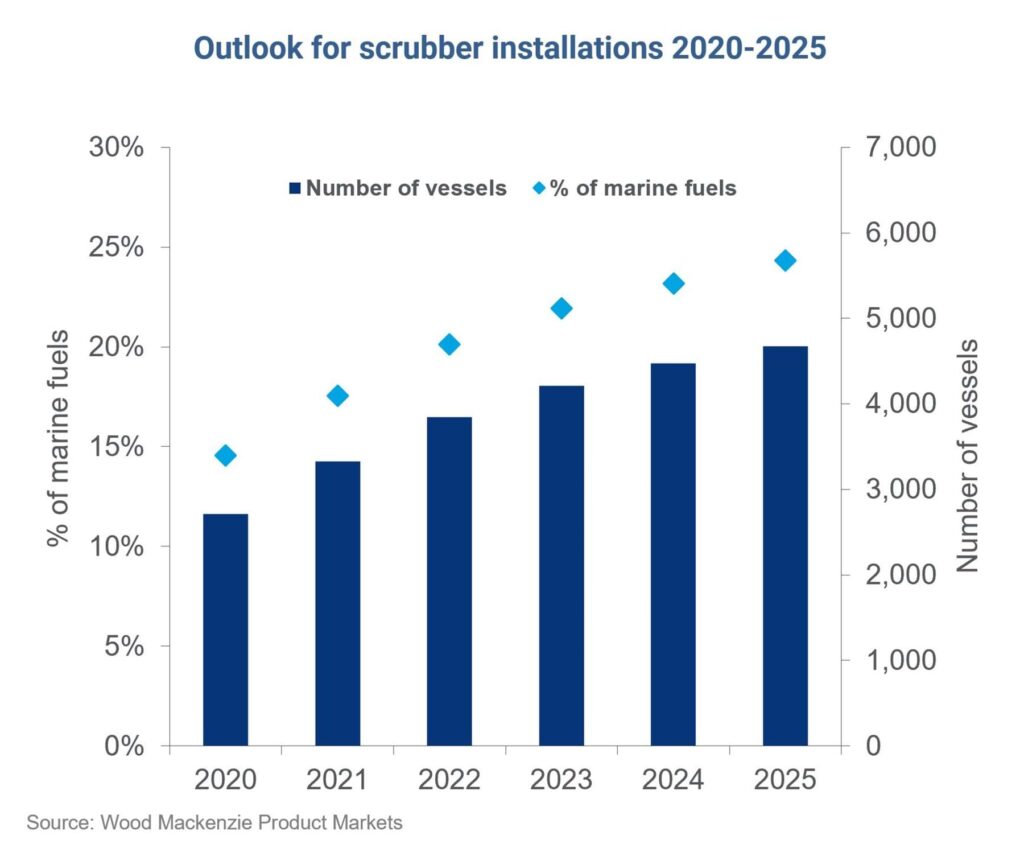

In the last 8-9 years, the shipping industry has taken the preparations more seriously; Yet, the idea of installing scrubbers remains relatively limited. Specifically, the vessels with scrubbers installed in 2020 will be about the 15% of marine fuel demand.

As for the time being, the industry consumes about 3.5 million barrels per day of HSFO; From January 2020 WoodMac expects that the demand will fall to about 1.3 million b/d, with a roughly 50:50 split between scrubbed and unscrubbed HSFO demand.

Additionally

- Unscrubbed HSFO demand falls to zero over the coming years as more scrubbers are deployed.

- Demand for MGO (similar to diesel) will jump by around 1 million b/d in 2020 and then remain fairly flat at around 2.4 million b/d through the mid-term.

Although scrubbers are now the centre of attention for those who will continue using HSFO, if the IMO in the future focuses on NOX and CO2 emissions, then scrubbers will be of less value.

Questioning whether the industry will be fully-compliant, Thompson stated that

No. Full compliance is going to be challenging, particularly in the early days of IMO 2020.

Thus, fuel-compliance will be the lowest in Asia. On the contrary, Singapore, as well as at ports in Japan and South Korea can be expected to be fully-compliant.

Immediate compliance will be also challenged by

- technical and operational issues; In other words, a ship will not have to detour if compatible fuels aren’t available at a destination port.

- Safety concerns; concerning the compatibility of new blends of VLSFO could be a valid ground for an exemption. And if a ship already has scrubbers on order (and can verify this) then there is a likelihood of an exemption.

IMO on refiners in Asia Pacific

WoodMac believes that refiners will be able to deliver about 1.4 million b/d of <0.5% VLSFO next year. To accomplish this goal, refiners will boost their production of VLSFO – either by segregation of intermediate product streams or by segregation of crudes and running their crude units in batch mode.

To supply the 1 million b/d of additional MGO for shipping, refiners will need to run an additional 1.7 million b/d of crude to meet this higher gasoil demand.

In the long run, LNG sellers will benefit from the IMO regulation on marine fuels as it drives a 23% annualised growth in demand for LNG in marine bunkering, reaching 22 million tonnes per annum by 2030.

In the short-term, Asian buyers are more benefited concerning their contracted LNG which is indexed to the Japanese Crude Cocktail (JCC), a mix of medium and sour crudes.

So as we head into the new year I expect IMO 2020 will have a material impact on Asian shipping and fuel supply. While this might not be immediate as in other regions, the move towards near-full compliance will happen relatively fast.