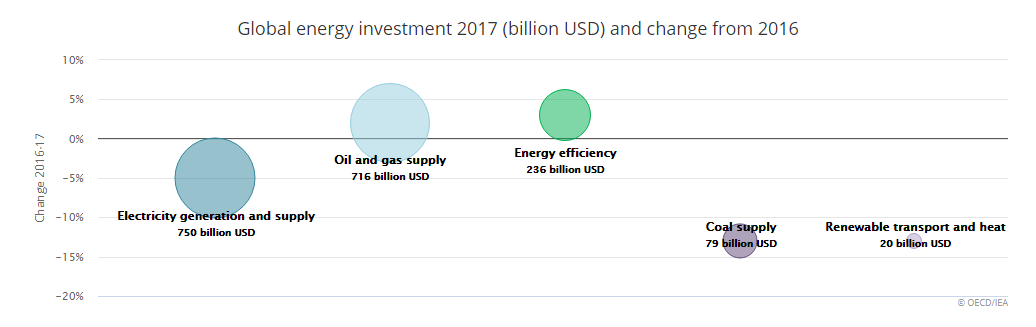

Global energy investment totaled USD 1.8 trillion in 2017, a 2% decline in real terms from the previous year, according to the International Energy Agency’s World Energy Investment 2018 report. The electricity sector attracted the largest share of energy investments in 2017, with more than USD 750 billion, exceeding the oil and gas industry, with USD 715 billion, for the second year in row.

Key findings

–> Total energy investment has fallen again and is increasingly underpinned by governments:

- 2017 was the third consecutive year of decline in global energy investment with energy efficiency the lone sector of growth.

- State-backed investments are accounting for a rising share of global energy investment, as state-owned enterprises have remained more resilient in oil and gas and thermal power compared with the private sector.

- The share of global energy investment driven by state-owned enterprises increased over the past five years to over 40% in 2017.

–> Government policies are playing a growing role in driving private spending

- Across all power sector investments, more than 95% of investment is now based on regulation or contracts for remuneration.

- Investment in energy efficiency is particularly linked to government policy, often through energy performance standards.

–> The power sector is becoming more capital intensive

- Electricity investment has shifted towards renewables, networks and flexibility.

- Yet, renewable power investment declined in 2017 by 7%, despite record levels of spending on solar PV.

- Moreover, the expected output from low-carbon power investments fell 10% in 2017 and did not keep pace with demand growth.

–> In emerging markets, auctions are supporting larger renewable projects

- In emerging markets the average size of awarded solar PV projects in auctions rose by 4.5 times while that of onshore wind rose by half over 2013-17, helping to support economies of scale.

- In Europe, tendered large projects are mainly concentrated in offshore wind; auctions have generally not resulted in large, land-based renewables projects.

–> Fewer decisions are being taken for investment in thermal generation

- In 2017, newly sanctioned coal power fell 18%, driven by a slowdown in China, India and Southeast Asia.

- However, despite declining capacity additions – and a wave of retirements of existing plants – the global coal fleet continued to expand in 2017.

- While investment decisions signal a continued shift towards more efficient plants, 60% of currently operating capacity uses inefficient subcritical technology.

- Meanwhile, sanctioned gas power fell nearly 23%, due mainly to the MENA region and the US.

–> Oil and gas companies are doing more with less

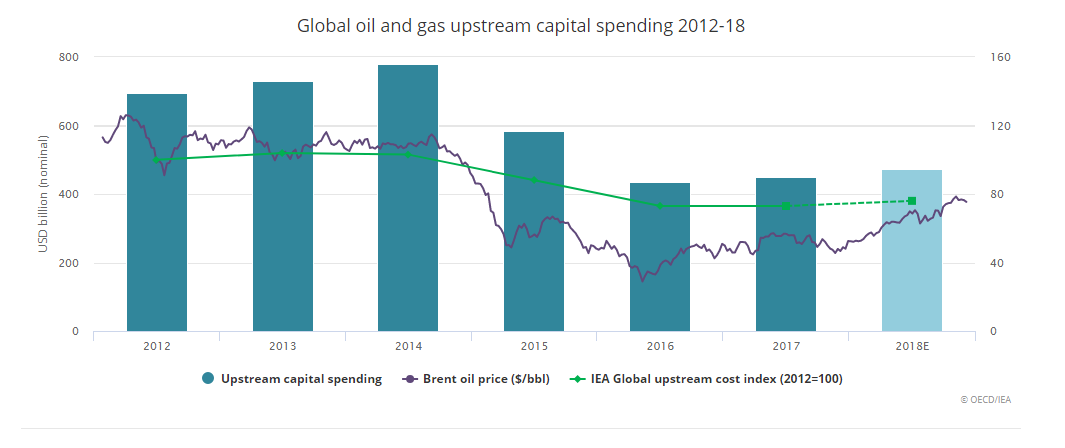

- Following the peaks in oil and gas upstream investment reached in 2014, investment collapsed abruptly as a result of lower prices. 2017 investment rebounded by 2% in real terms, and we estimate the same level of growth for 2018.

- One notable trend concerns the relationship between oil prices and upstream costs. In the past, there has been a roughly linear relationship between upstream costs and oil prices. When price spiked, so did costs, and vice versa.

What we are noting now is a decoupling. While prices have more than doubled since 2016, global upstream costs have remained substantially flat and for 2018 we estimate those increasing very modestly, by just 3%. Companies appear to have learned to do more with less.

–> The dynamics of the oil and gas industry are evolving

- The oil and gas industry has been traditionally characterised by long-lead times projects with predictable production profiles. Yet as a result of the shale revolution in the United States this trend is changing and the industry is re-thinking the way they choose, execute and manage projects.

- Furthermore, investment in conventional assets (responsible for the bulk of supply) remains focused on expansion of existing projects rather than developing new sources of production.

- Moving forward, the overall balance of market supply will be given by combination of conventional activities (which respond slowly) and unconventional projects (which respond to market conditions in a much more rapid way) suggesting the possibility of more volatility ahead in the markets.

–> US LTO is becoming a financially sustainable business

- The prospects of the US shale industry are improving. Between 2010 and 2014, companies spent up to USD 1.8 for each dollar of revenue.

- However, the industry has almost halved its breakeven price, providing a more sustainable basis for future expansion. This underpins a record increase in US light tight oil production of 1.3 million barrels a day in 2018.

–> Clean energy R&D investment is finally on the rise

- Government low-carbon energy RD&D spending in 2017 was estimated to have increased by 13% in 2017.

- Much of the increase in low-carbon energy technology RD&D spending is driven by North America, more than compensating for declines in Europe and Japan.

–> Yet investment in carbon capture, utilisation and storage is falling behind

- Commercial incentive as low as USD 40 per tonne of CO2 sequestered could trigger investment in the capture, utilisation and storage of up to 450 million tonnes of CO2.

–> ICT appears to be banking on the energy sector

- Corporate investments in new energy technology companies are growing strongly, reaching their highest ever level of just over USD 6 billion in 2017 – strategic investments by companies to get a stake in potentially key new technology areas.