Deloitte, together with ESPO, made an analysis of the main drivers and trends impacting Europe’s ports, in view of defining the changing role of port managing bodies in Europe.

The aim of the study, according to Isabelle Ryckbost, Secretary General ESPO, is to get an understanding of what drives ports’ decisions, how ports will adapt and navigate through this world in transformation and what is needed to optimise this process.

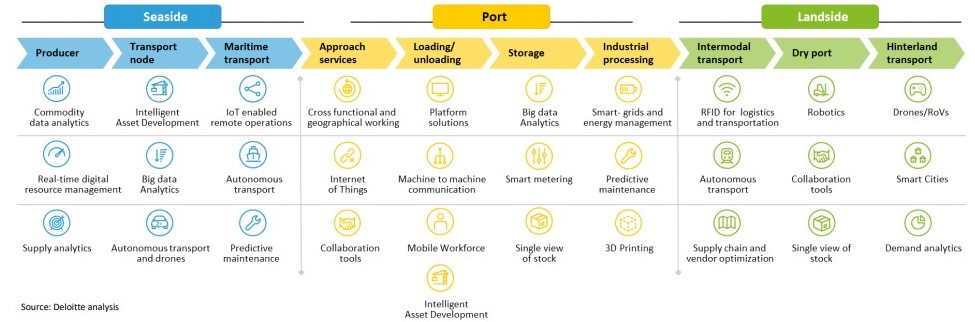

The study also identifies four categories of drivers and connecting trends which are transforming the portscape: environmental, technological, geopolitical and demographic. Based on these categories, the study explains how the role of European port authorities is transforming and draws a list of conclusions in that respect.

As ports in Europe are very diverse, they are impacted in a different way by drivers and trends. Overall, port authorities in Europe are taking up new, additional roles – be it in the field of greening or digitalisation, blue or circular economy – on top of their traditional functions

said the report.

However, while ports have been moving towards becoming commercial developers and active strategic landlords, their public role and mission-driven activities remain as important and are even further increasing. The wider variety of roles, responsibilities and stakeholders implies a greater complexity, which requires more than ever a strong port “manager” as neutral partner and facilitator in the value chain and the wider port ecosystem.

In addition, the diverse challenges ahead, the increasing complexity and scale increase in the sector pushes ports to cooperate with other ports, from coalitions on a single project to full mergers. But cooperation with other stakeholders will also be crucial to find workable solutions for issues like greening the shipping sector or the digitalisation of the port ecosystem. By teaming up, ports can leverage an external knowledge or lower the risk of certain investments.

The study also identifies some possible tensions. First, while the role of the port managing body is expanding, revenues are often decreasing.

Second, ports are heavy assets and infrastructure investments have very long lead times due to public tendering, financing and authorisation procedures. This makes it particularly challenging for ports to respond and react quickly to overnight changing realities in times of a very uncertain market outlook.

Furthermore, the report suggests an opportunity for revitalising the port-city relationship since the new port authority’s roles, including in the field of circular economy and renewable energy, make them a very relevant partner in the greening of the city and make them attractive for different new job profiles available in the city. It also identifies a way to reinvent maritime passenger transport after COVID-19.

Finally, supporting the changing role of ports requires a holistic view of ports, which considers all facets and roles, as well as the port-specific needs and abilities.

This diversity makes the European port system more resilient and implies that the best strategy to optimise and support the respective ecosystem will be different for each port

the report concludes.