The US Energy Information Administration (EIA) predicts that the share of high sulphur residual fuel oil consumed as bunker in the US will fall from 58% in 2019 to 3% in 2020, and then rebounds to 24% in 2022. The Administration highlights that the regulations will affect petroleum supply, demand, and trade flows on a more long-term basis.

The report, ‘The Effects of Changes to Marine Fuel Sulphur Limits in 2020 on Energy Markets’, presents that on the contrary to the recent increase in scrubber installations and orders, the number of vessels installed with scrubbers required to continue using high sulphur residual fuel oil remains limited.

Therefore, a large but brief increase in the share of distillate fuel oil and low-sulphur residual fuel oil is predicted in 2019 and shortly after 2020.

According to the report, a recovery in high sulphur residual fuel oil consumption driven by scrubber installations will not happen, until 2022. In case it occurs, it will be at levels lower than before the 2020 IMO sulphur cap.

In addition, after 2023, EIA expects high sulphur residual fuel oil consumption to decrease to a 22% share of US oceangoing marine vessel bunker fuel by 2025.

On the other hand, low sulphur residual fuel oil consumed is expected to rise from 38% in 2020 to 43% in 2025.

In the meantime, EIA foresees that the need to use distillate in lower sulphur bunker fuels will rise distillate’s share of US bunker demand from 36% in 2019 to 57% in 2020. However, this share will experience a decrease to 29% by 2025.

Moreover, the report notes that the LNG use in marine bunkering will be limited in 2020.

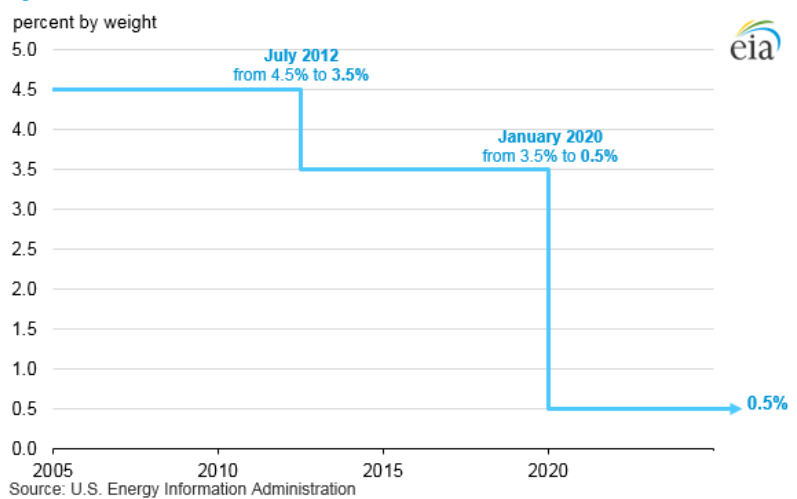

As the implementation date for the 0.5% sulphur cap approaches, the EIA expects that shifts in petroleum product pricing may begin as early as mid-to-late 2019.

EIA anticipates that the effects on petroleum prices will be most acute in 2020, and the effects on prices will be moderate after that.

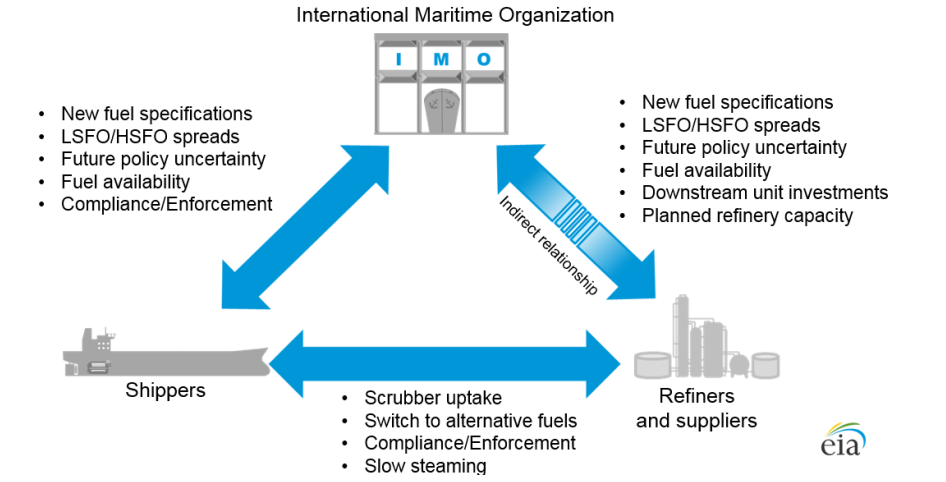

The report also focuses on the uncertainties arising of IMO projections across various stakeholders.

The effects of implementing the IMO 2020 regulations are highly uncertain. Many policy and technical complications, as well as potential market participant responses, create numerous interrelated factors that will have a significant influence on the eventual outcome. Further, these factors are highly interdependent on one another, making cause and effect difficult to disentangle.

For further information, click the PDF herebelow