DHL and NYU Stern School of Business have published the new DHL Trade Growth Atlas, which expects that world trade is set for continual growth into 2023.

Key points

- The Covid-19 pandemic has not been the major setback for global trade that many anticipated.

- Prospects for future trade growth remain surprisingly positive.

- E-commerce sales boomed during the pandemic and forecasts point to strong cross-border e-commerce growth continuing.

- New poles of trade growth are identified in Southeast and South Asia, and trade growth is expected to accelerate dramatically in Sub-Saharan Africa.

- Trade growth is spread across a wider variety of countries.

- Viet Nam, India, and the Philippines stand out on both speed and scale of projected trade growth through 2026.

- While emerging economies increased their shares of world trade from 24 to 40 percent between 2000 and 2012, with half of the increase driven by China alone, these shares have barely changed over the past decade.

- Emerging economies continue to race forward on measures of connectivity, innovation, and leading companies.

According to DHL, prospects for future trade growth are surprisingly positive. Trade growth forecasts have been downgraded due to the war in Ukraine, but recent forecasts still call for trade to grow slightly faster in 2022 and 2023 than it did over the preceding decade.

Forecasters expect trade growth to modestly outpace GDP growth, sustaining or even expanding the role of international trade in the world economy. Forecasts also call for strong cross-border e-commerce growth to continue, expanding access to international markets.

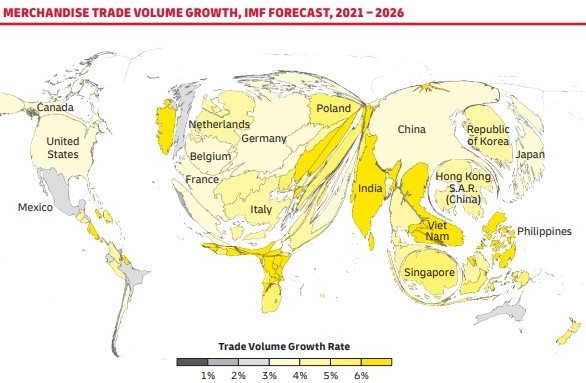

In addition, as trade continues to present large opportunities, the geography of trade growth is broadening. Between 2016 and 2021, China alone generated one-quarter of the world’s trade growth. While China is still expected to achieve the most trade growth of any individual country from 2021 to 2026, the latest International Monetary Fund (IMF) forecast implies that China’s share of global growth will fall by half over this same period (to 13%).

In fact, new poles of trade growth are emerging, most notably in Southeast and South Asia, and trade growth is forecast to accelerate significantly in Sub-Saharan Africa. Viet Nam, uniquely, is ranked among the top 10 countries over the past five years for both the speed (growth rate) and scale of its trade growth.

Another way to highlight the emergence of new poles of trade growth is to look at regional trade growth rankings. From 2016 – 2021, China beat every major world region on the growth rates of its exports and imports.6 But the latest IMF forecast implies that over the next five years, the Association of Southeast Asian Nations (ASEAN) region will achieve the fastest trade growth, followed by South & Central Asia, and Sub-Saharan Africa.

The forecast acceleration in Sub-Saharan Africa’s exports is especially striking, as this region ranked last in export growth over the previous five-year period. Five of the 10 countries with the fastest projected trade growth through 2026 are in Africa, and three are in the Caribbean region.

While trade growth continues to be fastest in emerging economies, IMF forecasts imply that the largest amount of trade growth over the next five years (55% of the world total) will take place in advanced economies, which still conduct the majority of global trade

said DHL.

From a regional perspective, Europe is forecast to generate almost as much total trade growth (35% of the world total) as East Asia & the Pacific (37%). “This means there are significant trade growth opportunities in both advanced and emerging economies, and in regions around the world,” the report notes

As for the emerging economies, their share of world trade soared from 24% in 2000 to 40% in 2012, and has since fluctuated around 40%. China drove about half of the overall increase, but its share did not grow between 2015 and 2019.7

In addition to accelerating growth, trade is a powerful lever for reducing inflation. As DHL notes, according to one recent analysis, selected reductions in U.S. trade barriers could cut the country’s inflation rate by 1.3 – 2%.

Even at the low end of this range, the average U.S. household would save $800 per year. And international trade is also a key ingredient for economic resilience, because it enables countries to diversify their sources of key inputs and the markets where they can sell their products