Materiality Matrix enables an organization to define which ESG (Environmental Social Governance) initiatives are worth to invest in.

The overall value ensued from an ESG initiative can be generally categorized into business and societal values. Business value refers to favorable stakeholder behaviors resulting from initiatives such as company products consumption, corporate investment, or, alternatively, corporate materialization objectives. Societal value results to the direct social benefits, such as healthier lifestyles, and/or environmental benefits, like increased recycling, deriving from the ESG initiative. Shipping companies acknowledging their multi-level impact, as far as stakeholders are concerned, constitute the initial phase of a productive dialogue commencement.

There are two important factors that must be determined during this process:

- Stakeholders: all stakeholders should be identified along with their interests and concerns. The list for the shipping industry may include (but not be limited to) the following: shareholders and investors, charterers, customers, employees, business partners, local communities, regulators, Flag Administrations, suppliers, Non- Government Organizations, media organizations, Ports and others. A further categorization may extend to incorporate key stakeholders (in accordance with the interest sector of the Company) and secondary ones.

- Materials: the Materials in the Matrix consist of the interests and concerns and have a major effect on an organization’s performance. They ought to be relevant, decisive, substantial and purposeful. In accordance with GRI G4, regarding the reporting principles, materials can refer to opportunities and risks which are most important to stakeholders, the economy, environment and society, or the reporting organization, and therefore merit particular focus on a sustainability report. The areas to be covered are: Management/Social aspects; Financial aspects; Human aspects and; Environmental aspects.

The assessment and analysis described enables the company to determine the substantively influential factors on the stakeholders’ assessments and decisions; recognize and act effectively in relation to sustainability and social opportunities and risks; and finally, determine how these aspects co-affect the company, the stakeholders, the society and the environment.

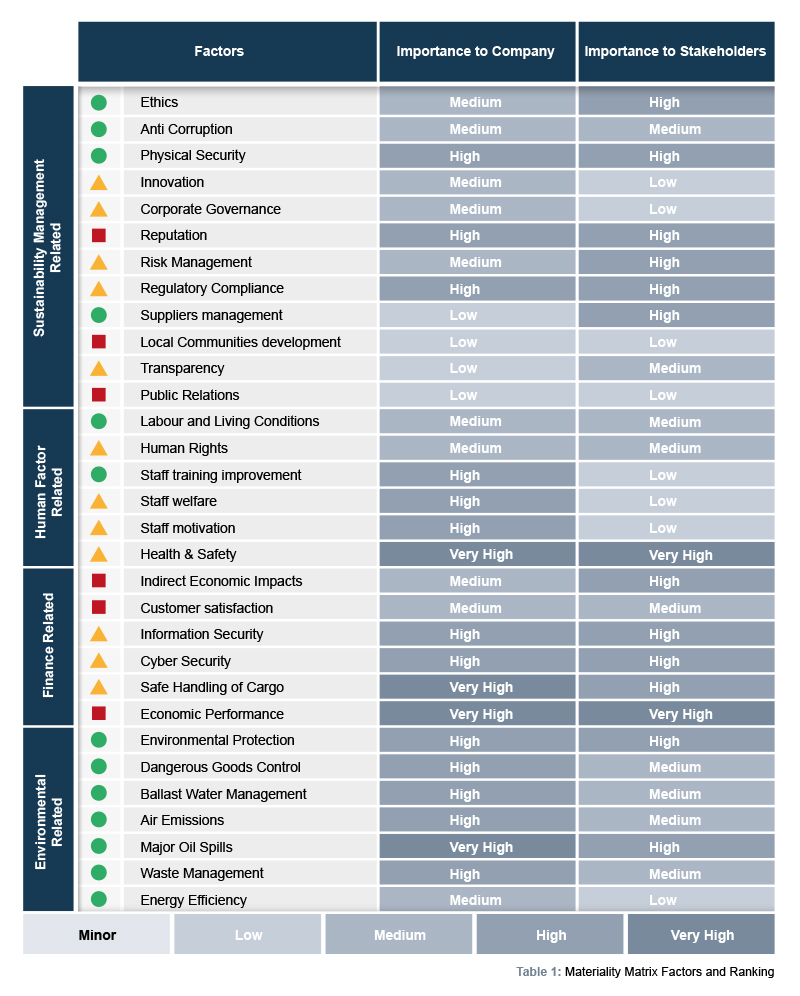

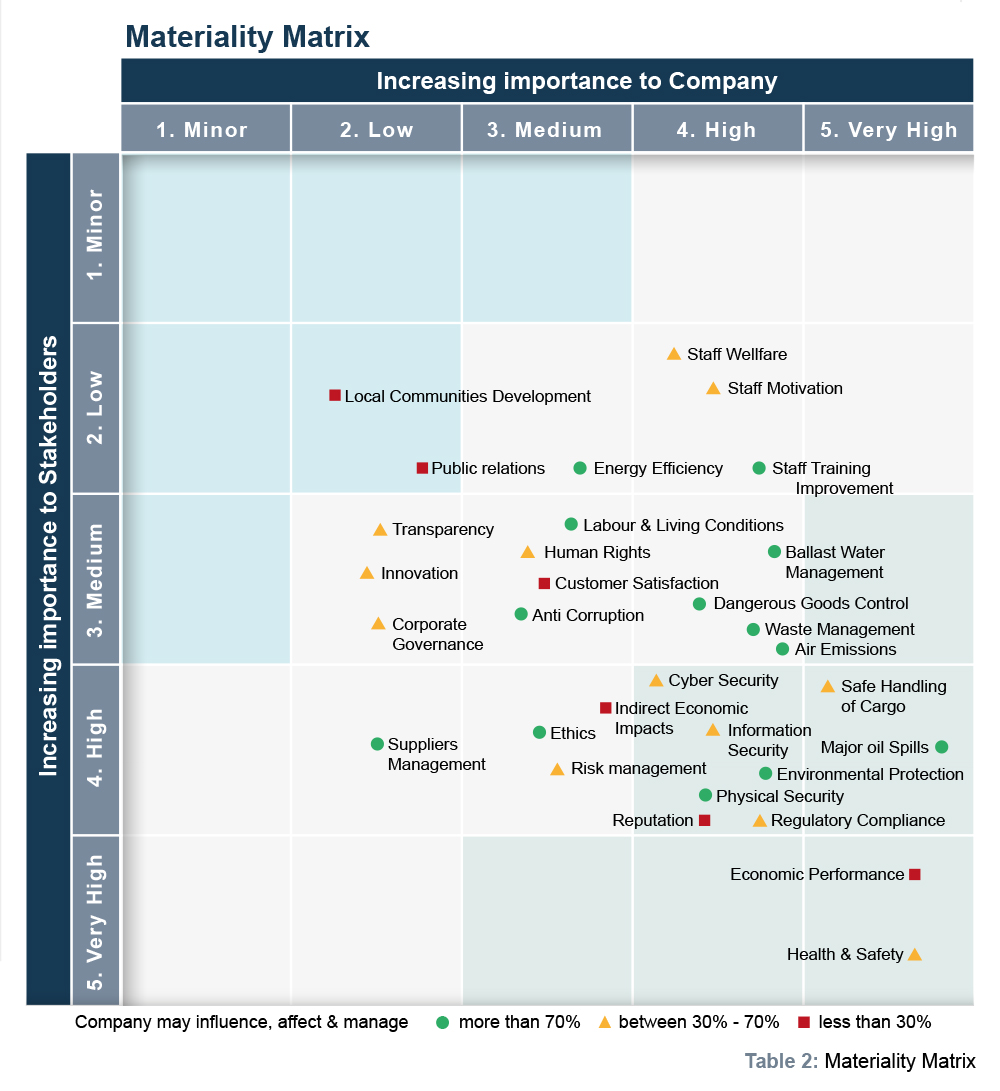

Mapping a shipping industry’s materiality matrix resides in the factors and focus areas that will be included ultimately in the matrix. For example, in Table 1, 31 factors are used for 4 main categories of the industry’s topics, and are listed and assessed according to their importance for the company and stakeholders.

Five Importance Levels

- Minor: Almost no importance for both the company and the stakeholders.

- Low: Factor has minimum importance and its impact on activities is low.

- Medium: Factor has medium importance and should be managed for the smooth operation of the company.

- High: Factor has high importance and if not managed appropriately it may impact/harm the company’s or the stakeholders’ activities.

- Very High: Factor has excessive importance and its impact on activities is increased. If not managed appropriately it may seriously impact/harm the company’s or the stakeholders’ activities.

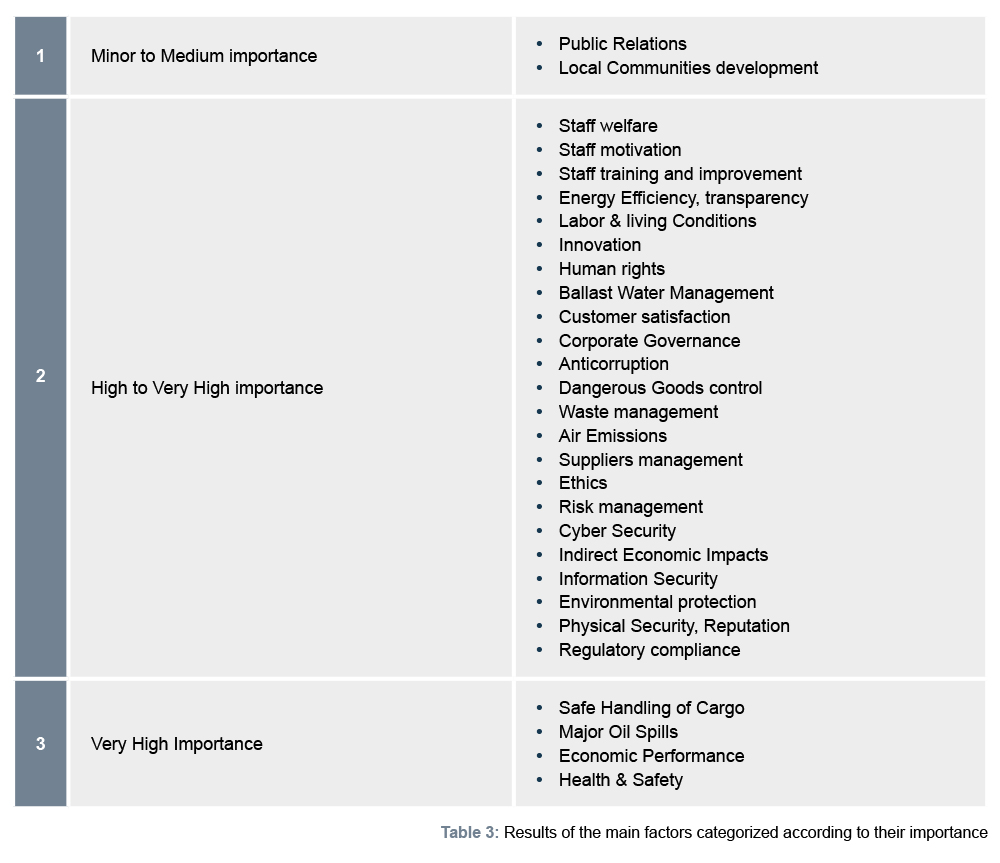

The matrix provides the company with the areas in which it should focus on, in order to achieve its goals. Analyzing the results, there are three categories dividing the factors (with variations to their importance). Table 3 highlights the priorities that should be set by a shipping company. As such:

- All shipping organizations should focus on three key elements; the human element, the environment and the economic performance.

- The human element is of high importance for all maritime stakeholders since all related factors have been highly rated in the materiality matrix.

- Shipping organizations should also focus on the environmental factor. Environmental issues are not only important for the ecosystem of our planet, but, also, put a lot of pressure to the maritime industry since both governments and the public opinion intensively criticize any ship related environmental incident.

- The maritime industry is a contributor to environmental problems, but it can also be part of the solution, through sustainable and resilient thinking following relevant guidelines. A major part of the industry’s reputation is based on its environmental behavior and all stakeholders share the responsibility.

- Economic performance plays a key role. The industry offers great opportunities and has an overall satisfactory economic performance; this the main reason for someone to invest in shipping. At the end of the day, finance is of outmost importance for all stakeholders. Money is what fuels the economy and enhances progress, but if the goal is only to gain income without better understanding the industry’s nature and the interaction between stakeholders and their concerns, there is a severe risk of failure.

Concluding, an efficient ESG approach can solve the afore mentioned concerns. PwC mentioned that ESG is one of the most important topics on the Board agenda. Key stakeholders, such as investors, banks and charterers, will soon expect that ESG reporting will be part of a shipping company’s ongoing reporting and will drive the basis of their relationship with the company.

Concluding, an efficient ESG approach can solve the afore mentioned concerns. PwC mentioned that ESG is one of the most important topics on the Board agenda. Key stakeholders, such as investors, banks and charterers, will soon expect that ESG reporting will be part of a shipping company’s ongoing reporting and will drive the basis of their relationship with the company.

The next crucial step is to build an ESG strategy, driven by key executives and the Board of Directors, that will provide for impactful ESG reporting and the best time to take this step is now. What is more, the complex and continuously changing maritime environmental regulations and the need to build resilience during a crisis period advocate for linking ESG factors to risk management and shipping finance.