During the 2024 GREEN4SEA Singapore Forum, Jack Spyros Pringle, Lead Consultant, Business Advisory, Lloyd’s Register, focused his presentation on the development of effective transition pathways for vessels to align with emissions reduction targets.

Let’s delve into the realm of green shipping, exploring best practices and the challenges therein, along with strategies for shipping companies to navigate these obstacles. To set the stage, let’s consider the driving forces behind this change. An intriguing aspect is the potential divergence of markets resulting from the implementation of various regulations worldwide.

What is driving this change? An interesting dynamic is the sort of potential teering of the markets that we will see across shipping based on the implementation of different regulations around the world.

What I mean by market teering is essentially shipping companies have a question to answer of which market would they like to play at the low level it is essentially complying with international regulations and simply having a kind of ticket to international trade but as you move up the tiers you can align with more stringent targets and regulations and access those markets.

Great example is in the EU with EU ETS and FuelEU where essentially those regulations will create a dynamic where the most efficient vessels and vessels with dual fuel capabilities will be required for EU trades so shipping companies need to take a sort of call on whether they want to position their fleets and assets to be able to access that market and this sort of brings the question of when shipping companies are looking at this challenge what’s the sort of balance between the sort of short term positioning and the long term positioning. So, what do you do with your existing assets to keep them attractive in the market, but then, long-term, select the right fuels and so on to make sure your fleet can sort of remain attractive to charters?

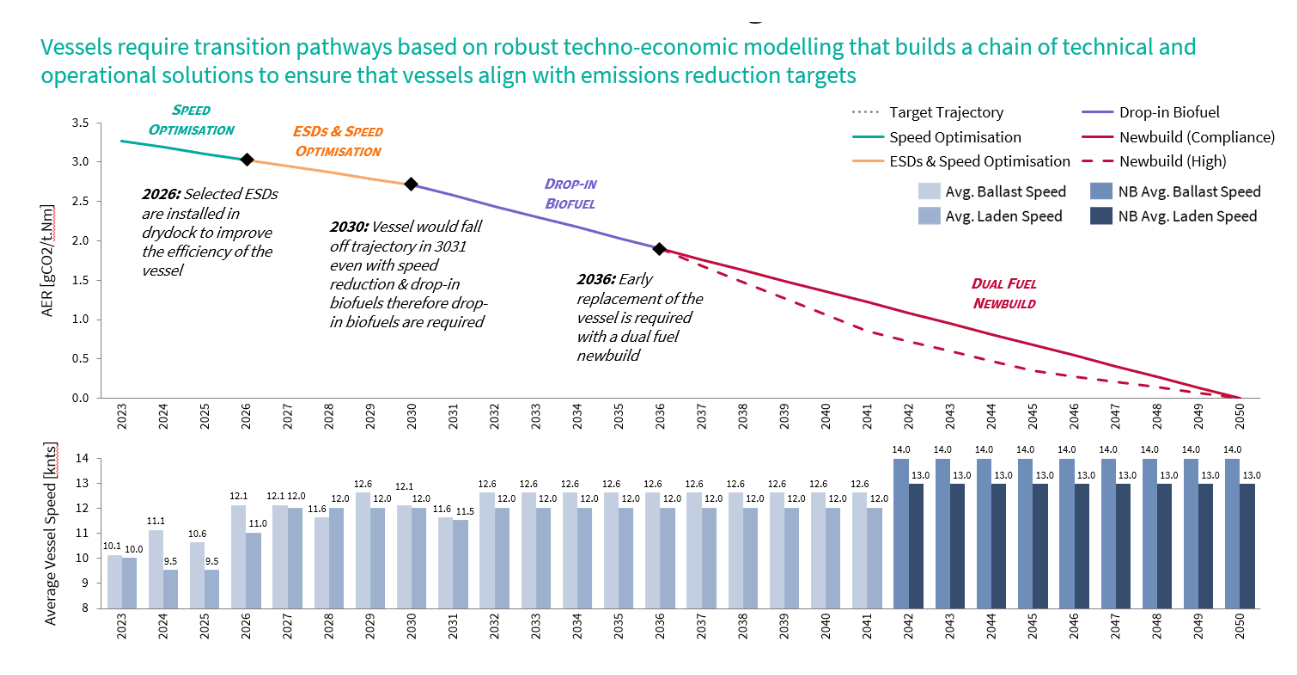

Within those challenges, we always talk about ship owners having a king of four levers available to them to reduce their emissions and help decarbonize. The first one is speed optimization, which means reducing the speed of vessels and reducing their consumption. The tradeoff here is that, of course, if you reduce the speed of the vessel, it may be less attractive to your charters, so you have to run it at a slower speed, which maybe doesn’t comply with market conditions, but of course it is a sort of slightly easier first port of call in terms of reducing emissions.

Then we have energy-saving devices. This is all about improving the standing efficiency of the vessel to improve its emissions intensity. Then we have got fuel transition, so that includes anything from drop-in biofuels to main engine retrofits to convert to burning alternative fuels. Of course, there are serious challenges around the investment case.

There are high-capex options. What is that going to do to the asset? Is it going to extend its life? What will that do to the residual value of that ship? And then, of course, new builds, so get replacement getting more efficient vessels in the water, of course the fuel question comes into it as well, but also thinking about fleet composition, do we need to move towards larger asset sizes, for example, to get to a more efficient form of transportation or even look at future energy markets to see what the future cargos will be for fleets of vessels?

How can we maximize the life of our existing assets?

The most responsible thing to do is not to simply replace every vessel and start building across and doing a widespread fleet replacement; it is actually to extract as much value and life from existing ships as possible and then replace them with the right technologies and fuels.

So, we see this as a short chain of solutions, sort of using those levers and looking at them in tandem with one another to find the most cost-effective way to comply with an emissions reduction target. So that could be a combination of speed optimization technology implementation, some drop in biofuels, and then ultimately fleet replacement. This is just an example of some of the work we have been doing for ship owners.

It is obviously a highly sort of fragmented market in that you have got a huge number of technologies available to be installed on ships but actually their effectiveness is relatively unknown or hard to quantify SO there is sort of two ways you can tackle that challenge you either do a bottom up approach where you assess individual technology and you assess their feasibility and then whether they are the right choice for a particular vessel or actually what we find is quite useful is to reverse engineer it we have been doing work to find a relationship between capital investment for technologies and fuel savings taking that relationship understanding how that drives emissions intensity reduction and payback periods.

So essentially, what that allows us to do is say if a particular vessel needs x% of carbon intensity reduction plus a payback period of 3 years, that will equate to a certain bucket of technologies, and we can take that bucket of technologies, look at what represents good value versus bad value, and then do the dedicated feasibility studies around that. So, it allows us to converge on a potential solution more rapidly and efficiently.

The other big challenge is around the assessment of fuels, both from the perspective of main engine retrofits and new builds. Obviously, when ship owners were evaluating new build projects in the past, it was a simple exercise to do that to understand the technology side of it, which was very well known, and then understand the revenue potential of that asset. We are now in a place where there are far more variables in that process around fuel regulation, and the market tiering dynamics are explained.

So the way we have been approaching this is actually using a sort of total cost of ownership model, so actually modeling an operational profile across a vessel applying different technologies and fuels and stacking them up against one another and then looking at the total costs over the life of the vessel, so fuel but also regulatory penalties and also technology costs, but also looking at the emissions profile across the life of the vessel and understanding what you need to do to keep that vessel in compliance. This essentially looks at these vessels from the perspective of both the owner and the charterer, so the owner and their customer are a very useful way to select the right fuel.

And finally, there is a single challenge that needs to be addressed. It is a multifaceted problem that needs to be solved, and we would always recommend this to our clients. This is sort of done through a sort of cohesive energy transition strategy where you do that sort of bottom-up vessel-level modeling to understand what we need to do across each individual vessel in the fleet to keep it in compliance, but also that sort of top-down strategic piece to select the right fuel.

Above article has been edited from Jack’s Spyros Pringle presentation during the 2024 GREEN4SEA Singapore Forum.

Explore more by watching his video presentation here below

The views presented are only those of the author and do not necessarily reflect those of SAFETY4SEA and are for information sharing and discussion purposes only.