During the 2024 GREEN4SEA Singapore Forum, Ansuman Ghosh, Director Risk Assessment, UK P&I Club, emphasized that declaring a clear winner in the fuel race is premature, as the transition towards fuel technology maturity will unfold gradually, shaped by safety considerations, fuel availability, and infrastructure expansion.

I will focus on the critical topic of emissions management in the maritime industry, particularly in light of new regulations. While alternative fuels are essential for the future, we must first address the immediate regulatory changes and their implications.

The International Maritime Organization (IMO) has provided guidelines and roadmaps for emissions management, transitioning from a tank-to-wake perspective to a lifecycle emissions approach. This shift offers a new viewpoint on managing emissions throughout a vessel’s operational life.

Industry Readiness and EU-ETS Implementation

The industry is abuzz with discussions about the European Union Emissions Trading System (EU-ETS). Key elements include mandates, accounts, contracts, and Monitoring, Reporting, and Verification (MRV) reporting.

- Mandates:

- Shipowners are ultimately responsible for emissions management. However, they can delegate this task to technical managers through formal agreements. Even in cases involving bareboat charter parties, clear mandates must be established.

- Marine Operator Holding Accounts (MOHA):

- Companies are setting up MOHAs at designated registries. These online accounts function like online banking systems, submit EU-ETS data, and manage allowances. Managers can also be granted access to these accounts.

- Contracts:

- Contracts are crucial for defining responsibilities and ensuring proper transfer of emissions allowances or equivalent costs between owners, charterers, and managers. Clear contracts help prevent disputes and delineate duties, especially when multiple parties are involved.

- MRV Reporting:

- While MRV reporting has been in place for some time, there are updates due to the EU-ETS and upcoming FuelEU Maritime regulations starting in 2025. Accurate and transparent data sharing between owners, charterers, and managers is vital to avoid disputes.

Approaches to Emissions Management

The industry is focusing on three main approaches to emissions management:

- Owner-Managed Emissions:

- Larger companies, with interests in carbon trading, often manage emissions directly, integrating it into their business models.

- Manager-Managed Emissions:

- Owners may delegate emissions management to technical managers. However, this approach carries risks for managers, such as credit risks if owners default on payments. Managers typically require financial assurances before accepting this responsibility.

- Shared Responsibility:

- In this model, the manager handles specific tasks while the owner retains overall responsibility. Properly worded mandates are essential to ensure clear division of responsibilities.

BIMCO ETSA Clause (for TCP) 2022

The BIMCO ETSA Clause outlines the cost transfer process from charterers to owners. It includes provisions for placing necessary allowances in designated accounts and allows owners to suspend charter party performance if emissions credits are not provided. Standard clauses should be used without significant amendments to avoid altering their meanings.

FuelEU Maritime is a new regulation focused on reducing the greenhouse gas (GHG) intensity of maritime fuels. Here’s a breakdown for those unfamiliar with the details:

FuelEU Maritime is a new regulation focused on reducing the greenhouse gas (GHG) intensity of maritime fuels. Here’s a breakdown for those unfamiliar with the details:

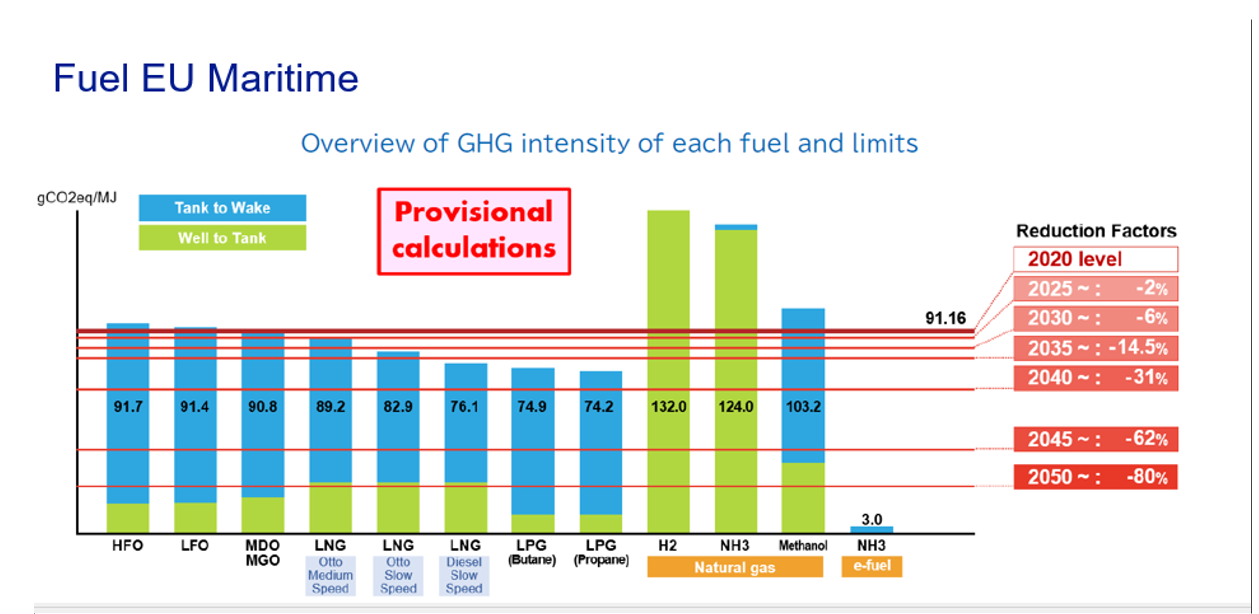

Starting in 2025, the GHG intensity of maritime fuels must be reduced from the 2020 baseline of 91.16 gCO2e/MJ. This reduction will progress incrementally:

- 2% reduction by 2025

- 6% reduction by 2030

- 14.5% reduction by 2035

For instance, Heavy Fuel Oil (HFO), which has a GHG intensity of 91.7 gCO2e/MJ, and other fuels like Low Sulfur Fuel Oil (LFO) and Marine Diesel Oil (MDO) are already above the baseline. Operators using these fuels will need to reduce their GHG intensity by 2% by 2025. They can achieve this through measures such as incorporating biofuels.

There are also provisions for pooling, banking, and borrowing GHG intensity credits. This means:

- Pooling: Operators can combine the GHG intensities of multiple vessels.

- Banking: If a vessel exceeds its reduction target, the surplus can be saved for future use.

- Borrowing: If a vessel fails to meet its target, it can borrow credits from future compliance periods.

The type of engine and combustion cycle also impacts compliance as the amount of methane slip changes. For example, LNG dual fuel engines have different compliance levels based on their speed, combustioncycle and load. Two stroke, diesel cycle, LNG engines perform better , while four stroke engines have larger methane slip. The methane slip is even larger in low load operations.

Looking at the figure above, for a long-term solution, using green NH3 (ammonia) as an e-fuel is promising, as its GHG intensity is significantly lower at just around 3 gCO2e/MJ. But, do we have enough supply? Or what is the cost of green ammonia? The answer is we don’t have enough supply and the current costs are much higher than the conventional fuels. Plus, there is a new technology maturity phase to be considered.

As per FuelEU Maritime, starting in 2030, shore power will be mandatory for container and passenger vessels. Non-compliance will result in penalties and potential blacklisting of companies.

Wind energy offers a dual benefit:

- Reduced fuel costs in turn reduces EU ETS costs due to decreased propulsion power needs.

- Benifits on FuelEU Maritime compliance if wind energy assists in propulsion.

By understanding and leveraging these provisions, operators can strategically plan to meet the upcoming FuelEU Maritime regulations.

Above article has been edited from Ansuman’s Ghosh presentation during the 2024 GREEN4SEA Singapore Forum.

Explore more by watching his video presentation here below

The views presented are only those of the author and do not necessarily reflect those of SAFETY4SEA and are for information sharing and discussion purposes only.