The Q3 2023 Shipping Market Overview & Outlook from BIMCO has been released which features an analysis of the tanker shipping market regarding supply and demand.

BIMCO’s chief shipping analyst, Niels Rasmussen finds in his report that record oil demand amplifies market strength.

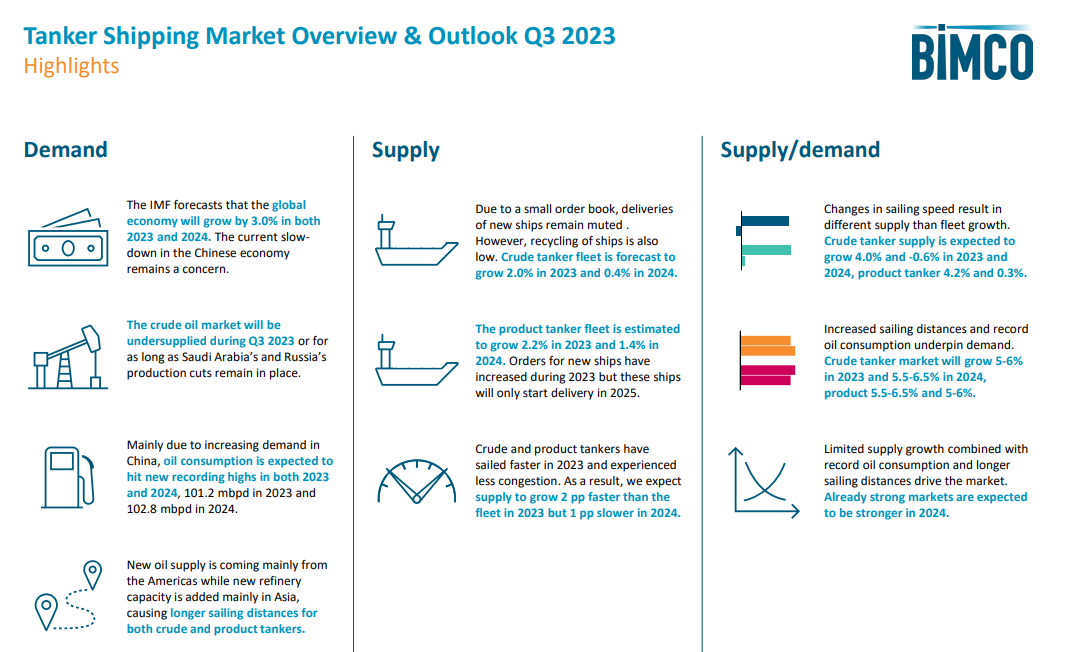

Demand

We forecast that the crude tanker market will see cargo volume growth of between 2.0% and 3.0% in 2023 and between 3.5% and 4.5% in 2024. As average sailing distances are increasing, we estimate tonne miles growth of between 5.0% and 6.0% in 2023, and between 5.5% and 6.5% in 2024.

… stated Niels Rasmussen, chief analyst at BIMCO

Despite some recent signs of slowing economic activity, China has, as expected, still been the driver of increasing global oil demand. This is due not least to an increase in travel and thus demand for jet fuel. The US Energy Information Administration (EIA) expects that China will account for more than half of the 3.4 million barrels per day (mbpd) increase in global consumption between 2024 and 2022. Global consumption is forecast to hit new record highs of 101.2 mbpd and 102.8 mbpd in 2023 and 2024 respectively.

Along with the higher prices, this imbalance is expected to lead to further draws on inventories which in turn will cause a reduction in crude oil shipments. The imbalance could also create a need to rebuild inventories once the market is again in balance, thus generating increased shipping demand.

Supply

The crude tanker fleet is expected to grow by 2.0% and 0.4% in 2023 and 2024 respectively. Contracting of crude tankers has remained subdued and the order book remains low at only 3.7% of the size of the trading fleet. New ship deliveries will therefore remain low for the coming period. However, no crude tankers

have yet been recycled in 2023 and BIMCO expect recycling to remain low for the rest of the year as well as during 2024.

We now forecast the product tanker fleet to grow by 2.2% in 2023 and 1.3% in 2024, an increase over our previous forecast.

..stated Niels Rasmussen.

Supply/demand balance

The Baltic Clean Tanker Index (BCTI) has year to ate 2023 fallen 28% compared to the same period last year whereas the Baltic Dirty Tanker Index is down 9%. However, both indices remain higher than the ten year average.

Time charter rates have fallen from the highs achieved in late 2022. Yet they remain significantly ahead of what was achieved during the first seven months of 2022. Despite this, second hand ship prices have continued to increase, confirming both the strength of the market and expectations of future strength.

Supply growth is expected to be limited in 2024, while cargo volumes and tonne miles are forecast to continue to grow.

We therefore continue to believe that market conditions will improve although production cuts may limit recovery during the rest of 2023. Risks to our forecast naturally remain and in particular, the strength of Chinese demand is key.

..said.