ABS has published its Outlook for 2024 which explores the carbon-neutral fuel pathways and the transformational technologies that will support the maritime industry’s challenging journey to 2050.

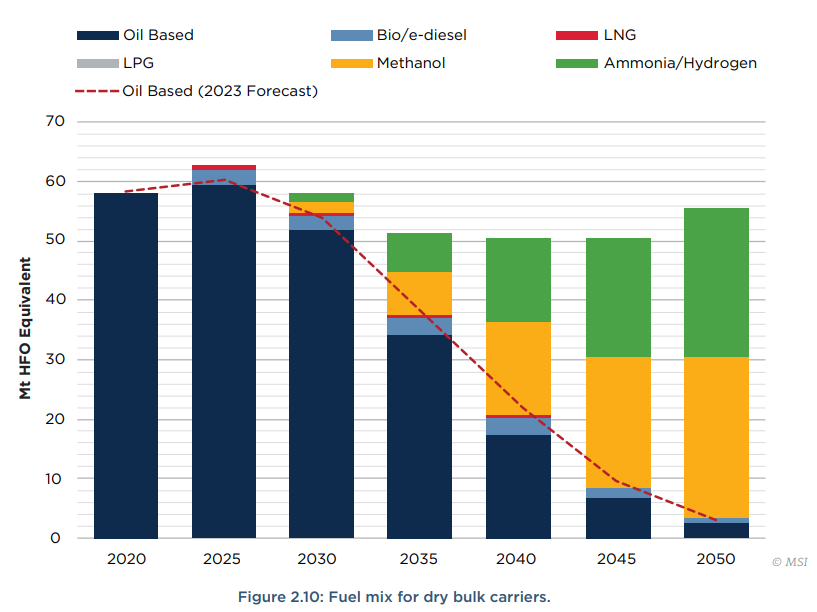

Transition to alternative fuels in bulk carriers

According to the report, for bulk carriers, there is an increasing interest in alternative propulsion options, with a significant projected transition to methanol and ammonia/hydrogen-based fuels post-2030. Seaborne crude oil and chemical products trade is projected to increase moderately. The peak in oil product trade will follow the peak in crude oil trade, with shifts in refinery locations affecting global trade flows. Chemical trade forecasts have been revised downward due to less optimistic assumptions made for economic growth.

Growth of alternative fuels in maritime shipping

Adoption of alternative fuels, such as liquefied natural gas (LNG), methanol, and ammonia, is increasing, especially in the very large crude carrier (VLCC) segment. Container trade has settled into a slower rhythm with modest downgrades in global trade volume forecasts. Shifts toward shorter-haul intra-regional trades and robust port handling growth in East Asia are noteworthy. There is a notable shift toward methanol dual-fuel propulsion among major liner operators, reflecting broader industry trends toward sustainable shipping practices.

Future prospects for LNG and LPG Carriers

For the LNG and liquefied petroleum gas (LPG) carriers, e-methane, biomethane, e-ammonia, and e-hydrogen are anticipated to gain traction as fuel sources after 2030, despite a conservative start in their adoption. The revised fuel mix projection maintains the trajectory set in last year’s Outlook publication, though recent geopolitical events have caused some recalibration of the forecasting model. These events have disrupted supply chains and increased short-term fuel consumption due to the rerouting of vessels away from the Suez Canal and Red Sea area.

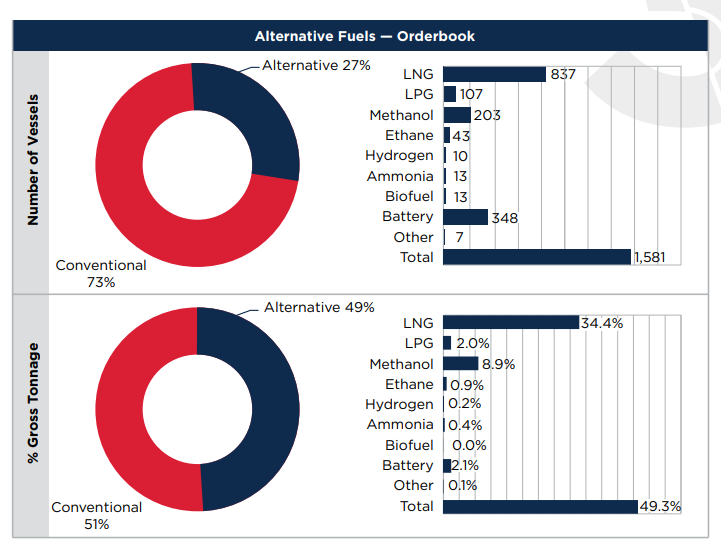

In 2023, investments in alternatively fueled vessels continued strongly, with dual-fuel engines being featured in 27 percent of new vessel orders by number of vessels and 49 percent by gross tonnage (gt). The market has seen a dominance of containerships and pure car, truck carrier (PCTC) in these investments, which is gradually shifting to bulk carriers and tankers. The forecasted deliveries up to 2030 and the evolving alternative fuel type usage denote an active shift toward a more sustainable fleet composition.

This year’s projected fuel mix yields several key takeaways. The primary takeaway is a significant and ongoing shift toward cleaner, alternative fuels in the maritime industry, from 2023 to 2050.

-

Decline of oil-based fuel use

Oil-based fuels dominated the fleet’s energy mix in 2023, accounting for 90 percent of the fuel used. However, there’s a steady decline projected over the next few decades, reaching down to 15 percent by 2050. This indicates that fossil fuels, even at that low percentage, are projected to still be around. This decline is indicative of the maritime industry’s efforts to move away from conventional fossil fuels in response to increasing environmental regulations and pressure to reduce carbon emissions. -

Gradual increase in LNG use

LNG use is relatively stable, starting at nine percent in 2023 and experiencing an increase to 14 percent by 2028 before stabilizing around 13 percent by 2040. LNG is not entirely carbon-free, but certain LNG pathways (biomethane, e-methane) have the potential to significantly reduce emissions compared to conventional fuels, making it a practical choice for compliance and environmental performance improvements in both the short and long term. -

Emergence and growth of methanol and ammonia

The most significant growth in alternative fuels, methanol, starts at practically zero percent in 2023, but increases steadily to 42 percent by 2050. Ammonia, similarly, starts from zero percent and grows to 33 percent by 2050. These fuels are likely favored in later years due to their potential to reduce Well-to-Wake (WtW) greenhouse gas (GHG) emissions when produced from renewable sources. The growth in these fuels is particularly notable from 2030 onward, where methanol jumps from seven percent to 42 percent and ammonia from two percent to 33 percent by 2050, highlighting a strong industry shift toward these more sustainable options. -

Stable but minor role for LPG

LPG has a relatively stable but minor role throughout the forecast period. LPG hovers around one percent throughout, indicating it is not a major player in the fuel transition strategy.

ABS’s two main net-zero scenarios:

The first scenario assumes a global reduction in emissions through enhanced energy efficiency technologies (EETs), achieving only a 15 percent reduction by 2040. The second, more ambitious scenario, hinges on widespread retrofitting and adoption of zero-carbon fuels, such as e-ammonia and e-methanol, aiming to meet the 70 percent reduction target by 2040 through substantial fleet renewal and retrofits.

The availability and infrastructure for alternative fuels such as LNG, methanol, ammonia, and biofuels are developing at different paces.

-

LNG is currently the most developed alternative fuel in terms of bunkering infrastructure. Major ports worldwide have established LNG bunkering facilities, and new projects continue to expand this network. LNG remains a cost-effective option due to its relatively lower price compared to other low-carbon fuels.

-

Methanol is gaining traction due to its compatibility with existing engine technologies and ease of storage. Several ports have established methanol bunkering facilities, with ongoing projects to develop infrastructure further. Conventional methanol, primarily produced from natural gas, is generally cost-competitive when compared to diesel bunker fuels. The projected cost of methanol can vary but is expected to decrease over time.

-

Ammonia is considered a future zero-carbon fuel, with significant projects underway to develop its infrastructure. However, ammonia’s bunkering network is still in its nascent stages. The toxicity and handling requirements pose challenges that need to be addressed before widespread adoption can occur.

-

Biofuels are also being explored as a viable alternative. Ports are beginning to integrate biofuels into their bunkering options. Biofuels can be used in existing engines with minimal modifications, but their high cost and limited availability of feedstocks remain significant barriers.

The transition to alternative marine fuels is heavily influenced by the production and availability of renewable electricity, essential for producing green hydrogen, ammonia, and methanol. The global capacity for renewable energy is expanding, but the pace and scale of this expansion are crucial for making alternative fuels economically viable and widely available.

Nuclear propulsion in the maritime industry

Nuclear power is highlighted as a significant enabler for decarbonization, providing a high-density, long-term power supply. It supports the creation of carbon-free fuels and can be integrated into ships for propulsion or installed on floating offshore platforms, contributing to the global push for zero emissions.

- Advanced nuclear reactors have many possible implementations within the maritime value chain due to their potential flexibility, offering various arrangements of size and power output, long fueling cycles, the possibility of factory fabrication and small carbon footprints.

- The main barriers limiting nuclear adoption are the regulatory gaps regarding mobile and nontraditional reactors, as most regulatory bodies address only traditional reactors.

- Port electrification through clean nuclear energy would assist in the push toward decarbonization, as it would facilitate the electrification of port equipment as well as provide an onshore power supply to visiting vessels.

- Ammonia and hydrogen from nuclear reactors can be used as carbon-free pink fuels for vessels.

Finally, the role of digitalization is enhancing operational efficiency and supporting decarbonization efforts. Technologies, such as artificial intelligence (AI) and digital twins, optimize ship operations, reduce emissions and improve safety.

To remind, Christopher Wiernicki recently stated that decarbonization is more than just a story of CO2 emissions per ton mile, but a once-in-a-generation opportunity to reset and revitalize national maritime strategies, rebuild port infrastructure, reinvigorate shipbuilding, and create jobs.

We need to consider safety protocols training programs and a collaborative framework in order to have a smooth transition to these alternative fuels and technologies.

… Maria Kyratsoudi, Manager Business Development, ABS, had said to SAFETY4SEA during the Posidonia exhibition, highlighting the importance of collaboration on the path to decarbonization.