“Getting to Zero Coalition” in its insight briefing series published a paper giving an overview and examining the potential challenges and opportunities of the hydrogen in the shipping industry.

On May 4th 2021, a webinar entitled “Hydrogen as a Cargo” was held among industry experts in order to explore the potential for shipping’s early adoption of green fuels to arise off the back of new global hydrogen supply chains, the advantages of using cargo as a fuel, and the infrastructure that would need to be in place for this to scale.

Key points:

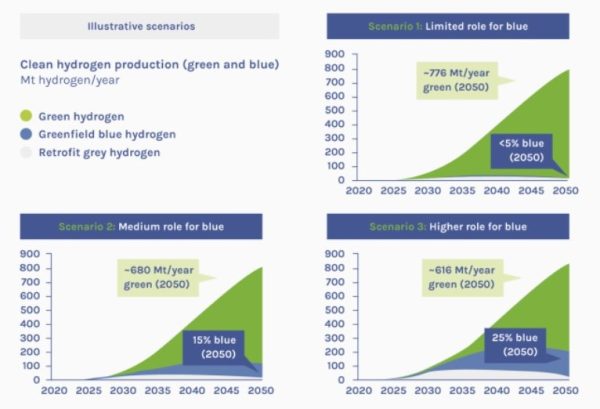

- Globally, by mid-century around 500-800 million tons of zero-emission hydrogen is needed for a decarbonized global economy (covering all end-uses)

- Hydrogen can be part of a flexible pathway to fully decarbonize the maritime industry as it is a feedstock for zero-emission ammonia and methanol, potential candidates to enable the transition to zero by mid-century.

- Exactly how hydrogen will move around the world is uncertain. Supply chain costs will vary depending on the form in which hydrogen will be transported and the mode e.g. by pipeline, truck or ship

- The timeline for deployment of hydrogen as a cargo will be highly influenced by early learning from pilots and demonstrations.

The Getting to Zero Coalition is an industry-led platform for collaboration that brings together leading stakeholders from across the maritime and fuels value chains with the financial sector and other stakeholders committed to making commercially viable zero-emission vessels a scalable reality by 2030.

The use of zero emission fuels in shipping will be built, in part, on the back of new global hydrogen supply chains. While some hydrogen will be locally used or transferred in pipelines, global trade in hydrogen by ship is expected to grow. Hydrogen will be shipped in the form of compressed or liquid hydrogen, and more likely ammonia or maybe methanol which have much higher energy densities.

As described, all three options present opportunities for this cargo to be used as a shipping fuel. For this to happen, the right infrastructure would need to be in place. In both heavy industry and mobility, the technologies needed to achieve net-zero emissions exist and are either already commercially available today or nearing technological maturity.

What is hydrogen?

According to the Hydrogen Council, there are three different types of hydrogen depending on the production process. Each types depend on the feedstock and therefore the amount of CO2 released during the production process:

- “Green” hydrogen is produced from renewable electricity and water through electrolysis

- “Blue” hydrogen is produced from natural gas using steam methane reformation (SMR) combined with carbon capture and storage (CSS)

- “Grey” and “black” hydrogen are produced from fossil fuels through the process of gasification or steam methane reformation (SMR).

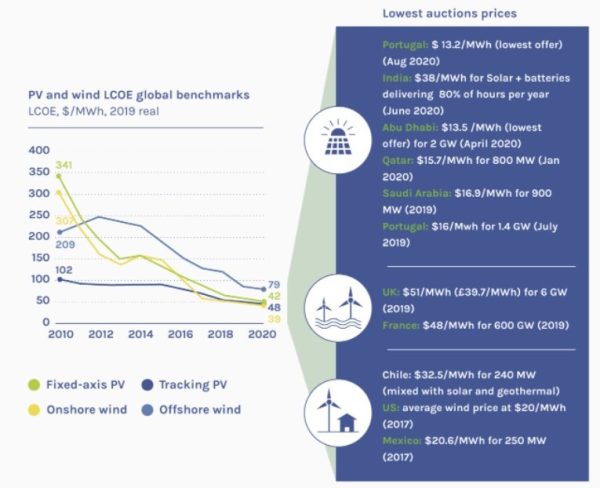

95% of the world’s hydrogen currently comes from fossil fuels, while in the near to medium-term, the cheapest zero emission hydrogen comes from electrolysis of water using renewable electricity (wind and solar power).

#1 Opportunities:

- Flexible: Hydrogen can be blended into the natural gas and ammonia grid at many locations, allowing production to be sited alongside other hydrogen off-takers. Off-take can be varied, with no requirement for steady-supply.

- Scalable: there is a need to drive down the cost of renewable electricity that can enable the energy transition, which will among other things, drive down the cost of green hydrogen. In the case of green hydrogen there is no limitation in feedstock availability.

#2 Challenges:

- Complex overall pricing method can have a high variation due to production cost, port system location and form of transportation

- Level of cooperation: the deployment of green hydrogen will depend on the capacity to develop training and standards to address safety issues

The hydrogen economy

According to a recent report by the Energy Transitions Commission, in the fundamental transition of the energy system, total global need for zero-emission hydrogen for mid-century is around 500 to 800 million tons per annum, a five to seven-fold increase from today’s outputs. As a matter of fact, zero-emission hydrogen and ammonia will represent 15%-20% of the final energy demand in a net zero economy in 2050.

As the demand for hydrogen grows across all industries, transport will play a major role in connecting production, storage, and end use. Hydrogen can be transported in the form of a gas, liquid or a more energy-dense carrier such as ammonia or methanol. It can be carried by trucks in small volumes, via pipelines, or on vessels over long distances.

The cost of hydrogen and the regional incidence

There are different costs of hydrogen: operational cost and lifecycle cost. The most commonly quoted figure for fossil hydrogen pricing is derived from steam methane reforming (SMR) technologies, which can produce hydrogen from natural gas at around USD 1-1.50/kg of hydrogen. This is widely seen as the target for renewable hydrogen to be competitive. By 2030, assuming scaled production and adequately developed transportation infrastructure, hydrogen could be shipped from locations such as Australia, Chile or the Middle East to projected demand centers at costs of USD 2-3/kg of hydrogen, with lower costs at point of production.

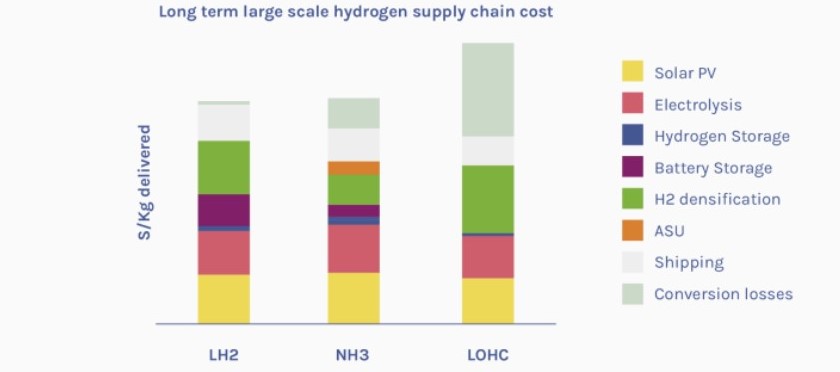

The cost of production is driven by the cost of feedstock and therefore, the cost of renewable energy. The cost of transport will depend on the transport itself whether by truck, pipeline, or ship. Shipping is cost-competitive only for long distances and requires conversion of hydrogen, into liquid hydrogen, ammonia, or possibly methanol. If there is a need for reconversion back into hydrogen, for example for use in steel smelting, the total hydrogen cost depends on the reconversion, which will have a strong impact on the final cost. Each conversion and reconversion incurs efficiency losses and adds to the final cost of the hydrogen.

The geography will play a major role in the final cost depending on the scalability of renewable electricity technologies. Early and cost-effective development of the hydrogen economy may best occur within clusters which de-risk investment and support the simultaneous and mutually-reinforcing development of hydrogen production and end use.

Scaling hydrogen as a cargo

#1 Demonstration and pilots projects

During the webinar, Southern Green Gas and Shell presented demonstration projects for hydrogen as a cargo.

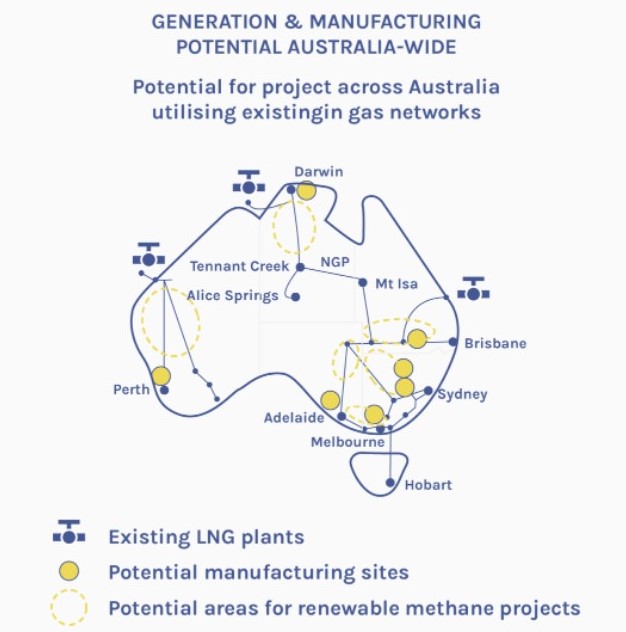

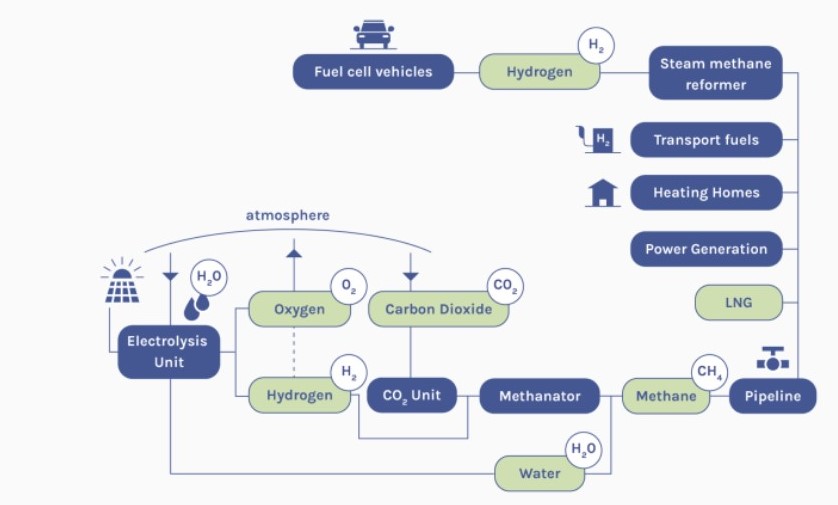

Brett Cooper, Chairman, Renewable Hydrogen Pty Ltd, presented an Australian case study in which Southern Green Gas uses solar resources to produce green methane, which is sent into existing pipelines to be delivered to LNG facilities on the coasts, as per shown on the network of methane transmission pipelines in Australia. In this case, the use of methane in the pipeline rather than hydrogen is due to the age and quality of the pipeline which would not be suitable for pure hydrogen.

Electricity is produced by modular solar panels in the non-arable land close to methane and natural gas pipelines. The key of this technology is the direct air capture (DAC) units powered by solar energy to synthesise e-methane from CO2 and green hydrogen from electrolysis. This same methane then flows into the network of transmission pipelines which gives the opportunity for new plant production to expand around.

The second example was presented by Nikunj Gupta, General Manager Hydrogen Import Export at Shell. Gupta described an unbalanced global energy production and highlighted the need to transport energy from renewable country producers to other countries that might face energy shortage and want to meet their carbon commitments. Taking into account the whole supply chain, for Shell, liquid hydrogen along with ammonia, is one of the most competitive energy to move at scale.

#2 Standards and training

In order to scale the use of hydrogen, according to Kettleborough, standards and traceability mechanisms are needed to label and certify the production of zero-emission hydrogen and transport. It will be necessary to track the carbon intensity of electricity during the hydrogen generation, which will depend on the proportion of renewable electricity used for green hydrogen, or the carbon capture rates and methane leakage through the supply chain for blue hydrogen.

#3 A role for Getting to Zero Coalition to support the industry for scale

According to the panellists, there is a need to develop networks between stakeholders and to bring organisations and states together to move forward. In addition, the highlight of pilot projects and creation of match making opportunities between off-takers could support the scale of hydrogen.