Daniel A. Tadros, Chief Operating Officer and Chief Legal and Compliance Officer, Shipowners Claims Bureau, Inc., Managers of the American P&I Club, outlines the importance of the shipping industry better understanding the underlying causes of a phenomenon that cannot be measured or quantified.

Social inflation has become a trendy term in the insurance industry used to explain the rising cost of insurance claims, particularly personal injury claims. The term “social inflation” broadly “refer[s] to all ways in which insurers’ claims costs rise over and above general economic inflation.” Studies have suggested that “social inflation refers to legislative and litigation developments which impact insurers’ legal liabilities and claims costs.” The term is a catch all phrase that includes everything from the impact of social media, societal shifts like politics, interpretation of law, legal precedent, public sentiment, and victimization to science and technology breakthroughs as they apply to medical treatment.

Numerous conferences, panel discussions and publications highlight the rising cost and discuss potential causes. The once rare settlement or jury award exceeding $1m has become ubiquitous. The more insurers fear large uncertain jury awards and increased litigation expenses the more likely they are to consider larger settlement amounts resulting in increased settlement floors. The more these cases settle for inflated values, the more plaintiffs’ counsel will push the envelope, continuing to raise the settlement floor.

In the UK and EU, the growing influence of litigation funders and evolving threat of class actions show that social inflation is to be taken seriously.

The Statistics

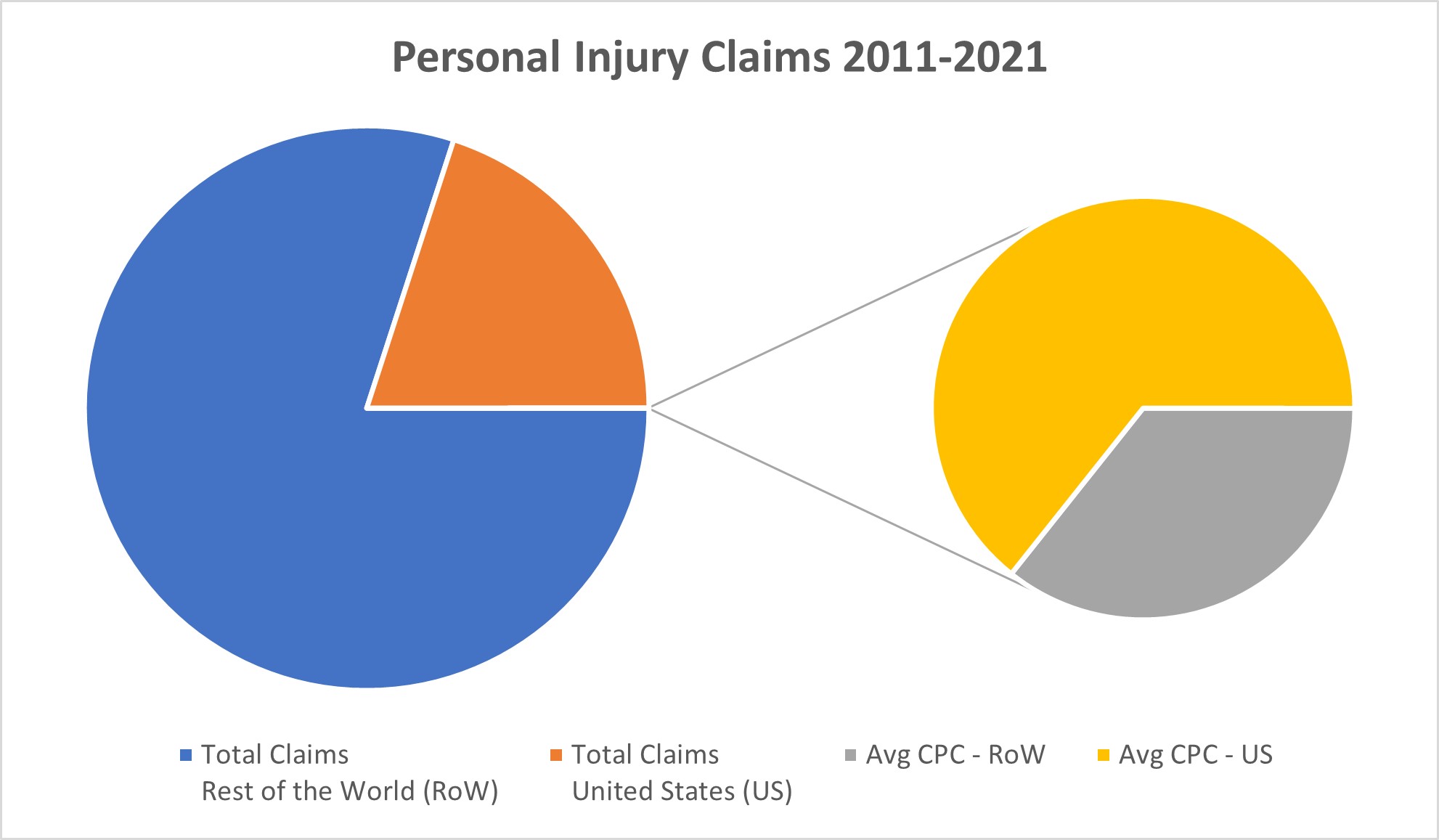

While the American Club is smaller in tonnage than most of the other International Group P&I Clubs, its presence in the US market provides a representative sample that in scale will likely mirror other Clubs’ and marine insurers’ experience. A review of the available data of the American Club for the ten-year period, 2011-2021, revealed that the American Club reported 5,069 global personal injury (including the US) files with an average per incident cost of $40,494.30. For the same period and within the global total, US claims represent approximately 20% of the total number of claims. The average cost per claim (CPC) of the US claim over this 10-year period is $72,970.05; approximately 80% more than the global average cost per claim.

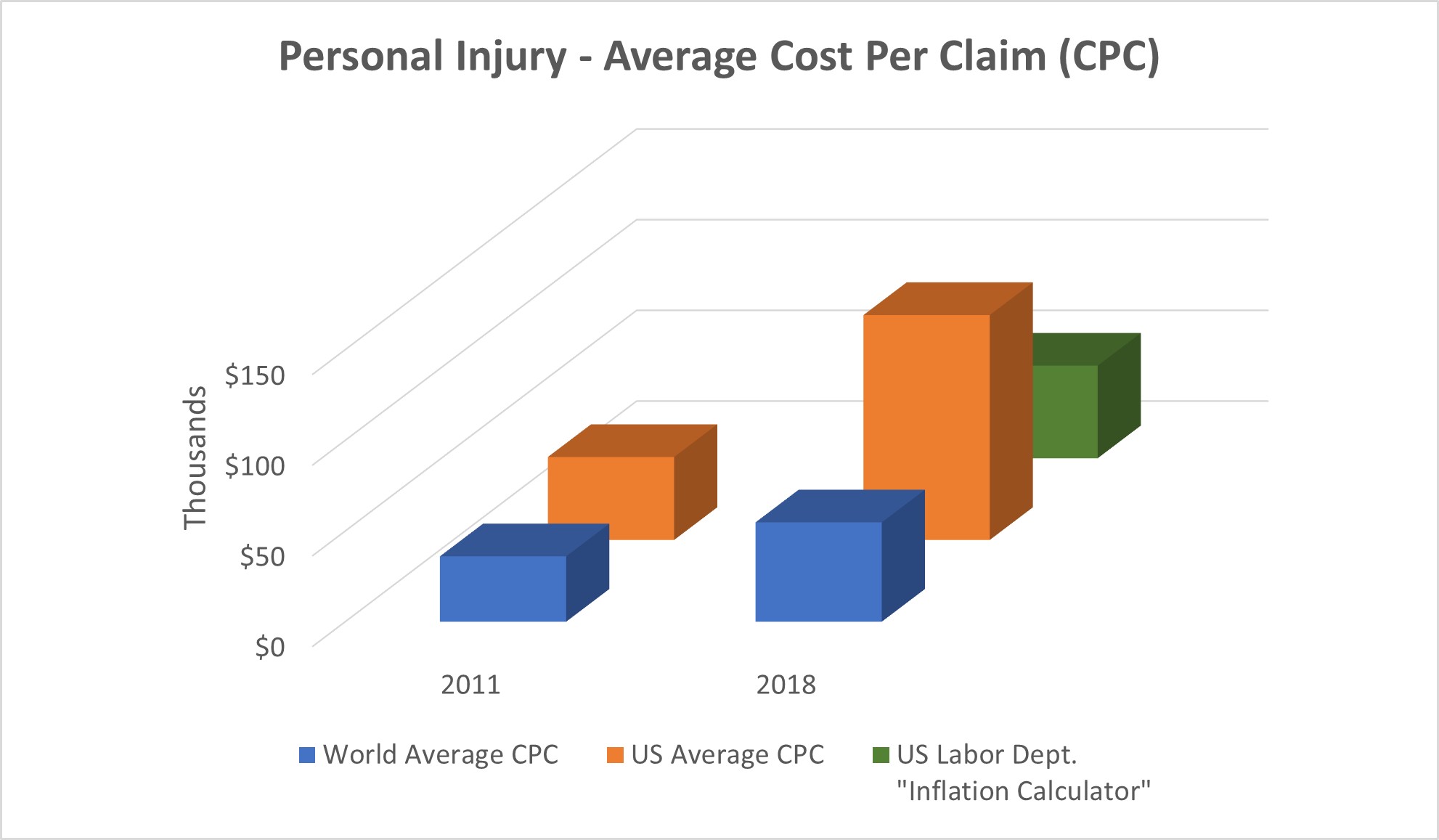

In 2011, the US average CPC was $45,757.57, whereas the world average cost per claim was $36,047.38 (a 26.85% difference). By 2018, the US average CPC rose to $124,025.18, whereas the average CPC for the world rose to $54,779.10 (a difference of 126.41%). The cumulative rate of inflation as published by the US Labor Department from 2011 through 2018 is 11.6%. Using the Labor Department “Inflation Calculator,” the average US CPC of $45,757.57 would be worth $51,080.72 in 2018. The actual CPC in 2018 for US claims is $124,025.18, an 143% increase above the cumulative rate of inflation for the same period. How does the 143% CPC increase compare to personal injury claims in the rest of the world? In 2011, the average CPC of $36,047.38 would be worth $40,240.91 in 2018 using the same cumulative inflation rate of 11.6%. The actual CPC for the world claims is $54,779.10. This is a 51% increase above the cumulative rate of inflation.

In 2011, the US average CPC was $45,757.57, whereas the world average cost per claim was $36,047.38 (a 26.85% difference). By 2018, the US average CPC rose to $124,025.18, whereas the average CPC for the world rose to $54,779.10 (a difference of 126.41%). The cumulative rate of inflation as published by the US Labor Department from 2011 through 2018 is 11.6%. Using the Labor Department “Inflation Calculator,” the average US CPC of $45,757.57 would be worth $51,080.72 in 2018. The actual CPC in 2018 for US claims is $124,025.18, an 143% increase above the cumulative rate of inflation for the same period. How does the 143% CPC increase compare to personal injury claims in the rest of the world? In 2011, the average CPC of $36,047.38 would be worth $40,240.91 in 2018 using the same cumulative inflation rate of 11.6%. The actual CPC for the world claims is $54,779.10. This is a 51% increase above the cumulative rate of inflation.

The Beginnings

The Beginnings

The data supports the proposition that inflation is not the primary reason for escalating values in personal injury claims. What factors are driving the increase? Most, if not all, personal injury claims in the United States are ordered to mediation or are required to hold a settlement conference before trial. Unfortunately, in many instances, Owners feel bullied into settlements at levels that they may not have been obligated to pay. The suggestion of the jury pool mindset corroborates societal factors impacting the claim value. With mediations and settlement conferences taking place across the US in both federal and state courts, how can an Owner (and in turn, the insurers) trust the judicial system under these circumstances? What steps can and should an Owner/employer take to protect themselves?

Possible Solutions

While there are no simple or definitive solutions for social inflation, Owners and the Industry can promote certain pro-active steps that apply with equal force worldwide. Owner/employers need to continue to be diligent and thoughtful with their safety protocols. Accidents will happen. Owners must respond with compassion, transparency, and authenticity. Most importantly, they must engage their employees early and often after any accident or injury. Our experience supports the proposition that company culture and an empathetic response will determine or direct an employee’s post injury propensity to seek counsel and “revenge” through litigation. Post injury arbitration agreements have also met with some success to limit the owner’s exposure and circumvent the potential impact of social inflation. Defense counsel prepared to meet the strategies and tactics of claimant’s counsel should be sought out and retained.

Defense counsel must appreciate the new reality and provide candid and realistic evaluations early in the discovery process. In favorable jurisdictions with appropriate facts, cases must be litigated. The insurance industry and Owners/ operators must challenge the rapidly developing strategies of plaintiff’s counsel and not shy away from similar tactics and trying cases. The proliferation of jury consultants and mock trials can benefit owners and insurers and their skills must be used. Higher risk cases (via injury, location, counsel etc.) should be identified and early resolution, if possible, should be accomplished before litigation ensues. The industry must continue to promote change and educate people, potential jurors, state and federal government officials, and the judiciary.

Overall, the extraordinary economic inflation seen over the past year affects claims across the board – as life for everyone gets more expensive, so do claimants’ losses. Adding social inflation to the equation means that the shipping industry at large must take note of this phenomenon that cannot be measured!

Daniel A. Tadros would like to thank his friend and colleague, Molly McCafferty, for her expertise and assistance with this article.

The views presented hereabove are only those of the author and do not necessarily reflect those of SAFETY4SEA and are for information sharing and discussion purposes only.