Signal Ocean today released an evaluation on the evolution of oil flows amid the enforcement of EU sanctions on Russian oil.

As the report notes, in the wake of recent geopolitical tensions and oil price developments, seaborne oil flows have shifted from importing to exporting countries, with European and Asian countries rebalancing their sources of origin. The analysis focuses on how Russian oil flows are diverted to other, non-European countries and what sources other than Russian oil purchases arise for European countries.

Key findings:

- The overall view of the first quarter of the year has already posed significant challenges for oil purchasing countries in Asia and Europe with Russian oil still finding new partners buying strong volumes of Russian crude and diesel oil.

- In Europe, it remains to be seen what the impact of the U.S and Saudi Arabia imports will have on the energy requirements of the top European destinations, and how these new patterns in oil flows will trigger further increases in the crude demand ton miles.

Oil flows to Europe & Asian Region

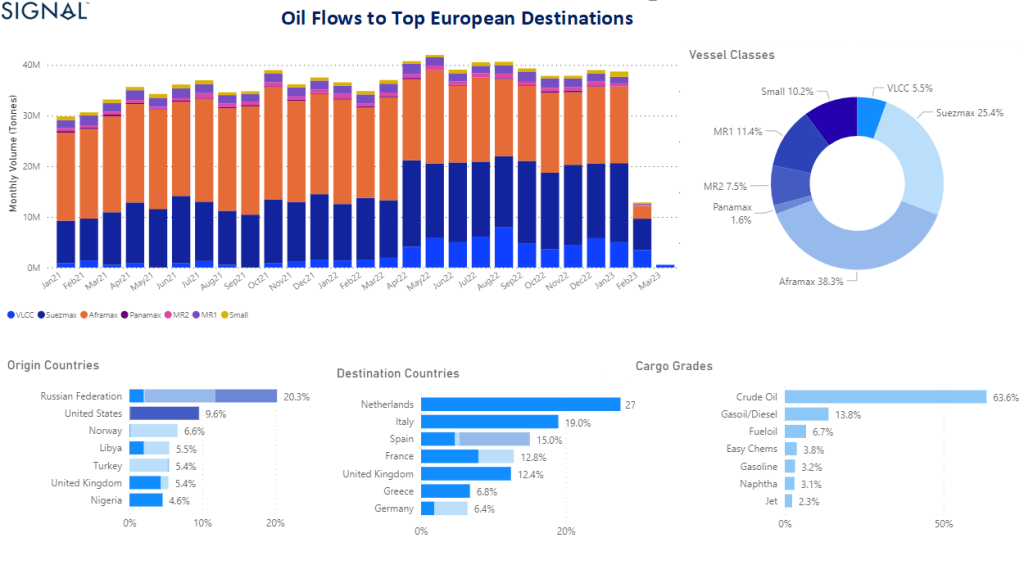

Overall, seaborne oil flows to European destinations (the Netherlands, Italy, Spain, UK, France, Greece, and Germany) showed a firm pace of growth in the fourth quarter of last year, while the gradual slowdown to Europe intensified in February and March following the enforcement of the Russian oil export ban.

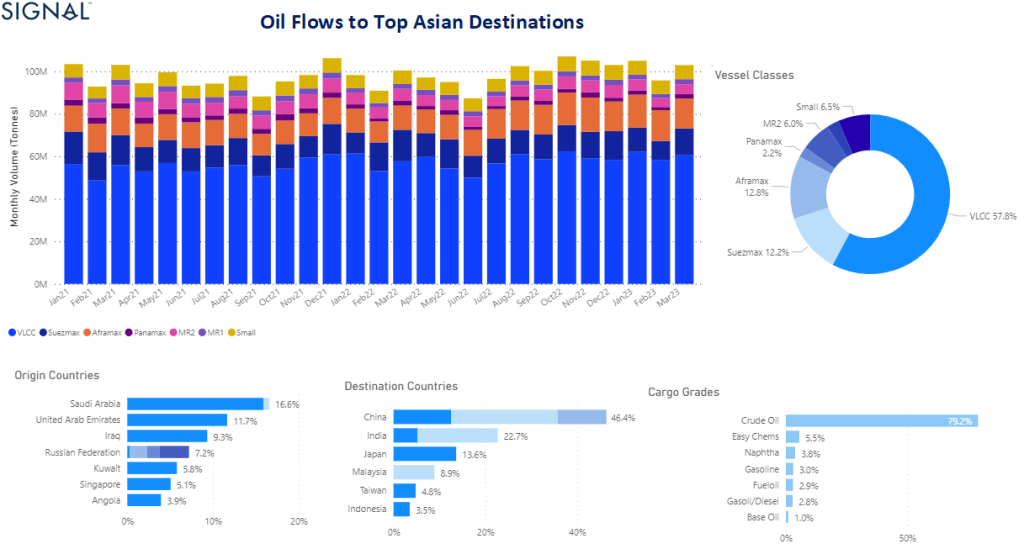

Top Asian destinations

In contrast to the main European oil importing countries, where there was a steady decline in the first quarter of the year, seaborne oil flows to the main Asian countries, China and China, Korea, Japan and others, showed a clear upward trend in March.

Russian oil flows to other non-European destinations

Amid the enforcement of European import bans on Russian oil, China and India topped the list of those that increased purchases of Russian crude at discounted prices, with the trend continuing to firm in the remaining months of this year. In the first quarter of this year, Chinese oil imports from Russia increased by around 60% compared to the first quarter of last year.

Furthermore, the first quarter of the year saw a surprising record increase in Russian exports to Morocco, Egypt, and Turkey. MR1 tankers seemed to capture nearly half of the business.

European countries and oil imports

Crude

For the first quarter of this year, U.S crude oil exports to the Netherlands increased by about 60% and to Germany by more than 100% compared to a similar period in 2022, with February recording the highest growth for the U.S crude oil exports to Germany.

Clean

In the clean segment, the report notes a trend of more exports from Qatar to the Netherlands in the first three months of the year. The Netherlands has increased its diesel oil imports from Qatar, buying almost twice the volumes now, compared to the small volumes it bought in January and February last year.