SEA-LNG shared its overview of LNG as a marine fuel in 2022-2023, highlighting how the shipping industry has advanced along the LNG pathway to decarbonisation in 2022 and outlines what progress is anticipated in 2023.

The momentum continues

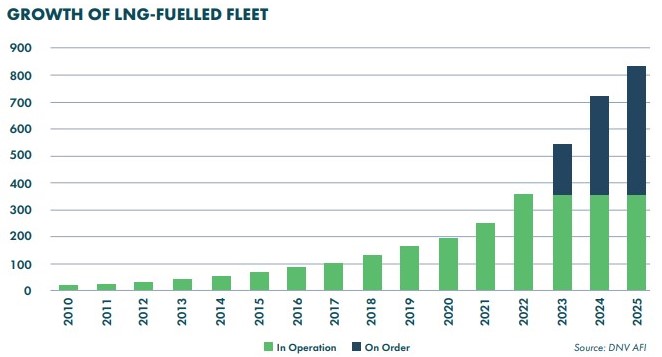

According to the report, 2022 was another very strong year for LNG vessel orders, with numbers almost equalling those in 2021, the record year to date, despite exceptionally high LNG prices.

The growing, multisector orderbook and continuing build-out of infrastructure reflect the recognition from ship owners and fuel suppliers that LNG delivers immediate and important local air quality benefits and GHG compliance today and offers a low-risk, incremental pathway to decarbonisation.

The shipping industry is making newbuild investment decisions now that will impact GHG emissions today and for the next 25-30 years, the typical lifetime of a deep-sea vessel.

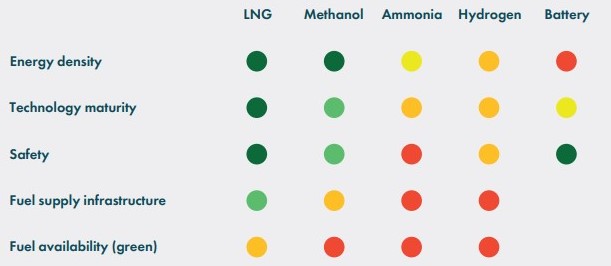

While regulators and industry are agreed on the net-zero emissions destination, the implications of the pathway are rarely discussed. The total pathway emissions associated with many of the alternative fuels being discussed may be much higher than those associated with LNG and its bio and synthetic variants.

Waiting is not an option

As SEA-LNG notes, “there is growing recognition that decarbonisation will not be a “big bang” process where the industry moves in a single step from fossil to zero-emission, renewable fuels.”

In 2023, the commercial availability of bio-LNG will continue to scale up.

As one of the cheapest of the alternative fuels under discussion, bio-LNG offers an immediate next step on the LNG pathway to decarbonisation, and allows owners to transition safely and easily from fossil LNG. This means that vessels ordered today will be able to continue operating within increasingly stringent GHG emissions regulations up to and beyond 2050

Availability and cost of bio-LNG

A study conducted this year by the Maritime Energy and Sustainable Development Centre of Excellence lxi (MESD CoE) at Nanyang Technological University, Singapore (NTU Singapore) explored the role of bio-LNG in shipping’s decarbonisation.

The findings suggest that pure bio-LNG could cover up to 3% of the total energy demand for shipping fuels in 2030 and 13% in 2050. If it is considered as a drop-in fuel blended with fossil LNG, bio-LNG could cover up to 16% and 63% of the total energy demand in 2030 and 2050, respectively, assuming a 20% blending ratio. In the long term, ship owners who have invested in the LNG pathway will need to shift to e-LNG.

Currently, the cost of bio-LNG is around 3-4 times higher compared to the average fossil LNG bunker price. However, the average cost for delivered bio-LNG is forecast to decline by around 30% by 2050 compared to today’s values, mainly driven by the reduced cost of producing biomethane in large-scale anaerobic digestion plants. It is key to note that although the cost of bio-LNG bunkers is relatively high compared to fossil fuels, it is cheaper than most other green alternative fuels such as biomethanol and electro-fuels, including e-ammonia and e-methanol.

The choice of dual-fuel gas vessels powered by LNG for our new ships is part of our commitment to build a zerocarbon future

concluded Xavier Leclercq, Vice-President of CMA SHIPS.