According to VesselsValue, in the first six months of 2019, 201 cargo vessels were sold for demolition, 75% were scrapped in Bangladesh or India, with the former having the majority share. In comparison to 2018’s first six months, scrapping decreased by 18%.

The scrapping decrease was also affected from the collapse of the Brumadinho dam in January.

Also, the demolition rates increased later into the first half as the tonnage supply became more scarce and yard availability and appetite grew. H1 of 2018 saw rates peak during mid March at 470/465 ($ per LDT) for tankers and bulkers respectively. H1 2019 saw a lower and later peak of 465/460 ($ per LDT) towards the end of April.

Moreover, VesselsValue reported that the offshore sector saw an oversupply, as scrapping deals surpassed newbuilding orders. This results to the decrease of the offshore vessels that operate.

79 vessels were scrapped in the first half of 2019, down c.23% compared to the first half of 2018.

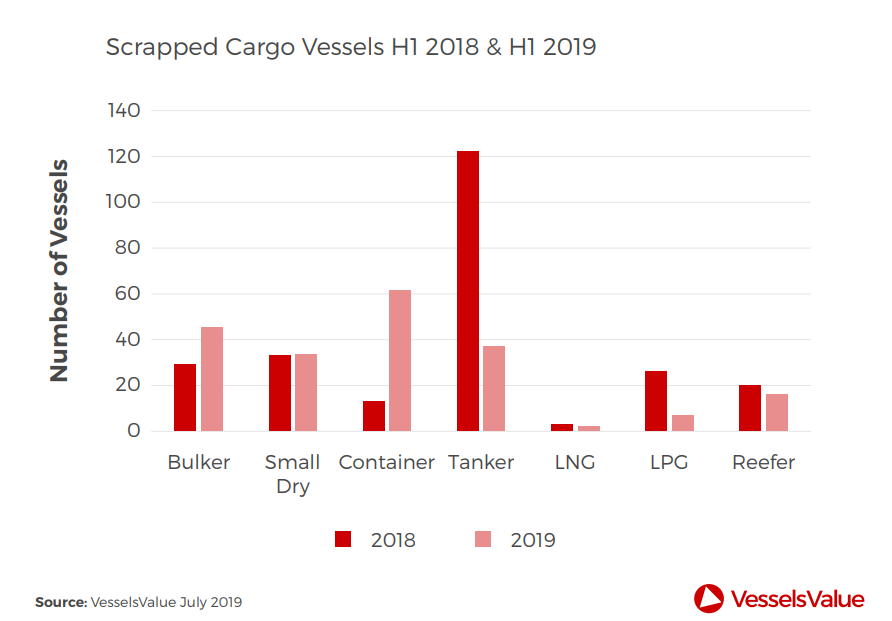

In the meantime, cargo:

- Bulker Demolition activity in the bulker sector: increased c.55% compared to the first half of 2018.

- Small Dry sector: the only sector to remain consistent in terms of the number of vessels scrapped, in comparison to last year.

- Container: saw a significant increase of c.370% in container scrappage.

- Tanker: 3 times the number of tankers scrapped in the first half of this year, showing a clear dive in the number of tankers scrapped this year.

- LNG: The positive outlook on the gas sector continues to see little scrappage. Only two LNGs were scrapped in the first half of 2019, both for delivery in Bangladesh.

- LPG: The number of LPG vessels scrapped fell from 26 in H1 2018 to 7 in H1 2019, a c.73% decrease.

- Reefer: The Reefer market continues to cut numbers, with a further 16 being scrapped in H1 2019, a slight decrease from the 20 that were scrapped in H1 2018.