SAFETY4SEA is pleased to announce the results of its ‘2020 Fuel Options’ survey reflecting industry’s concerns with respect to 0.5% sulphur cap , due to become effective globally in less than two years from today.

The survey conducted within Q12018 with 765 participants of whom 45% were shipmanagers/shipowners and 70% from Europe, reflects trends with respect to industry’s readiness to comply with the upcoming 0.5% sulphur cap.

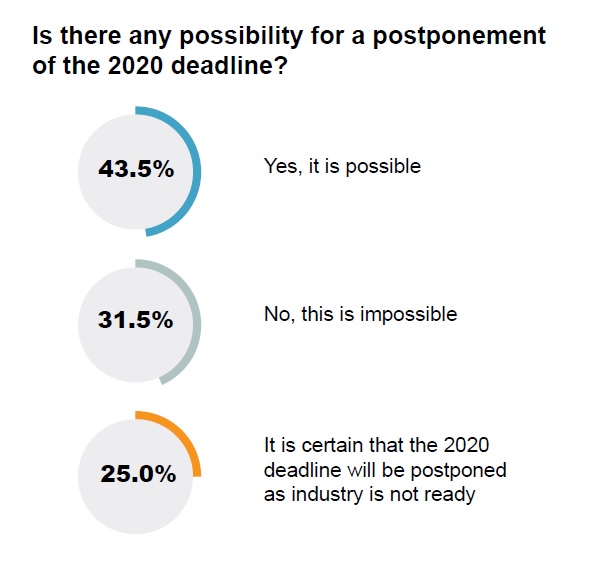

Faced with a decision with huge cost implications, shipowners are considering all options on how to tackle sulphur emissions. Although any possible delay was ruled out during IMO MEPC 71, industry stakeholders think that a postponement of the 2020 deadline is possible, likewise the time extension of the BWM Convention.

Key Emerging Challenges

- Fuel availability (refining capacity)

- Fuel price

- Fuel quality and compliance with ISO 8217 standard

- Market impact towards the next 10 years

- Global enforcement outside ECAs

LNG vs Srubbers investment

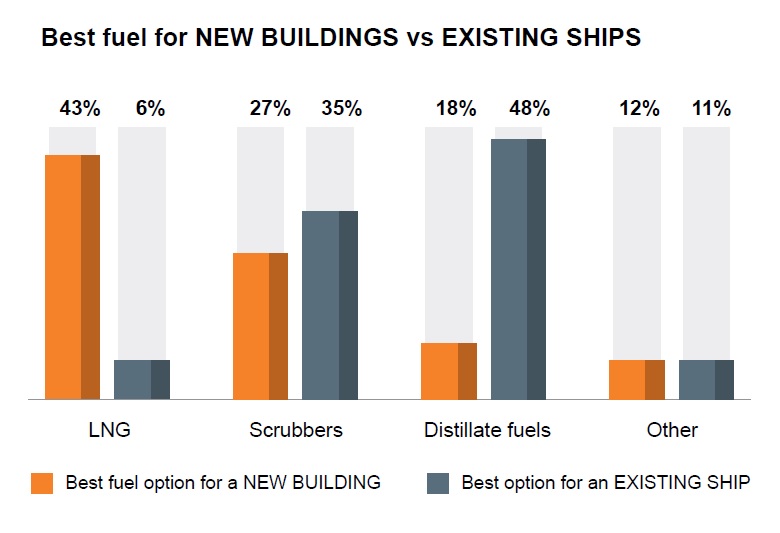

The responders of our survey consider the following key barriers for their decision to invest either on LNG or scrubber technology.

Key barrier for operators to invest in LNG

| 1 | Large and costly investment (CAPEX) | 67% |

| 2 | Availability of LNG infrastructure/ supply | 66% |

| 3 | Space onboard (LNG tanks) | 48% |

| 4 | Uncertainty on fuel price differential | 30% |

| 5 | Uncertainty on fuel gas prices | 27% |

Key barrier for operators to invest in SCRUBBERS

| 1 | Large and costly investment (CAPEX) | 64% |

| 2 | Waste disposal | 54% |

| 3 | Operational uncertainty and future compliance | 50% |

| 4 | Space availability onboard | 39% |

| 5 | Uncertainty on fuel price differential | 16% |

Open feeedback revealed the following concerns for the level playing field :

‘’Operators using distillate fuels may switch to non-compliant fuel off port limits’’

‘’Operators using scrubbers may use that as an excuse to carry high sulphur fuel oil and select to burn it directly off port limits’’

‘’Operators using dual fuel engines may select to operate with high sulphur fuel off port limits’’

Highlights

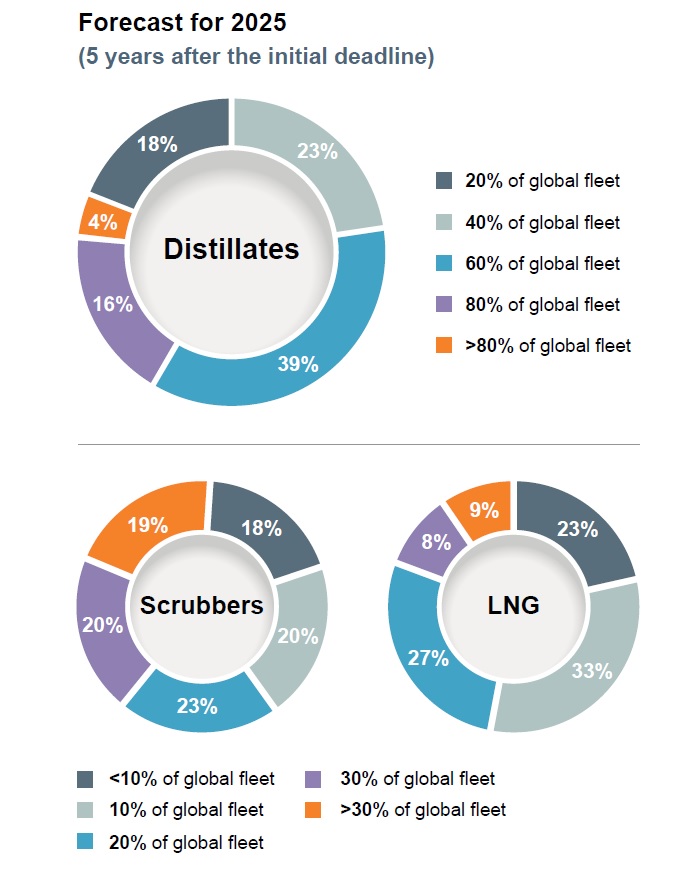

- Decision making is extremely difficult; majority prefer a ‘wait & see approach’

- All options will work in the market due to uncertainty while other options may arise initially in small segments (e.g. batteries etc)

- Market will be distorted and the fuel pie will be re-distributed by new entries

- Strongest “players” may increase market share, weakest may disappear while there may be a rise in penalties