With less than three weeks of liquid fuel reserves, Australia risks grinding to a halt following a global economic shock or conflict along a major trade route, but a new report by the Maritime Union of Australia outlines a potential solution for bigger fuel security that would cost consumers less than a cent per litre. The report examines the policy and industry changes that have caused fuel supplies to fall to just a quarter of the International Energy Agency’s fuel stockholding obligation, along with costing a potential solution.

Written by former Director of the Maritime Transport Policy Centre at the Australian Maritime College John Francis, the report, ‘Australia’s Fuel Security: Running on Empty‘, also highlights that Australia is the only developed oil-importing country where there is no government controlled stock of crude oil or refined petroleum products, no mandated commercial stock requirements for oil companies, and no government involvement in oil markets.

Concerns over declining domestic production, diminishing refining capacity, and potential flashpoints in the Middle East and South China Sea forced the Turnbull government to announce in May that it would undertake a National Energy Security Assessment.

This report namely responds to a request from Maritime Union of Australia to investigate the risks of relying on international flag ships on the spot market for the majority of Australia’s liquid fuel supply, an estimate of the number of tankers required to service Australia in the context of closing refineries and increasing imports, and finally, a calculation of cost, per litre, created by employing Australian labour on import tankers across nominal voyages from Singapore, South Korea and Japan to central Queensland, Brisbane, Sydney, Melbourne, Adelaide, Fremantle and Darwin (diesel, petrol and kerosene/jet fuel).

Key findings

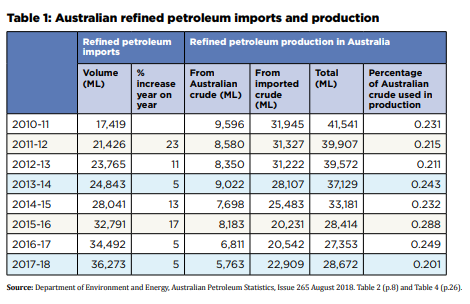

- Australia’s oil import dependence (crude and clean products) stood at about 90% in 2017-18. This growing dependence on overseas sourced petroleum products can be contrasted with Australia’s repeated failure to meet its 90 day IEA stockholding obligation, with stocks of key products standing at 18 to 21 days. The risk of any major disruption to Australia’s import arrangements and the capacity of importers or government to secure alternative supplies in a timely manner needs to be independently investigated.

- The exclusive reliance on foreign flagged tankers for crude and CPP supply chains removes any opportunity for the Commonwealth to be able to requisition national flag tankers if necessary to secure minimum import or coastal distribution requirements following major economic or geopolitical disruptions to oil markets. It has also diminished skills training for those operating and managing critical petroleum import supply chains and infrastructure.

- Any risk assessment of bank liquidity and potential disruption to world credit markets needs to include consideration of the cascade effects on world freight markets. This includes the likelihood of ships being arrested by suppliers of bunkers and other creditors such as ship mortgagees; those holding liens against the vessel such as ship’s crew seeking unpaid wages; unpaid ship repair facilities; and insurers etc. Potential arrests from claimants with a right to proceed in rem under Admiralty legislation are inevitably at heightened risk where ship owners are unable to secure sufficient lines of credit to pay their creditors as and when their debts fall due. Courts are often left with little choice but to order the sale of arrested vessels where their owners are subsequently unable to provide satisfactory security in relation to the proceedings.

- If a comprehensive risk assessment indicates that retention of a minimum number of tankers owned, managed and crewed by Australians is justified on national security grounds, the Commonwealth, in consultation with stakeholders, should investigate options to equitably apportion the differential costing.

- The additional cost per litre of cargo carried by an Australian tanker carrying clean petroleum import cargoes ranges from 0.49 cents to 1.25 cents per litre, and depends on the size of the ship and the distance from the supply country to the port of importation. This additional cost could be spread across the entire import volume to provide a very modest cost per litre. For example, the cost of 5 Australian ships spread across the projected import volume of 38,087 ML in 2018-19 results in a cost of less than one-tenth of a cent per litre. Fifteen Australian ships would cost less than a quarter of a cent per litre. Even if the whole future import volume covered by 60 ships, the cost is less than 1 cent per litre.

Explore more herebelow: